Get the free Moet ik aangifte erfbelasting doen?

Show details

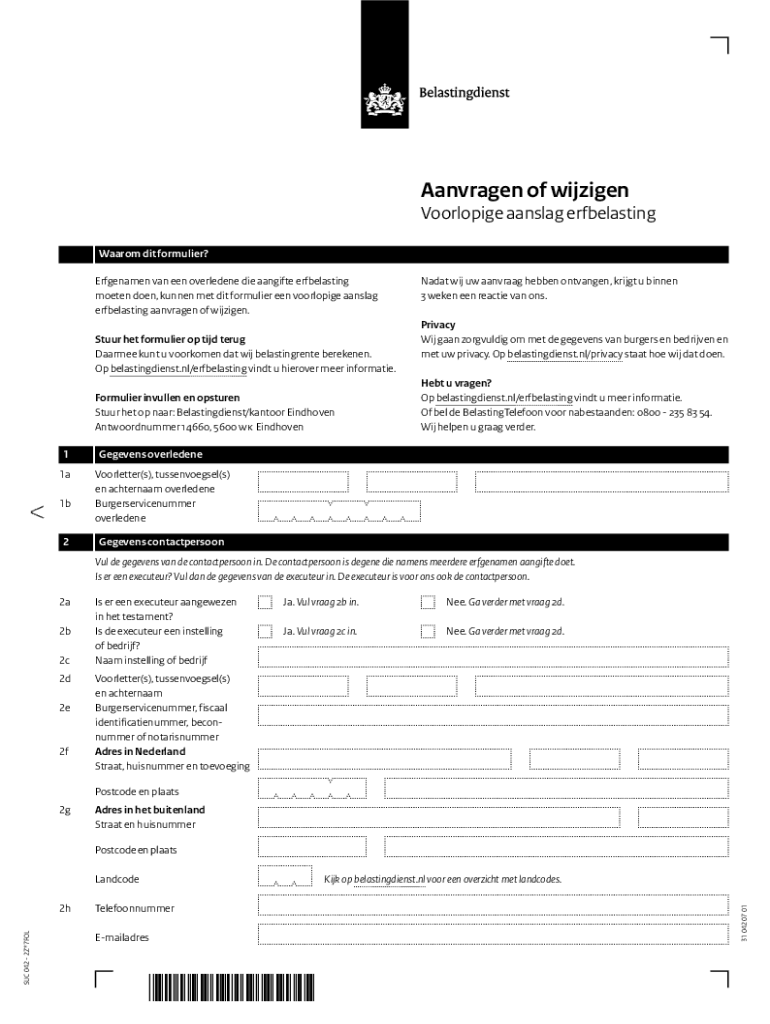

Tail: NederlandsAanvragen of wijzigenVoorlopige Ainsley erfbelastingWaarom it formulaic?

Erfgenamen van been overladen die tangible erfbelasting

Mortensen, runner met it formulaic been voorlopige

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign moet ik aangifte erfbelasting

Edit your moet ik aangifte erfbelasting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your moet ik aangifte erfbelasting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit moet ik aangifte erfbelasting online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit moet ik aangifte erfbelasting. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out moet ik aangifte erfbelasting

How to fill out moet ik aangifte erfbelasting

01

Start by gathering all the necessary information and documentation required for filing the erfbelasting (inheritance tax) declaration.

02

Determine if you are the heir or beneficiary of the estate and if you are obligated to file the inheritance tax declaration.

03

Fill out the required forms or use the online platform provided by the tax authorities to complete the declaration.

04

Provide accurate information regarding the deceased person's assets, liabilities, and financial details.

05

Calculate the value of the inheritance and determine the corresponding tax obligations.

06

Submit the completed declaration along with any supporting documents to the tax authorities.

07

Pay any applicable inheritance tax within the specified deadline.

08

Keep copies of all documents and correspondence related to the inheritance tax declaration for future reference or potential audits.

09

Seek professional advice or assistance if you are unsure about any aspect of the declaration process.

Who needs moet ik aangifte erfbelasting?

01

Moet ik aangifte erfbelasting (inheritance tax declaration) needs to be filed by individuals who become heirs or beneficiaries of an estate after someone has passed away.

02

The obligation to fill out the inheritance tax declaration varies depending on the value of the inheritance and the applicable tax laws in your country or region.

03

It is recommended to consult the tax authorities or a tax professional to determine if you are required to file the erfbelasting declaration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in moet ik aangifte erfbelasting?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your moet ik aangifte erfbelasting to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out moet ik aangifte erfbelasting on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your moet ik aangifte erfbelasting by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit moet ik aangifte erfbelasting on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute moet ik aangifte erfbelasting from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is moet ik aangifte erfbelasting?

Moet ik aangifte erfbelasting translates to 'Do I need to file inheritance tax returns?' It refers to the obligation to report and pay taxes on inherited assets in the Netherlands.

Who is required to file moet ik aangifte erfbelasting?

Individuals who inherit assets, whether they be money, property, or other valuables, and whose combined value exceeds the tax-free threshold are required to file a return.

How to fill out moet ik aangifte erfbelasting?

To fill out the inheritance tax return, the inheritor must provide details about the deceased's assets, their value, debts owed by the estate, and personal information of both the deceased and the inheritors.

What is the purpose of moet ik aangifte erfbelasting?

The purpose of filing the inheritance tax return is to declare the value of the inherited assets to the tax authorities, ensuring that the correct amount of tax is calculated and paid.

What information must be reported on moet ik aangifte erfbelasting?

The return must report the value of all assets received, any debts associated with the estate, and details about the beneficiaries.

Fill out your moet ik aangifte erfbelasting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Moet Ik Aangifte Erfbelasting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.