Get the free Credit Cards - Compare & Apply Online American Express

Show details

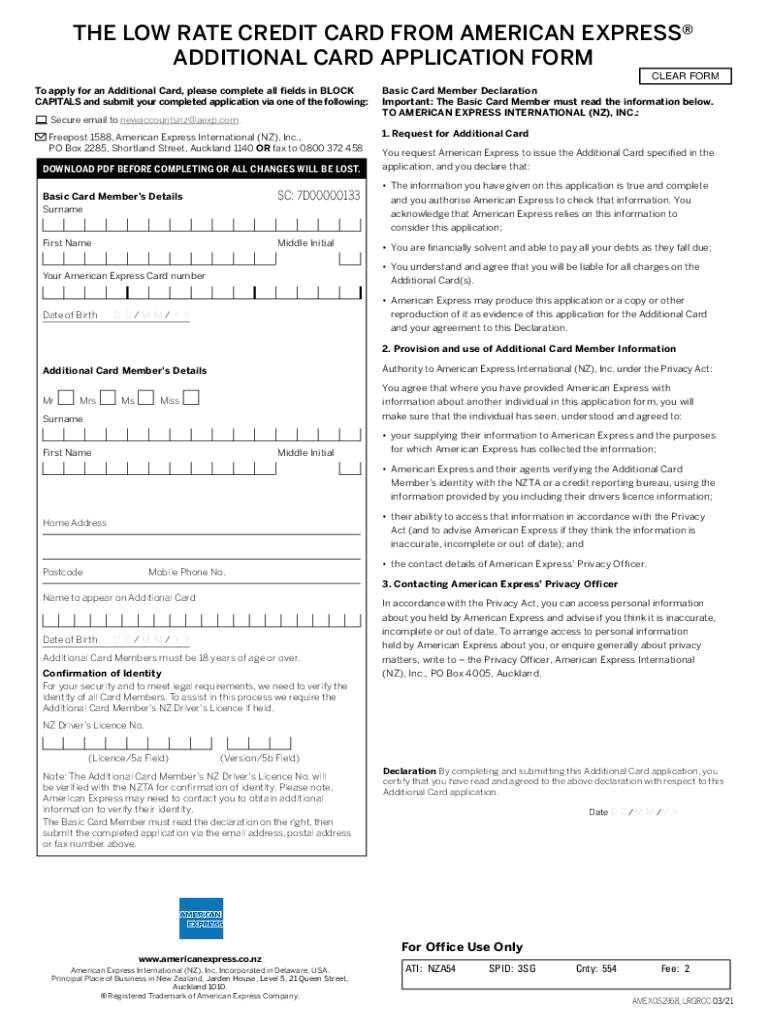

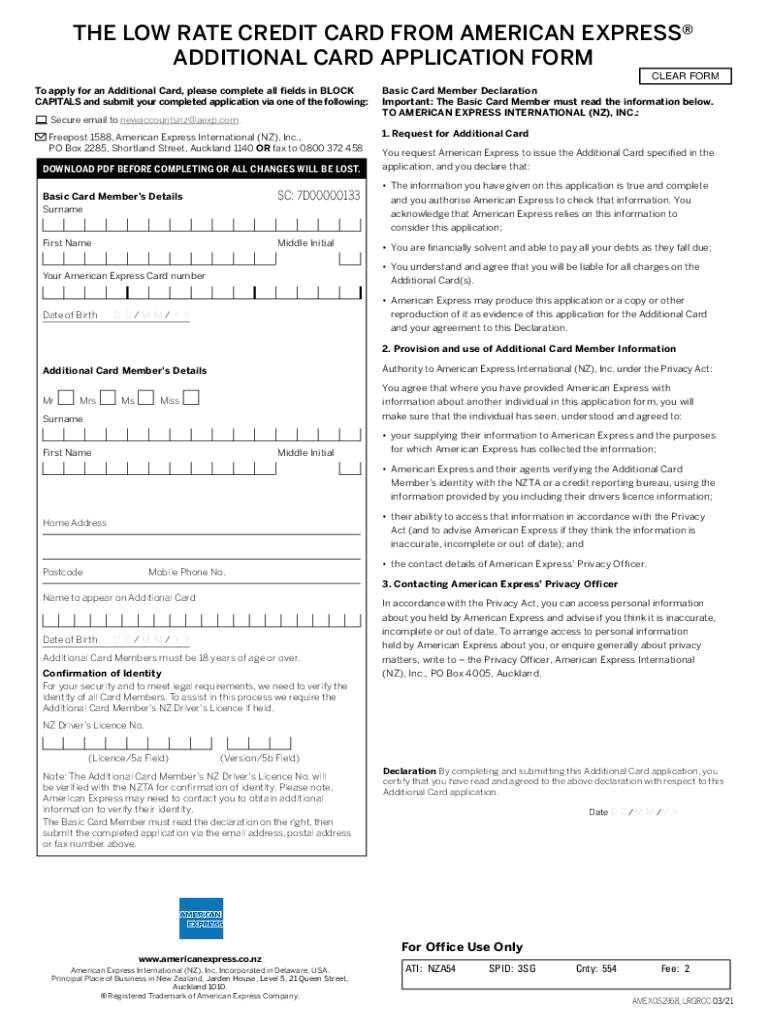

THE LOW RATE CREDIT CARD FROM AMERICAN EXPRESS ADDITIONAL CARD APPLICATION FORM CLEAR FORM To apply for an Additional Card, please complete all fields in BLOCK CAPITALS and submit your completed application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit cards - compare

Edit your credit cards - compare form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit cards - compare form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit cards - compare online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit cards - compare. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit cards - compare

How to fill out credit cards - compare

01

To fill out a credit card application, follow these steps:

02

Start by gathering all the necessary documents and information. This usually includes your identification documents, proof of income, and social security number.

03

Research and choose the credit card that best suits your needs. Compare different cards based on their interest rates, rewards programs, and fees.

04

Review the application form and make sure to fill out all the required fields accurately. Double-check for any errors or missing information.

05

Provide your personal details such as your name, address, contact information, and employment details.

06

Enter your financial information, including your income, monthly expenses, and any existing debts or obligations.

07

Read and understand the terms and conditions of the credit card agreement before signing it.

08

Submit the completed application form along with any supporting documents to the credit card issuer.

09

Wait for the credit card issuer to review your application. This process may take a few days to several weeks.

10

If your application is approved, you will receive your credit card by mail. Activate the card according to the provided instructions before using it.

11

Start using your credit card responsibly, ensuring timely payments and monitoring your spending to maintain a good credit score.

Who needs credit cards - compare?

01

Credit cards can be beneficial for various individuals, including:

02

- People who want to build or improve their credit history. Responsible use of a credit card can help establish a positive credit history.

03

- Individuals who frequently make online purchases or travel internationally. Credit cards offer secure and convenient payment options.

04

- Consumers who want to take advantage of rewards programs. Many credit cards provide cash back, airline miles, or other incentives for spending.

