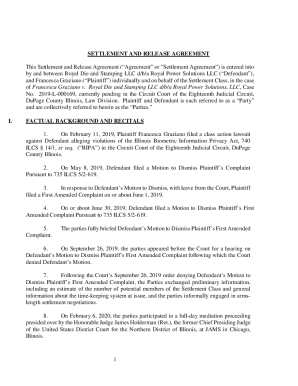

Get the free KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT

Show details

Este formulario es un acuerdo de participación en el Plan de Compensación Diferida para empleados públicos de Kansas, permitiendo a los participantes elegir realizar reducciones salariales y designar

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kansas public employees deferred

Edit your kansas public employees deferred form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas public employees deferred form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kansas public employees deferred online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

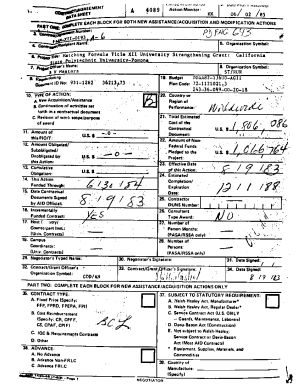

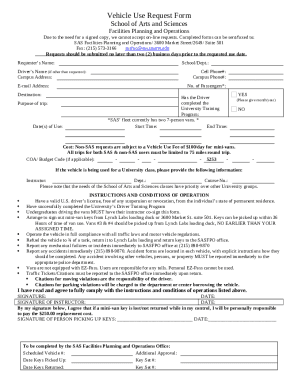

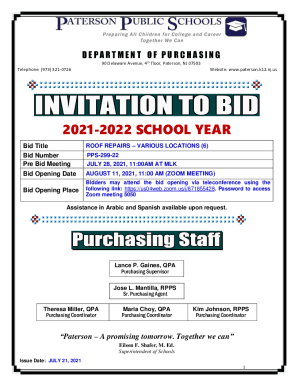

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kansas public employees deferred. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kansas public employees deferred

How to fill out KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT

01

Obtain the KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT form from your employer or the official website.

02

Read the instructions carefully to understand the requirements and options available.

03

Fill out your personal information including your name, address, and employee identification number.

04

Select your contribution amount, frequency, and any employer match options if applicable.

05

Indicate your investment choices as per the options provided in the agreement.

06

Review your completed form for accuracy and completeness.

07

Sign and date the agreement where indicated.

08

Submit the completed agreement to your HR department or the administering agency as instructed.

Who needs KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT?

01

State employees of Kansas looking to save for retirement.

02

Employees interested in additional tax-deferred savings options.

03

Individuals seeking to supplement their retirement income beyond standard pension plans.

Fill

form

: Try Risk Free

People Also Ask about

Is a deferred compensation plan a good idea?

Deferred comp plans are a good way to save for retirement, because of the tax advantages. But those tax advantages come with rules about withdrawals, designed to discourage you from spending the money before you retire. Please ask for a copy of plan summary, so you understand the rules for your plan.

What percentage of paycheck should go to deferred comp?

One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary. The DCP makes it easy for you to save a percentage of your income through the percent-of-pay feature.

Who can participate in a deferred compensation plan?

A deferred compensation plan is generally an addition to a company 401(k) plan and may be offered only to a few executives and other key employees as an incentive. Generally, those employees participate in both plans.

What is the Kpers 457 deferred compensation plan?

Saving through the optional KPERS 457 (deferred compensation) Plan is a simple way to help supplement your KPERS and Social Security benefits. It can help you bridge the gap between your financial goals and your destination in retirement. It's important to plan for your future — but you don't have to do it alone.

What is the 10 year rule for deferred compensation?

If you take your deferred compensation payments over a period of 10 years or more, those payments will be taxed in the state where you reside, rather than in the state in which you earned the compensation, possibly reducing your state income taxes.

What is a deferred compensation plan salary?

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Pensions, 401(k) plans, and employee stock options are all types of deferred compensation.

What are the disadvantages of deferred compensation?

The Risks Of Deferred Compensation Plans The biggest downside to most of these plans is the risk of the company declaring bankruptcy. It is surprising that most, if not all, of these plans aren't in a trust that cannot be touched by creditors.

Is a deferred compensation plan worth it?

Deferred comp plans are a good way to save for retirement, because of the tax advantages. But those tax advantages come with rules about withdrawals, designed to discourage you from spending the money before you retire. Please ask for a copy of plan summary, so you understand the rules for your plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT?

The Kansas Public Employees Deferred Compensation Plan Participation Agreement is a formal document that allows eligible employees of the state of Kansas to participate in a deferred compensation plan. This plan enables them to save a portion of their salary for retirement on a tax-deferred basis.

Who is required to file KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT?

Employees of the state of Kansas who wish to participate in the Kansas Public Employees Deferred Compensation Plan are required to file the Participation Agreement.

How to fill out KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT?

To fill out the Kansas Public Employees Deferred Compensation Plan Participation Agreement, employees need to provide their personal information, select their contribution amount, and choose investment options. The completed form should then be submitted to the appropriate human resources department or plan administrator.

What is the purpose of KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT?

The purpose of the Kansas Public Employees Deferred Compensation Plan Participation Agreement is to facilitate employees' savings for retirement by allowing them to defer a portion of their income, thus reducing their current taxable income and providing them with financial security in retirement.

What information must be reported on KANSAS PUBLIC EMPLOYEES DEFERRED COMPENSATION PLAN PARTICIPATION AGREEMENT?

The information that must be reported on the Kansas Public Employees Deferred Compensation Plan Participation Agreement includes the employee's name, social security number, date of birth, contribution percentage or amount, investment choices, and any other personal information as required by the plan.

Fill out your kansas public employees deferred online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Public Employees Deferred is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.