IRS 1095-A 2022 free printable template

Show details

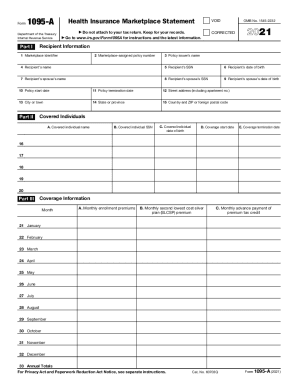

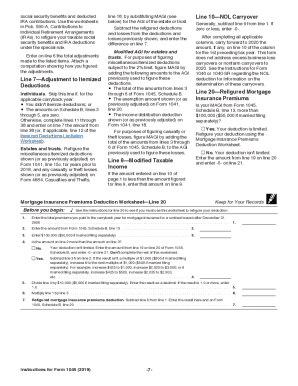

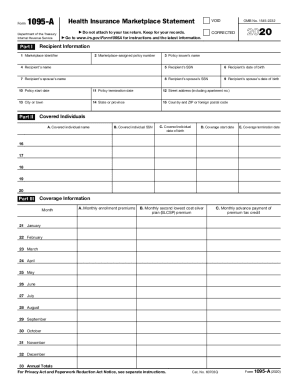

That Form 1095-A was sent in error. You shouldn t have received a Form 1095-A for this policy. Don t use the information on this or the Form 8962. Enrollment the individuals who would be in your tax family for the year of coverage Form 1095-A will list all enrolled individuals in Part II on your Form 1095-A. Cat. No. 60703Q Form 1095-A 2022 Instructions for Recipient You received this Form 1095-A because you or a family member enrolled in health insurance coverage through the Health Insurance...Marketplace. Enrolled individuals aren t individuals who would be in your tax family for the year of coverage your Form 1095-A will include coverage information in Part III that is applicable solely to the individuals listed on your Form 1095-A and separately issued Forms 1095-A will include individuals not in your tax family. CAUTION NOT FOR FILING Form 1095-A is provided here for informational purposes only. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in...a qualified health plan in the individual market through the Marketplace. Don t use the information on the original Form 1095-A you received for this policy. Part I. Recipient Information lines 1 15. If there are more than 5 individuals covered by a policy you will receive one or more additional Forms 1095-A that continue Part II. VOID box. If the VOID box is checked at the top of the form you previously received a Form 1095-A for the policy described in Part I. Go to www*irs*gov/Form1095A for...instructions and the latest information* OMB No* 1545-2232 CORRECTED Recipient Information 1 Marketplace identifier 2 Marketplace-assigned policy number 3 Policy issuer s name 4 Recipient s name 5 Recipient s SSN 6 Recipient s date of birth 7 Recipient s spouse s name 10 Policy start date 11 Policy termination date 12 Street address including apartment no. 13 City or town 14 State or province 15 Country and ZIP or foreign postal code Covered Individuals A. Covered individual name date of birth...D. Coverage start date E* Coverage termination date Coverage Information Month A. Monthly enrollment premiums B. Monthly second lowest cost silver plan SLCSP premium C. Monthly advance payment of premium tax credit 21 January 22 February 23 March 24 April 25 May 26 June 27 July 28 August 29 September 30 October 31 November 32 December 33 Annual Totals For Privacy Act and Paperwork Reduction Act Notice see separate instructions. Additional information* For additional information about the tax...provisions of the Affordable Care Act ACA including the premium tax credit see www*irs*gov/Affordable-Care-Act/Individuals-and-Families or call the IRS Healthcare Hotline for ACA questions 800-919-0452. Part I reports information about you the insurance company that issued your policy and the Marketplace where you enrolled in the coverage. Line 1. This line identifies the state where you enrolled in coverage through the Marketplace. identify the policy in which you enrolled* If you are...completing Part IV of Form 8962 enter this number on line 30 31 32 or 33 box a* Line 3.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1095-A

How to edit IRS 1095-A

How to fill out IRS 1095-A

Instructions and Help about IRS 1095-A

How to edit IRS 1095-A

To edit IRS 1095-A, you can use pdfFiller, which offers tools for editing the form directly. Begin by uploading your document to the pdfFiller platform, where you can make necessary changes, such as correcting information or adding details. After editing, ensure to save the revised document to keep your changes intact.

