Get the free Quid Pro Quo Contributions - Internal Revenue Service

Show details

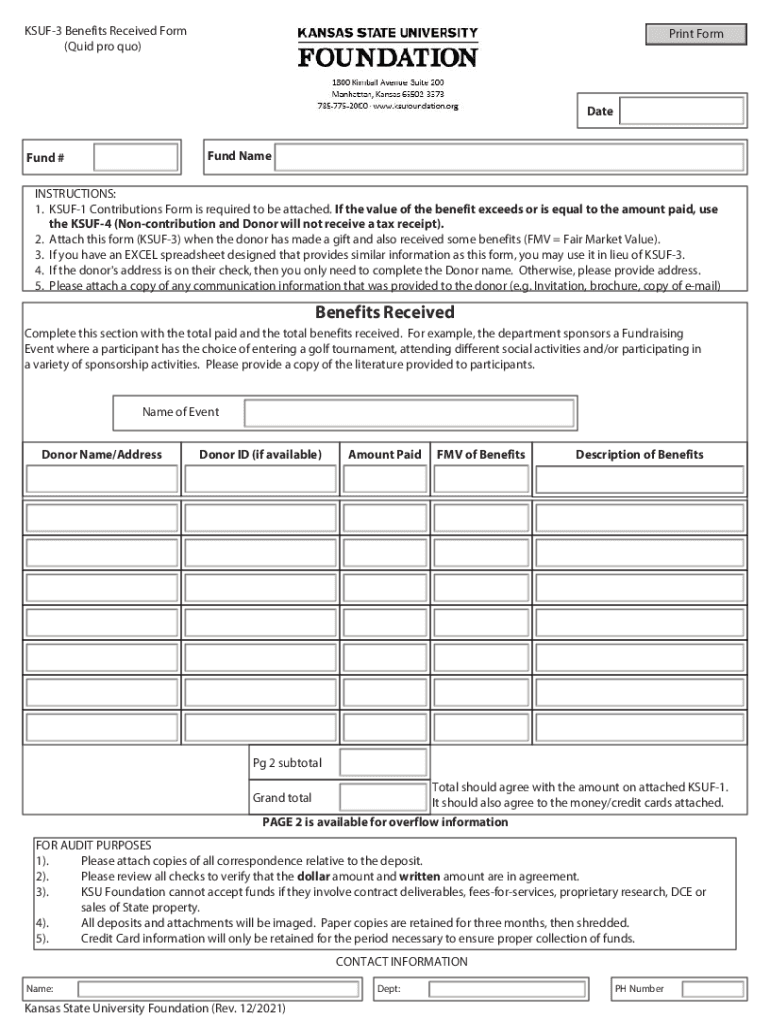

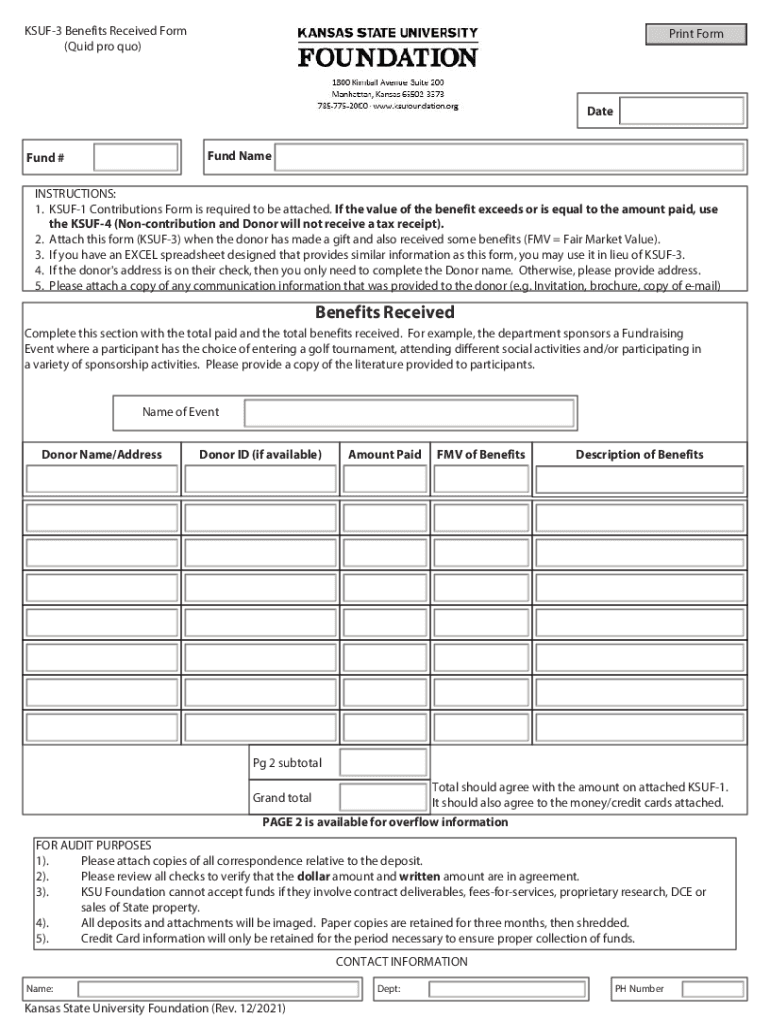

KSUF3 Benefits Received Form (Quid pro quo)Print Forth following PDF form should be attached to KSUF1 Contribution Transmittal Form when there are benefits received by the donor in exchange for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quid pro quo contributions

Edit your quid pro quo contributions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quid pro quo contributions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing quid pro quo contributions online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit quid pro quo contributions. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quid pro quo contributions

How to fill out quid pro quo contributions

01

Begin by understanding what quid pro quo contributions are. Quid pro quo contributions refer to a situation where a donor gives money or something of value to a charity in exchange for receiving goods or services in return.

02

Ensure that your organization is eligible to accept quid pro quo contributions. Some nonprofits may be restricted from accepting these contributions due to specific regulations or restrictions.

03

Clearly communicate the value of the goods or services being provided in exchange for the contribution. This is important for both the donor and the organization to understand the nature of the transaction.

04

Determine the fair market value of the goods or services. It is crucial to accurately determine the value to avoid any legal or tax-related issues.

05

Provide an acknowledgement letter to the donor stating the amount of the contribution and the estimated value of the goods or services received. This is required for tax purposes and should be done in compliance with tax regulations.

06

Keep accurate records of all quid pro quo contributions, including donor information, contribution amounts, and the value of goods or services exchanged.

07

Stay updated with any changes in regulations or reporting requirements related to quid pro quo contributions to ensure compliance with legal and accounting standards.