05

- Those who require a short-term loan or have emergency expenses. Credit cards can provide temporary financial assistance.

06

- Business owners who need to separate personal and business expenses. Credit cards can help track and manage business spending.

07

- Individuals who want to have a financial safety net or access to credit in case of unexpected financial needs.

08

However, it's important to remember that credit cards should be used responsibly and within your means to avoid debt and financial stress.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit cards - compare in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing credit cards - compare and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out credit cards - compare using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign credit cards - compare and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete credit cards - compare on an Android device?

Use the pdfFiller mobile app to complete your credit cards - compare on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is credit cards - compare?

Credit cards are a form of payment that allows consumers to borrow money from a financial institution to make purchases. They are different from debit cards, as they involve borrowing money that must be repaid with interest compared to debit cards which only allow spending money that is already in the account.

Who is required to file credit cards - compare?

Any individual or entity that holds a credit card account is required to file their credit card statements with the financial institution that issued the card. This is necessary for tracking expenses and ensuring timely payments.

How to fill out credit cards - compare?

To fill out credit cards, individuals need to review their statements, verify transactions, check for any discrepancies, and ensure timely payment of the balance. This process helps in managing finances effectively and avoiding unnecessary fees.

What is the purpose of credit cards - compare?

The purpose of credit cards is to provide consumers with a convenient form of payment and enable them to make purchases even if they do not have the cash on hand. They also help in building credit history and earning rewards.

What information must be reported on credit cards - compare?

Credit card statements typically include information about transactions, balance, available credit, due date, minimum payment, interest charges, and fees. Reporting accurate information is crucial for maintaining good financial health.

Fill out your credit cards - compare online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Cards - Compare is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.