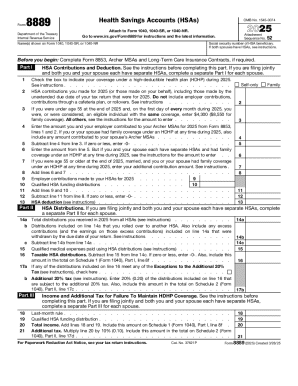

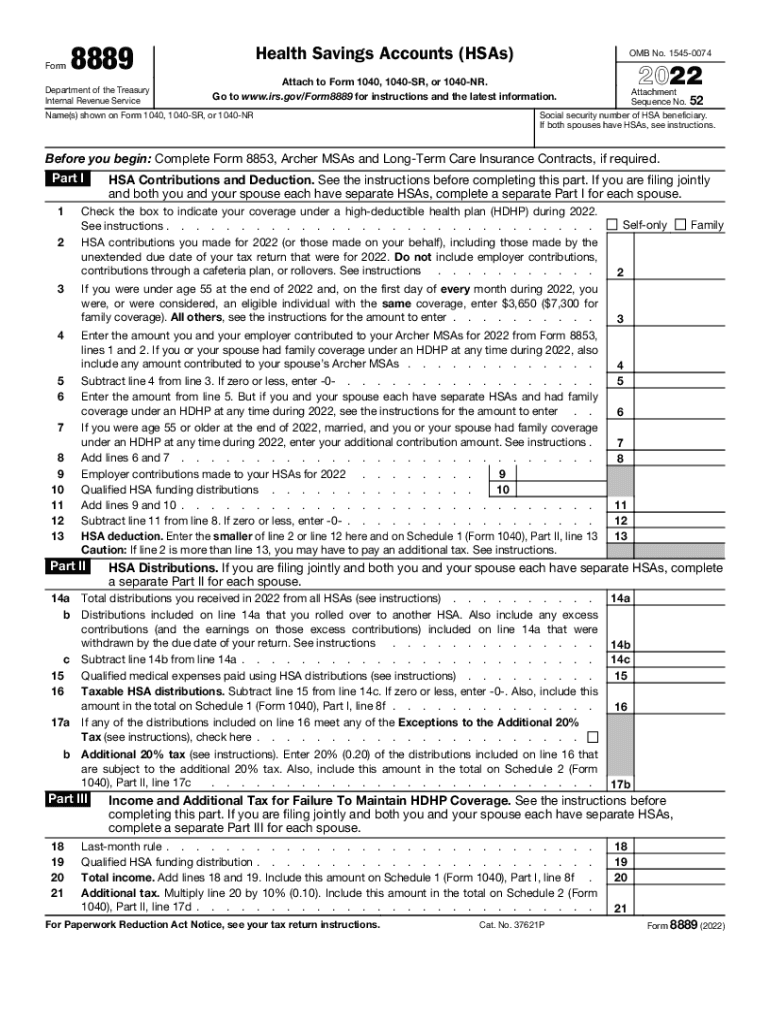

IRS 8889 2022 free printable template

Instructions and Help about IRS 8889

How to edit IRS 8889

How to fill out IRS 8889

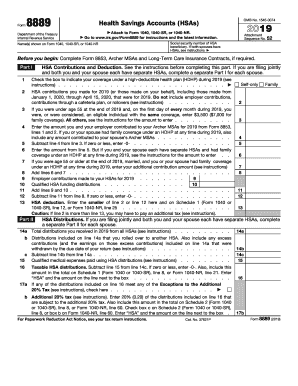

About IRS 8 previous version

What is IRS 8889?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8889

What should I do if I realize I made an error after filing IRS 8889?

If you discover an error after filing IRS 8889, you can submit an amended return using Form 1040-X. Be sure to include the corrections related to IRS 8889 and accurately reflect your current situation. It's important to file the amendment as soon as possible to avoid potential complications.

How can I verify that my IRS 8889 has been received and processed?

To verify the receipt and processing of your IRS 8889, you can use the IRS 'Where's My Refund?' tool, or contact the IRS directly for updates. Be prepared to provide your identifying information and details of the submission to facilitate the inquiry.

What privacy and data security measures should I consider when e-filing IRS 8889?

When e-filing IRS 8889, ensure that the software you use is IRS-approved and has strong encryption for data protection. Additionally, use a secure network to transmit your information and consider keeping digital copies of your documents in a secure location to protect your sensitive data.

How do I know if I need an authorized representative to file IRS 8889 on my behalf?

You may need an authorized representative to file IRS 8889 on your behalf if you are unable to do so due to illness, absence, or if you wish to appoint someone else to handle your tax matters. Proper authorization is done by filling out Form 2848, Power of Attorney and Declaration of Representative.

What common mistakes should I avoid when completing IRS 8889?

Common mistakes when completing IRS 8889 include inaccurately reporting your contributions or distributions, failing to reconcile your figures with your Form 1099-SA, or missing signature lines. It's crucial to double-check your entries and ensure all calculations are correct to minimize the risk of errors.