Who needs quid pro quo contributions?

01

Organizations that engage in fundraising activities

02

Charities and non-profit organizations

03

Donors who want to receive goods or services in exchange for their contributions

04

Individuals or groups conducting events or campaigns where a quid pro quo arrangement is established

05

Accountants and tax professionals who handle the financial aspects of quid pro quo contributions

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete quid pro quo contributions online?

pdfFiller has made it easy to fill out and sign quid pro quo contributions. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my quid pro quo contributions in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your quid pro quo contributions right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out quid pro quo contributions on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your quid pro quo contributions. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is quid pro quo contributions?

Quid pro quo contributions are donations made to a political campaign or organization in exchange for a specific benefit or service.

Who is required to file quid pro quo contributions?

Campaigns and organizations receiving quid pro quo contributions are required to report them.

How to fill out quid pro quo contributions?

Quid pro quo contributions should be reported on the appropriate campaign finance forms following the guidelines set by the election commission.

What is the purpose of quid pro quo contributions?

The purpose of quid pro quo contributions is to ensure transparency and accountability in political fundraising.

What information must be reported on quid pro quo contributions?

The amount of the contribution, the donor's information, the benefit received in exchange, and any other relevant details must be reported.

Fill out your quid pro quo contributions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quid Pro Quo Contributions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.