Get the free 2022 Form RI-1040 - tax ri

Show details

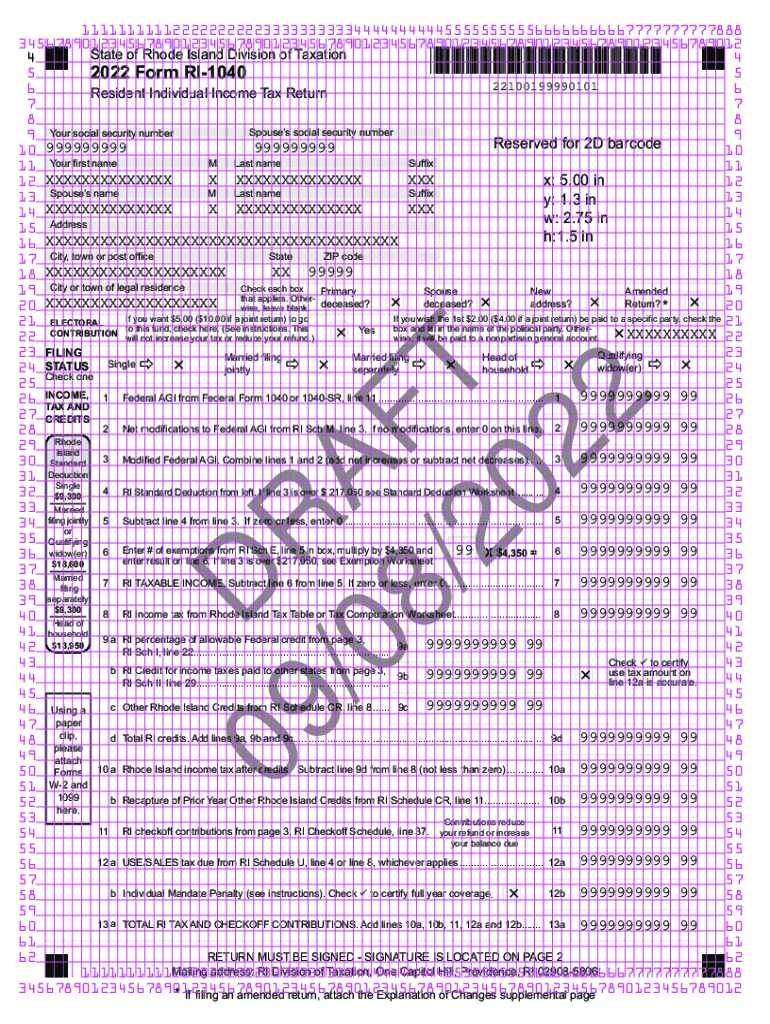

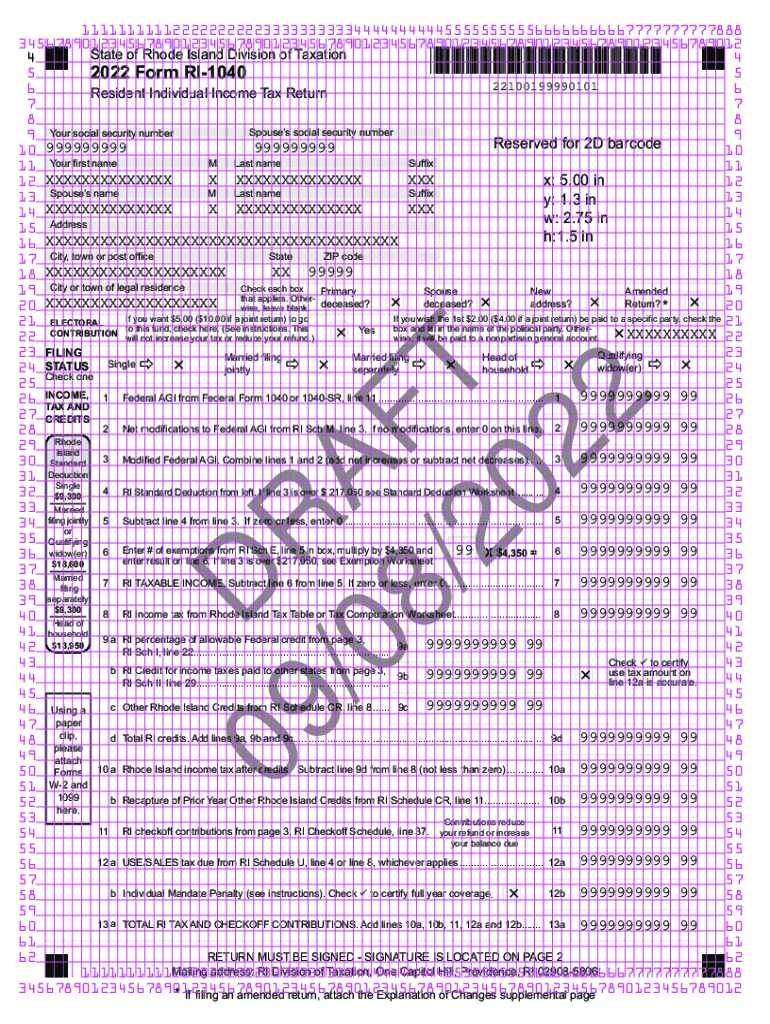

098//0DRAFT 20 221111111111222222222233333333334444444444555555555566666666667777777777888 34567890123456789012345678901234567890123456789012345678901234567890123456789012 State of Rhode Island Division

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2022 form ri-1040

Edit your 2022 form ri-1040 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2022 form ri-1040 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2022 form ri-1040 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2022 form ri-1040. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2022 form ri-1040

How to fill out 2022 form ri-1040

01

To fill out the 2022 Form RI-1040, follow these steps:

02

Begin by entering your personal information, including your name, address, and Social Security number.

03

Provide information about your filing status, such as whether you are single, married filing jointly, or head of household.

04

Fill in your income details, including wages, salaries, and tips, as well as any other sources of income you may have.

05

Deduct any allowable expenses and adjustments, such as student loan interest or contributions to retirement accounts.

06

Calculate your Rhode Island tax liability based on the provided tax tables or tax rate schedules.

07

Claim any tax credits or deductions that you are eligible for, such as the Earned Income Credit or the Child and Dependent Care Credit.

08

Enter any withholding or estimated tax payments you have made throughout the year.

09

Calculate the difference between your total tax liability and your total payments to determine if you owe additional taxes or if you are due a refund.

10

Sign and date the form, and include any necessary attachments or schedules.

11

Make a copy of the completed form for your records and file it by the due date.

12

