Get the free Employee vs. Independent Contractor Checklist

Show details

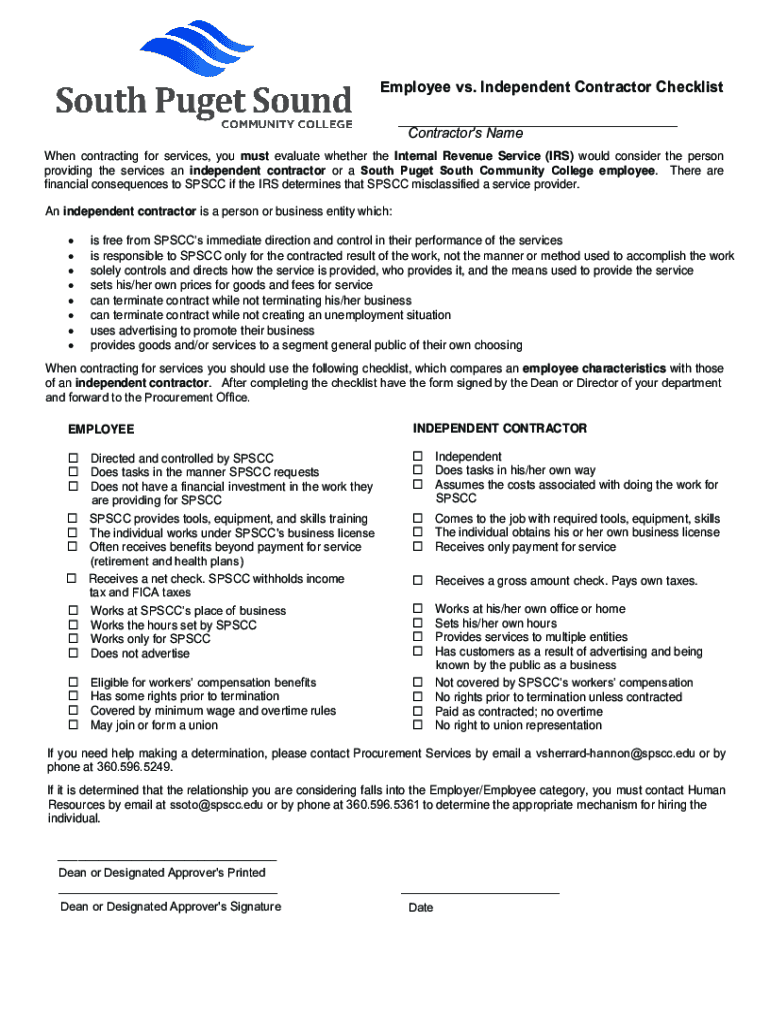

South Pug;! Employee vs. Independent Contractor Checklist ___ Contractor\'s Meighen contracting for services, you must evaluate whether the Internal Revenue Service (IRS) would consider the person

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee vs independent contractor

Edit your employee vs independent contractor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee vs independent contractor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee vs independent contractor online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employee vs independent contractor. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee vs independent contractor

How to fill out employee vs independent contractor

01

Determine the worker's status: Before filling out any paperwork, you need to determine whether the worker should be classified as an employee or an independent contractor. This determination depends on factors such as the degree of control you have over the worker, the worker's level of independence, and the nature of the work being performed.

02

Obtain the necessary forms: If the worker is classified as an employee, you will need to obtain and fill out various forms such as IRS Form W-4 for federal income tax withholding and Form I-9 for verifying employment eligibility. On the other hand, if the worker is an independent contractor, you may need to obtain a completed Form W-9 for reporting payments to the contractor.

03

Collect relevant information: Regardless of whether the worker is an employee or an independent contractor, you will need to collect certain information such as the worker's full name, address, Social Security number or taxpayer identification number, and date of birth. This information is typically used for payroll and tax purposes.

04

Determine payment arrangement: For employees, you will need to establish a regular pay schedule and determine whether the worker will be paid on an hourly, salary, or commission basis. Independent contractors, on the other hand, are usually paid based on a specific project or agreed-upon rate.

05

Prepare the necessary agreements: Depending on the worker's status, you may need to prepare specific agreements such as an employment agreement for employees or a service agreement for independent contractors. These agreements outline the terms and conditions of the working relationship, including payment terms, confidentiality clauses, and termination provisions.

06

Comply with tax and labor laws: Ensure that you comply with all relevant tax and labor laws when filling out the paperwork for employees or independent contractors. This includes withholding and remitting payroll taxes for employees and providing Form 1099-MISC to independent contractors if required.

07

Retain records: It is important to retain all documentation related to the worker's classification and employment status for a specified period of time in case of audits or legal disputes. Consult with a legal or tax professional to determine the appropriate record retention period.

Who needs employee vs independent contractor?

01

Business owners: Business owners who require assistance with specific projects or tasks on a temporary basis may benefit from hiring independent contractors. This allows them to avoid the costs and responsibilities associated with hiring and maintaining employees.

02

Entrepreneurs: Entrepreneurs who are just starting their ventures or have limited resources often opt to work with independent contractors to complete certain functions such as web design, marketing, or bookkeeping. This helps them save on overhead costs and provides flexibility in managing their workforce.

03

Freelancers: Freelancers who operate as independent contractors themselves might require the services of other independent contractors to assist with their workload. This enables them to take on larger projects or handle multiple clients simultaneously without the need to hire employees.

04

Organizations with specialized projects: Organizations that have specialized or one-time projects may find it more practical to hire independent contractors who possess the necessary skills or expertise. This allows them to access specialized talent without committing to long-term employment.

05

Professionals in the gig economy: Professionals working in the gig economy, such as ride-share drivers, delivery drivers, or freelance writers, typically operate as independent contractors. Their work arrangement suits their flexibility and desire for autonomy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employee vs independent contractor for eSignature?

Once your employee vs independent contractor is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in employee vs independent contractor without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit employee vs independent contractor and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out employee vs independent contractor on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your employee vs independent contractor. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is employee vs independent contractor?

An employee is someone who works for a company on a regular basis under the direction and control of the employer. An independent contractor is someone who is self-employed and provides services to a company without being under the direct control of the employer.

Who is required to file employee vs independent contractor?

Employers are required to correctly classify their workers as either employees or independent contractors and file the appropriate tax forms.

How to fill out employee vs independent contractor?

To fill out the employee vs independent contractor classification, employers should consider the level of control they have over the worker, the worker's independence, and the nature of the work relationship.

What is the purpose of employee vs independent contractor?

The purpose of distinguishing between employees and independent contractors is to determine tax obligations, benefits eligibility, and legal responsibilities towards the worker.

What information must be reported on employee vs independent contractor?

Employers must report the worker's contact information, tax identification number, payment details, and classification as employee or independent contractor.

Fill out your employee vs independent contractor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Vs Independent Contractor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.