How to fill out IRS 1095-A

To fill out IRS 1095-A, gather all necessary information such as your Marketplace health coverage details and personal identification. Follow these steps:

01

Locate the correct version of the form for the tax year you are filing.

02

Fill in your personal information, including name and address.

03

Provide the details of your health coverage, including the start and end dates.

04

Ensure all sections are completed accurately to prevent delays in processing.

About IRS 1095-A 2022 previous version

What is IRS 1095-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1095-A 2022 previous version

What is IRS 1095-A?

IRS 1095-A is a tax form used to report health insurance coverage obtained through the Health Insurance Marketplace. It provides information required to claim the Premium Tax Credit and to confirm compliance with the Affordable Care Act. Filers must retain this form for their records as it is necessary for filing federal tax returns.

What is the purpose of this form?

The purpose of IRS 1095-A is to provide evidence of health coverage for individuals who purchased insurance through the Marketplace. This form reports details such as the months of coverage, the premium amounts, and the type of coverage acquired. Additionally, it helps taxpayers determine if they qualify for the Premium Tax Credit when filing their tax returns.

Who needs the form?

Individuals who purchased health insurance through the Health Insurance Marketplace must receive a 1095-A. This includes those who enrolled in a health plan for themselves, their spouse, or their dependents. It is essential for anyone who intends to claim a Premium Tax Credit or reconcile their advance premium tax credits when filing taxes.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1095-A if you did not purchase health coverage through the Health Insurance Marketplace or if you were covered by employer-provided insurance, Medicare, or Medicaid. Additionally, individuals who were granted a hardship exemption related to health coverage typically do not need to complete this form.

Components of the form

IRS 1095-A comprises several important sections, including:

01

Part I: Information about the primary insured.

02

Part II: Details of the health coverage provided.

03

Part III: Information about other individuals covered under the same plan.

Each section includes specific instructions detailing what information is required, ensuring accurate reporting of coverage periods and premium amounts.

What are the penalties for not issuing the form?

Failure to issue IRS 1095-A, when required, may subject responsible parties to penalties from the IRS. This can include fines for not providing the form to individuals or submitting incomplete or incorrect information. It is crucial for Marketplace issuers to comply to avoid potential monetary penalties associated with filing inaccuracies.

What information do you need when you file the form?

When filing IRS 1095-A, gather the following information:

01

Your personal identification details (name, address, Social Security number).

02

The months for which you had coverage.

03

The amount of premium payments made throughout the year.

04

The names and identification numbers of any covered dependents.

This information is necessary to complete the form accurately and to establish eligibility for any applicable tax credits.

Is the form accompanied by other forms?

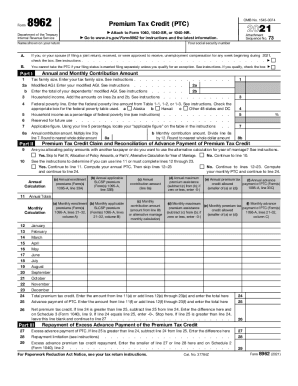

IRS 1095-A can accompany other forms, particularly IRS Form 8962, which is used to calculate the Premium Tax Credit. When filing taxes, it is essential to attach Form 8962 to report the credits claimed based on the information provided in Form 1095-A. Be sure to incorporate relevant forms to ensure compliance with tax obligations.

Where do I send the form?

If you are filing IRS 1095-A as an information return, it should be submitted to the IRS along with Form 1094-B or 1094-C if applicable. If you are an individual taxpayer using the form to file your tax return, you do not send it to the IRS but keep it for your records. Ensure you check the current submission guidelines as they may change annually.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

easy to read and generate forms which made my experience less stressful - ty

I love this software. I can easily 'sign' a document to approve vendor bids, etc. This really keeps the ball rolling. Thanks.

See what our users say