Get the free Systematic Investment Plan SIP Auto Debit

Show details

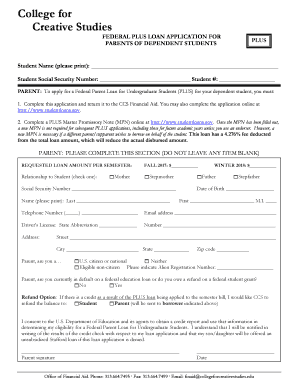

SIP Auto Debit/STP/SVP/MICRO Form No. Canada Robe co Mutual Fund Investment Manager : Canada Robe co Asset Management Co. Ltd. Construction House, 4th Floor, 5, Watchband Firsthand Mary, Ballard Estate,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign systematic investment plan sip

Edit your systematic investment plan sip form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your systematic investment plan sip form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing systematic investment plan sip online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit systematic investment plan sip. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out systematic investment plan sip

How to fill out systematic investment plan (SIP)?

01

Start by identifying a suitable mutual fund: Research and choose a mutual fund that aligns with your investment goals, risk appetite, and time horizon. Look for a fund with a consistent track record and a professional management team.

02

Determine the investment amount: Decide how much you can comfortably invest regularly. SIP allows you to invest a fixed amount at regular intervals, so set an amount that suits your financial situation and future goals.

03

Complete the necessary paperwork: Visit the mutual fund company's website or reach out to their customer service to obtain the required application forms. Fill in the details accurately, including personal information, investment amount, SIP frequency, and bank account details for auto-debits.

04

Choose the SIP frequency: SIPs offer flexibility, allowing you to invest monthly, quarterly, or even weekly. Select the frequency that suits your financial plans and investment goals. Remember that a longer-term investment horizon usually yields better returns.

05

Provide necessary documents: Along with the completed application form, you may need to submit supporting documents like proof of address, PAN card, and KYC compliance. Make sure to gather all the required documents to avoid any delays in processing your SIP registration.

06

Set up auto-debit for SIP payments: To make the investment process hassle-free, authorize the mutual fund company to deduct the SIP amount from your bank account automatically. Ensure you have sufficient funds in your account on the selected debit dates.

07

Monitor your SIP investments: Keep a close eye on your SIP investments by regularly reviewing the performance of the mutual fund. Assess whether the fund is meeting your investment objectives and make adjustments if necessary. It's important to stay informed and make well-informed decisions.

Who needs systematic investment plan (SIP)?

01

Individuals looking to invest in mutual funds: SIPs are a suitable investment option for individuals looking to invest in mutual funds but may not have a lump sum amount to invest upfront. SIPs allow for regular, disciplined investment with small amounts, fostering a savings habit.

02

Investors seeking long-term wealth creation: SIPs are designed for long-term investors who aim to create wealth over time. By systematically investing at regular intervals, you can take advantage of cost averaging and benefit from the power of compounding.

03

Individuals with varying risk appetites: SIPs offer a wide range of mutual funds across different risk categories. Whether you are a conservative investor seeking stability or an aggressive investor willing to take on higher risk for potential higher returns, there is a mutual fund suitable for your risk appetite.

04

Those seeking financial goals like retirement planning or education funding: SIPs can help individuals achieve their financial goals, such as saving for retirement or funding education expenses. By investing regularly and staying invested for the long term, you can accumulate a substantial corpus over time.

05

Investors looking for convenience and flexibility: SIPs offer convenience and flexibility by automating the investment process. Once set up, the investment amount is deducted automatically, eliminating the need for constant monitoring and manual investments. Additionally, SIPs allow you to increase or decrease the investment amount based on your financial circumstances.

Overall, anyone looking to invest in mutual funds, build long-term wealth, and achieve financial goals with convenience and flexibility can benefit from a systematic investment plan (SIP).

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is systematic investment plan sip?

A systematic investment plan (SIP) is a method of investing in mutual funds where an investor contributes a fixed amount regularly to the fund.

Who is required to file systematic investment plan sip?

Individuals who wish to invest in mutual funds through a systematic investment plan (SIP) are required to file the SIP application form.

How to fill out systematic investment plan sip?

To fill out a systematic investment plan (SIP) form, an individual needs to provide personal information, investment amount, and bank account details.

What is the purpose of systematic investment plan sip?

The purpose of a systematic investment plan (SIP) is to enable individuals to invest in mutual funds regularly and systematically to achieve their financial goals.

What information must be reported on systematic investment plan sip?

Information such as personal details, investment amount, bank account details, and mutual fund selection must be reported on a systematic investment plan (SIP).

How can I edit systematic investment plan sip from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like systematic investment plan sip, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit systematic investment plan sip in Chrome?

Install the pdfFiller Google Chrome Extension to edit systematic investment plan sip and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out systematic investment plan sip on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your systematic investment plan sip. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your systematic investment plan sip online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Systematic Investment Plan Sip is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.