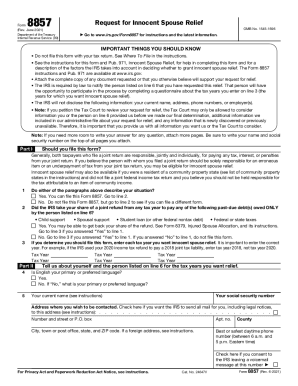

IRS 8857 2007 free printable template

Show details

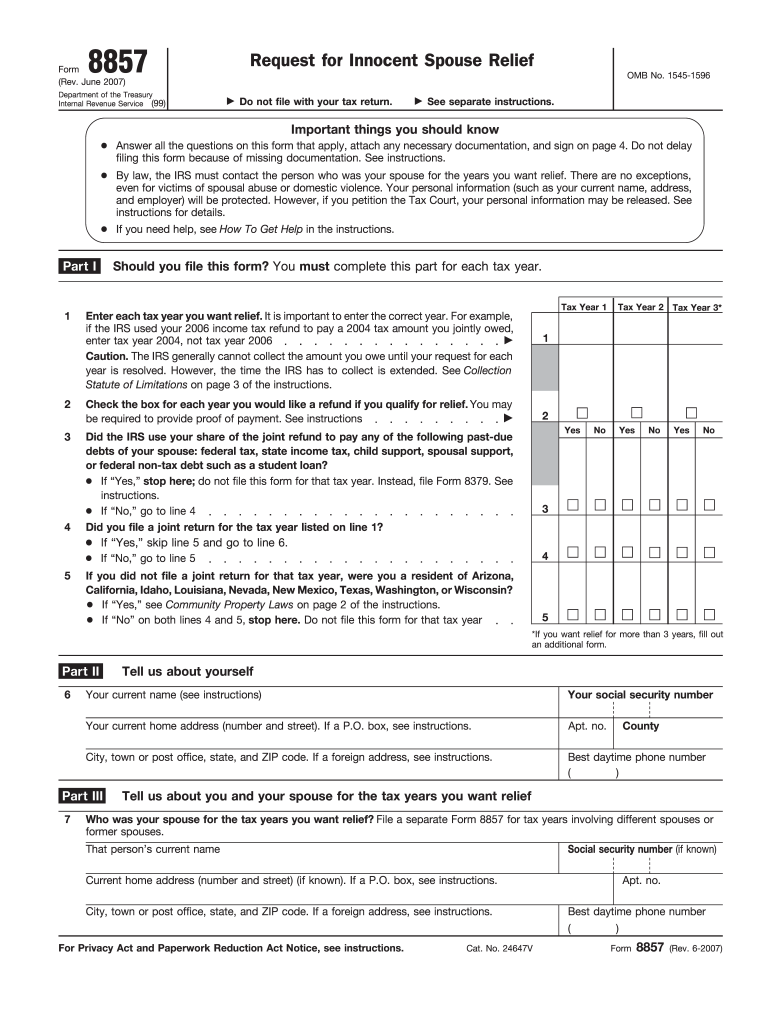

Cat. No. 24647V Rev. 6-2007 Form 8857 Rev. 6-2007 Page Note. If you need more room to write your answer for any question attach more pages. No. City town or post office state and ZIP code. If a foreign address see instructions. Best daytime phone number County Who was your spouse for the tax years you want relief File a separate Form 8857 for tax years involving different spouses or former spouses.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8857

How to edit IRS 8857

How to fill out IRS 8857

Instructions and Help about IRS 8857

How to edit IRS 8857

To edit IRS 8857, users can utilize pdfFiller's editing tools. Users can upload the form to their pdfFiller account, allowing them to make necessary adjustments, fill in missing information, or correct any errors. Once the edits are complete, the form can be saved and signed if required.

How to fill out IRS 8857

Filling out IRS 8857 requires careful attention to detail. Begin by gathering necessary financial records related to the tax year in question, including income statements, expenses, and any relevant documentation. Follow these steps to complete the form:

01

Enter personal identification information.

02

Provide details regarding your tax situation.

03

Include relevant income and deductions.

04

Sign and date the form before submission.

About IRS 8 previous version

What is IRS 8857?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8857?

IRS 8857, also known as the Request for Innocent Spouse Relief, is a tax form that allows individuals who filed a joint tax return to request relief from additional tax liabilities taken against their spouse or former spouse. This form is critical for individuals who believe they should not be held responsible for tax debts attributed to their partner's income or deductions.

What is the purpose of this form?

The primary purpose of IRS 8857 is to provide a mechanism for individuals to seek relief from joint tax liabilities. This ensures that those who qualify are not unfairly burdened by tax debts incurred solely by their spouse's actions, such as underreporting income or overstating deductions. By completing this form, individuals can potentially avoid significant financial hardship related to these taxes.

Who needs the form?

IRS 8857 should be completed by individuals who filed a joint tax return and want to request relief from tax liabilities incurred by their spouse or former spouse. It is particularly relevant for those who believe they qualify for “innocent spouse” status, allowing them to be exempt from the additional tax, interest, or penalties associated with errors or omissions made by their partner.

When am I exempt from filling out this form?

There are specific situations in which individuals may be exempt from filing IRS 8857. If the tax return was solely filed under the name of one spouse, or if the tax liability is solely attributable to one partner's income that the other spouse was unaware of, then filing this form may not be necessary. Additionally, if both spouses are no longer responsible for the debt, exemption can apply.

Components of the form

The IRS 8857 consists of several key components that must be completed. These include personal identification information, statements regarding the nature of the relief being requested, and documentation supporting claims of innocence for the tax debt. Each section must be filled out accurately to ensure a proper review of the request.

What are the penalties for not issuing the form?

Failure to file IRS 8857, when applicable, can lead to various consequences. Individuals may be held liable for the tax debt in question, which could include penalties and interest charges. Furthermore, the IRS may reject requests retroactively if there is a belief that the individual is responsible for the debt, potentially leading to severe financial implications.

What information do you need when you file the form?

When filing IRS 8857, a variety of information is required. This includes personal identification data, details about the tax return in question, and specific disclosures regarding income and liabilities. Supporting documents such as past tax returns and relevant financial records are also necessary to substantiate the request for relief.

Is the form accompanied by other forms?

IRS 8857 may need to be filed alongside other documents depending on the individual's circumstances. For instance, if you are also claiming other tax reliefs or submitting related appeals, those forms should be included to provide a complete picture to the IRS. It's important to review specific guidelines to ensure all required documentation is submitted.

Where do I send the form?

Once completed, IRS 8857 should be sent to the address provided in the form's instructions. Typically, submissions are directed to the appropriate IRS processing center based on the individual’s state of residence. Ensuring that the form is sent to the correct location helps avoid delays in processing the request.

See what our users say