Get the free Educational Reimbursement Plan

Show details

El plan de reembolso educativo de Marathon Petroleum ofrece beneficios para fomentar el autod desarrollo brindando asistencia financiera para ciertos gastos relacionados con la educación, incluyendo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign educational reimbursement plan

Edit your educational reimbursement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your educational reimbursement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing educational reimbursement plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit educational reimbursement plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out educational reimbursement plan

How to fill out Educational Reimbursement Plan

01

Review the educational reimbursement policy provided by your employer.

02

Select the course or program you wish to pursue that aligns with your career goals.

03

Ensure the program is eligible for reimbursement according to the company’s guidelines.

04

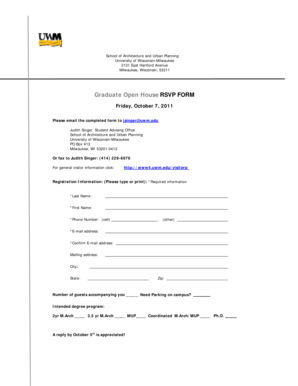

Fill out the Educational Reimbursement Plan application form, including necessary personal and course details.

05

Attach required documentation, such as proof of enrollment, course fees, and any other supporting documents.

06

Submit the completed application to your supervisor or the designated HR representative for approval.

07

Once approved, complete the course and obtain proof of completion.

08

Submit the proof of completion along with any additional receipts to process the reimbursement.

Who needs Educational Reimbursement Plan?

01

Employees seeking to enhance their skills or education relevant to their job.

02

Individuals pursuing further education or training to advance their career.

03

Staff members looking to transition to a new role that requires different qualifications.

04

Those interested in professional development opportunities provided by their employer.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to pay back tuition reimbursement if you get fired?

If you are fired for cause, such as insubordination, failure to perform your duties, harassment, discrimination, theft or some other serious reason, you might be required to pay back your tuition.

How much do most companies pay for tuition reimbursement?

There are no fixed limits on tuition reimbursement. Employers can contribute however much they want. Many employers set their limit at $5,250 per year– the maximum amount they can deduct from their taxes. However, employers who are especially motivated to train their workforce may be willing to contribute more.

How does tuition reimbursement work with employers?

Tuition reimbursement (also known as tuition assistance) is an employee benefit through which an employer pays for a predetermined amount of continuing education credits or college coursework to be applied toward a degree.

Do companies actually make you pay back tuition reimbursement?

FAQs about tuition reimbursement programs You can require an employee to pay back the tuition reimbursement if they leave your company voluntarily within a set amount of time. However, you must specify this in your policy covering employee tuition reimbursement.

Do employer reimbursement programs need to be repaid?

The details will depend on the company's policy, and you should always read the fine print. There may be a clause in your contract that ties your reimbursement to your employment. For example, if you leave your job within a year of completing your degree program, you may have to pay the money back.

Do companies really make you pay back tuition reimbursement?

Tuition assistance is usually sent directly to the school upfront, while tuition reimbursement is typically paid out to the student after the course is completed. You may have to pay back funds should you leave the company during or shortly after completing your courses.

What is tuition reimbursement example?

First, companies could require a passing grade to receive reimbursement, while others tie the amount of tuition assistance to the grades you get in your classes. For example, your company might provide 90% tuition reimbursement for an A, 80% for a B, and 70% for a C.

What is the IRS rule for tuition reimbursement?

Payments made directly to the lender, as well as those made to the employee, qualify. By law, tax-free benefits under an educational assistance program are limited to $5,250 per employee per year. Normally, assistance provided above that level is taxable as wages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Educational Reimbursement Plan?

An Educational Reimbursement Plan is a program offered by employers that reimburses employees for their educational expenses, such as tuition, fees, or books, as a way to encourage professional development.

Who is required to file Educational Reimbursement Plan?

Typically, employees who wish to receive reimbursement for qualifying educational expenses must complete a form as part of their employer's Educational Reimbursement Plan, but the specific filing requirements can vary by organization.

How to fill out Educational Reimbursement Plan?

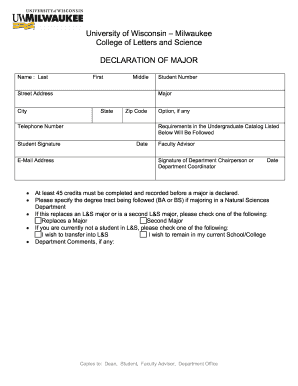

To fill out the Educational Reimbursement Plan, employees generally need to provide personal information, details of the course or program, copies of receipts for expenses, and any other documentation required by the employer.

What is the purpose of Educational Reimbursement Plan?

The purpose of the Educational Reimbursement Plan is to support employee development, enhance skills, and increase job performance, resulting in greater employee retention and satisfaction.

What information must be reported on Educational Reimbursement Plan?

Information that must be reported generally includes employee name, position, educational institution, course details, dates of attendance, amount spent on eligible expenses, and any supporting documentation such as receipts or grade reports.

Fill out your educational reimbursement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Educational Reimbursement Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.