Note: This is a general overview of the steps involved in filling out Form RI-1040. Be sure to consult the official instructions provided by the Rhode Island Division of Taxation for detailed guidance.

Who needs 2022 form ri-1040?

01

The 2022 Form RI-1040 is generally required to be filled out by Rhode Island residents who earned income during the tax year. It is used to report and pay state income tax to the Rhode Island Division of Taxation. Non-residents who earned income from Rhode Island sources may also need to file this form. It is important to consult the official guidelines and requirements set by the Division of Taxation or seek professional advice to determine if you need to file Form RI-1040.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2022 form ri-1040 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 2022 form ri-1040 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in 2022 form ri-1040 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2022 form ri-1040 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I fill out 2022 form ri-1040 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your 2022 form ri-1040. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is form ri-1040?

Form RI-1040 is the Rhode Island Resident Individual Income Tax Return form.

Who is required to file form ri-1040?

Residents of Rhode Island who have income that is subject to state taxation are required to file form RI-1040.

How to fill out form ri-1040?

Form RI-1040 can be filled out manually or electronically following the instructions provided by the Rhode Island Division of Taxation.

What is the purpose of form ri-1040?

The purpose of form RI-1040 is to report an individual's income, deductions, credits, and calculate the amount of state income tax owed or refunded.

What information must be reported on form ri-1040?

Information such as income sources, deductions, credits, and any other relevant financial information must be reported on form RI-1040.

Fill out your 2022 form ri-1040 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2022 Form Ri-1040 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.