Get the free "Quarterly Reporting Requirements for Currency Exchange License Holders ...

Show details

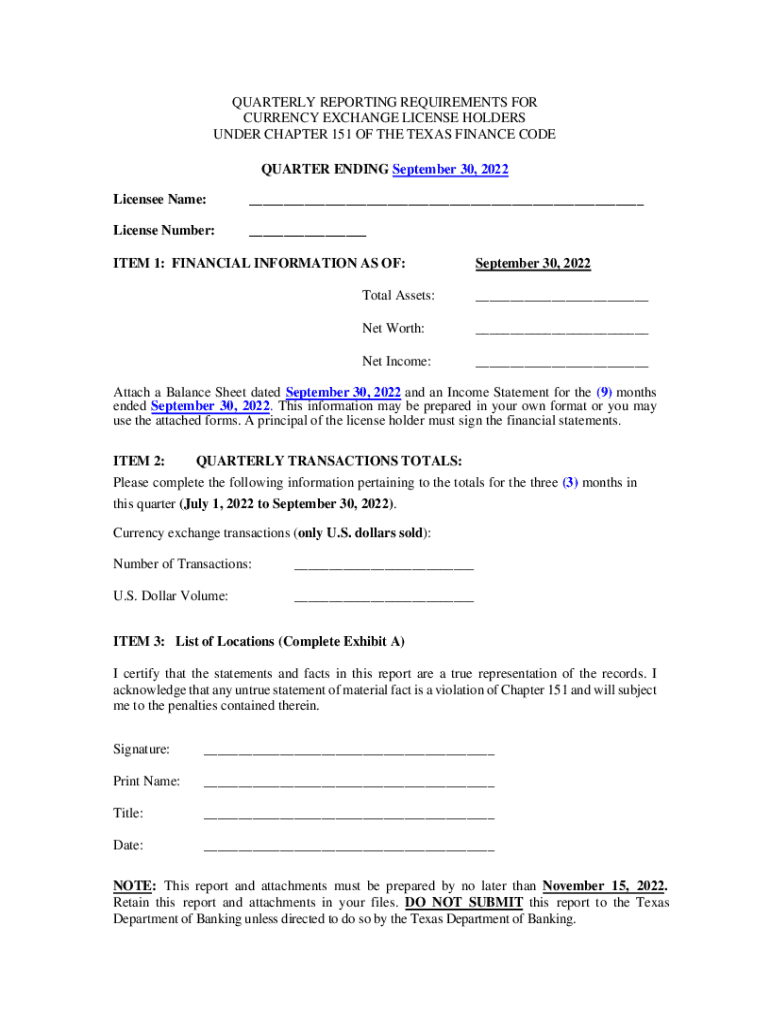

QUARTERLY REPORTING REQUIREMENTS FOR CURRENCY EXCHANGE LICENSE HOLDERS UNDER CHAPTER 151 OF THE TEXAS FINANCE CODE QUARTER ENDING September 30, 2022, Licensee Name:___License Number:___ITEM 1: FINANCIAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ampquotquarterly reporting requirements for

Edit your ampquotquarterly reporting requirements for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ampquotquarterly reporting requirements for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ampquotquarterly reporting requirements for online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ampquotquarterly reporting requirements for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ampquotquarterly reporting requirements for

How to fill out ampquotquarterly reporting requirements for

01

Gather all the necessary financial data and records for the reporting period.

02

Review the specific requirements for the quarterly reporting, such as the forms or templates to be used and the deadline for submission.

03

Fill out the forms or templates accurately and completely. Provide all required information, including financial statements, sales figures, expenses, and any other relevant data.

04

Double-check your entries for any errors or omissions.

05

Submit the completed quarterly report within the designated deadline.

06

Keep a copy of the report for your records.

Who needs ampquotquarterly reporting requirements for?

01

Companies or organizations that are required to provide regular financial updates to regulatory bodies, shareholders, or stakeholders.

02

Businesses that are publicly traded on stock exchanges.

03

Government agencies that monitor financial activities and require periodic reporting.

04

Non-profit organizations that need to disclose financial information to donors or grant providers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ampquotquarterly reporting requirements for directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign ampquotquarterly reporting requirements for and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I fill out ampquotquarterly reporting requirements for on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your ampquotquarterly reporting requirements for. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit ampquotquarterly reporting requirements for on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ampquotquarterly reporting requirements for on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is ampquotquarterly reporting requirements for?

Quarterly reporting requirements are used to provide regular updates on the financial performance and other key metrics of a business.

Who is required to file ampquotquarterly reporting requirements for?

Companies and organizations are required to file quarterly reporting requirements to ensure transparency and accountability.

How to fill out ampquotquarterly reporting requirements for?

Quarterly reporting requirements can be filled out by providing accurate financial data, performance metrics, and other relevant information in the designated forms or formats.

What is the purpose of ampquotquarterly reporting requirements for?

The purpose of quarterly reporting requirements is to keep stakeholders informed about the financial health and performance of a company on a regular basis.

What information must be reported on ampquotquarterly reporting requirements for?

Information such as revenue, expenses, profits, cash flow, debt levels, and other key financial metrics must be reported on quarterly reporting requirements.

Fill out your ampquotquarterly reporting requirements for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ampquotquarterly Reporting Requirements For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.