Get the free Loan Estimate and Closing Disclosure: Your guides as you choose the ...

Show details

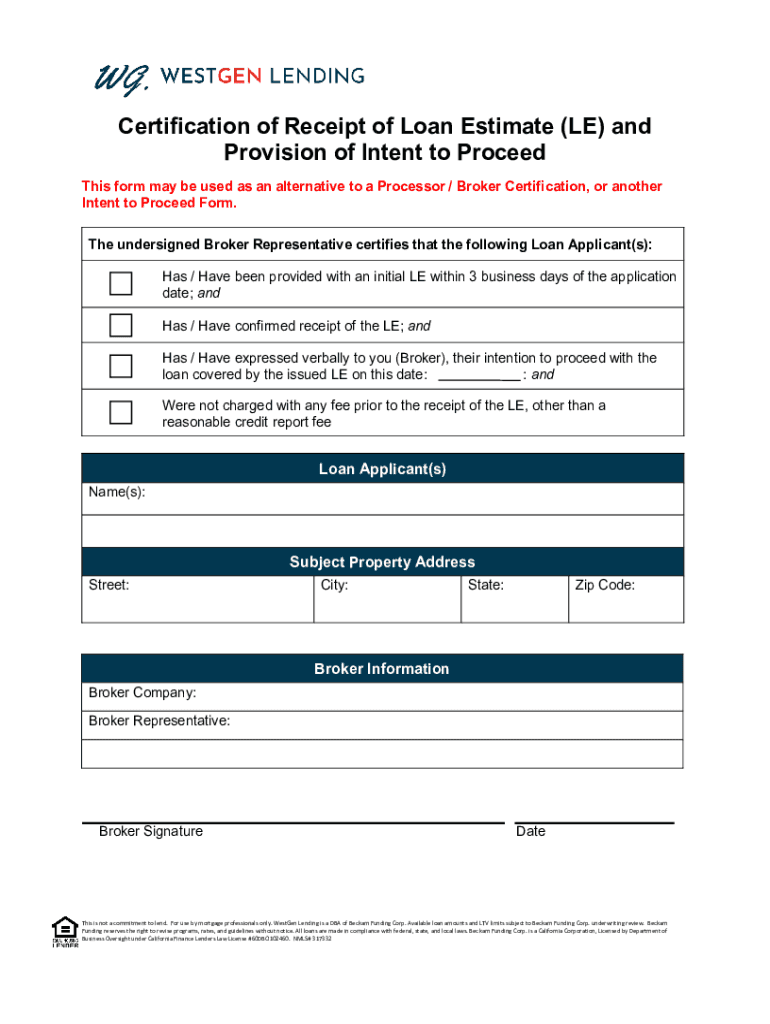

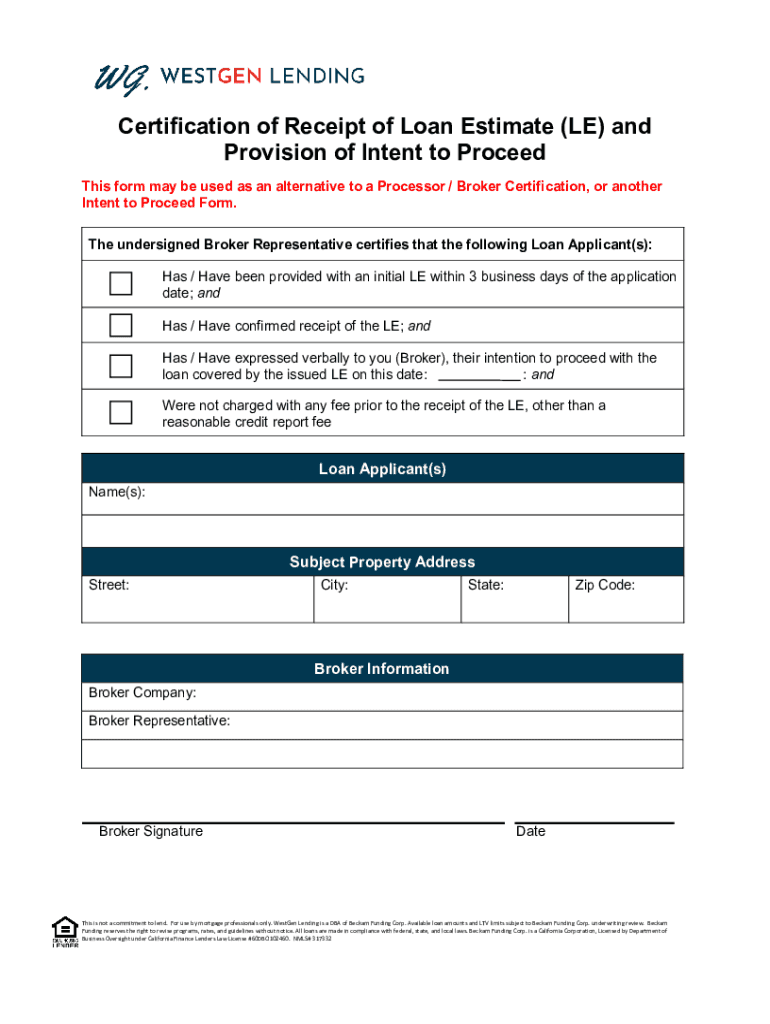

Certification of Receipt of Loan Estimate (LE) and Provision of Intent to Proceed This form may be used as an alternative to a Processor / Broker Certification, or another Intent to Proceed Form.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan estimate and closing

Edit your loan estimate and closing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan estimate and closing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan estimate and closing online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan estimate and closing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan estimate and closing

How to fill out loan estimate and closing

01

Gather all necessary financial information such as income, assets, debts, and credit score.

02

Contact a lender to start the loan estimate process.

03

Provide the lender with all requested documentation.

04

Review the loan estimate document for accuracy and make any necessary corrections.

05

Sign and submit the loan estimate.

06

Schedule a closing appointment with the lender and required parties.

07

Review the closing disclosure document for accuracy and make any necessary corrections.

08

Sign all necessary paperwork at the closing appointment.

Who needs loan estimate and closing?

01

Individuals or families looking to purchase a home or refinance their current mortgage need a loan estimate and closing.

02

Real estate agents, lenders, and title companies also require loan estimates and closings to facilitate the home buying process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get loan estimate and closing?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the loan estimate and closing in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the loan estimate and closing electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the loan estimate and closing in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your loan estimate and closing directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is loan estimate and closing?

Loan estimate is a document that provides details about a loan that a borrower has applied for, including estimated interest rate, monthly payment, and closing costs. Closing is the final step in the homebuying process where the property is transferred from the seller to the buyer.

Who is required to file loan estimate and closing?

Lenders are required to provide a loan estimate to borrowers within three business days of receiving a loan application. Closing documents are typically prepared and filed by the closing agent or attorney.

How to fill out loan estimate and closing?

To fill out a loan estimate, borrowers need to provide personal and financial information. Closing documents are typically filled out by the closing agent or attorney with input from both the buyer and seller.

What is the purpose of loan estimate and closing?

The purpose of a loan estimate is to provide borrowers with an overview of the terms of the loan they are applying for. The purpose of closing documents is to finalize the sale of a property and ensure all legal and financial obligations are met.

What information must be reported on loan estimate and closing?

Loan estimate must include details such as loan amount, interest rate, monthly payment, closing costs, and terms of the loan. Closing documents must include a settlement statement, deed, and any other legal documents necessary for the transfer of property.

Fill out your loan estimate and closing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Estimate And Closing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.