IL Financial Form 486- 2011 free printable template

Show details

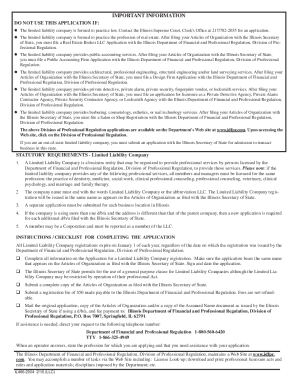

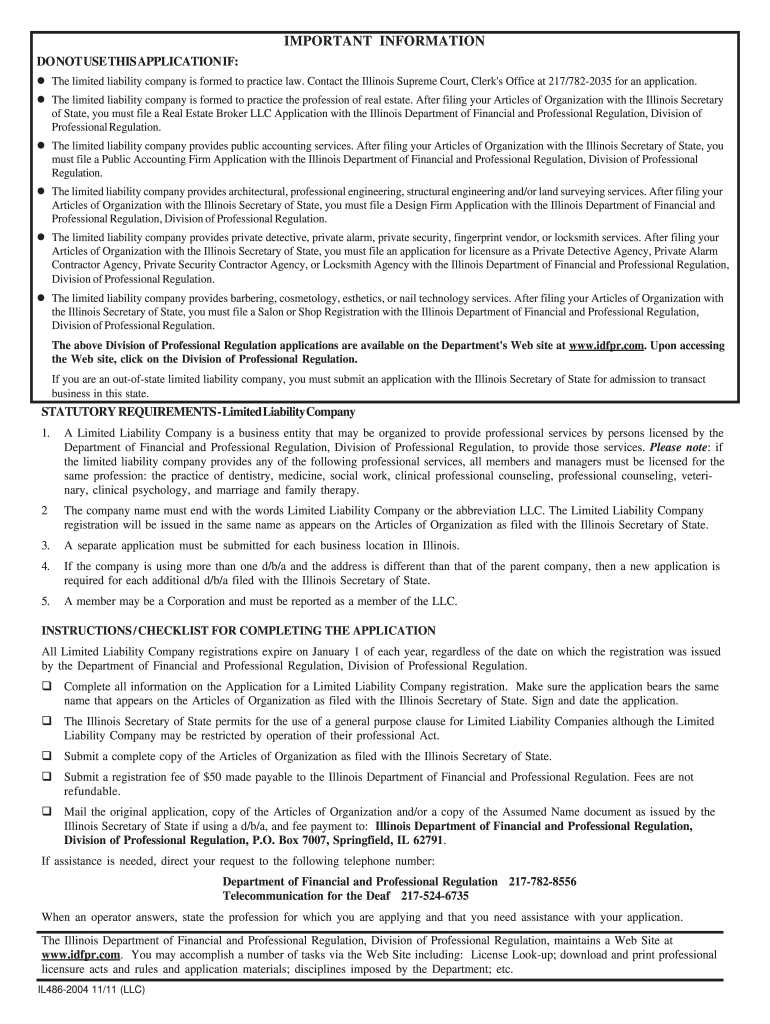

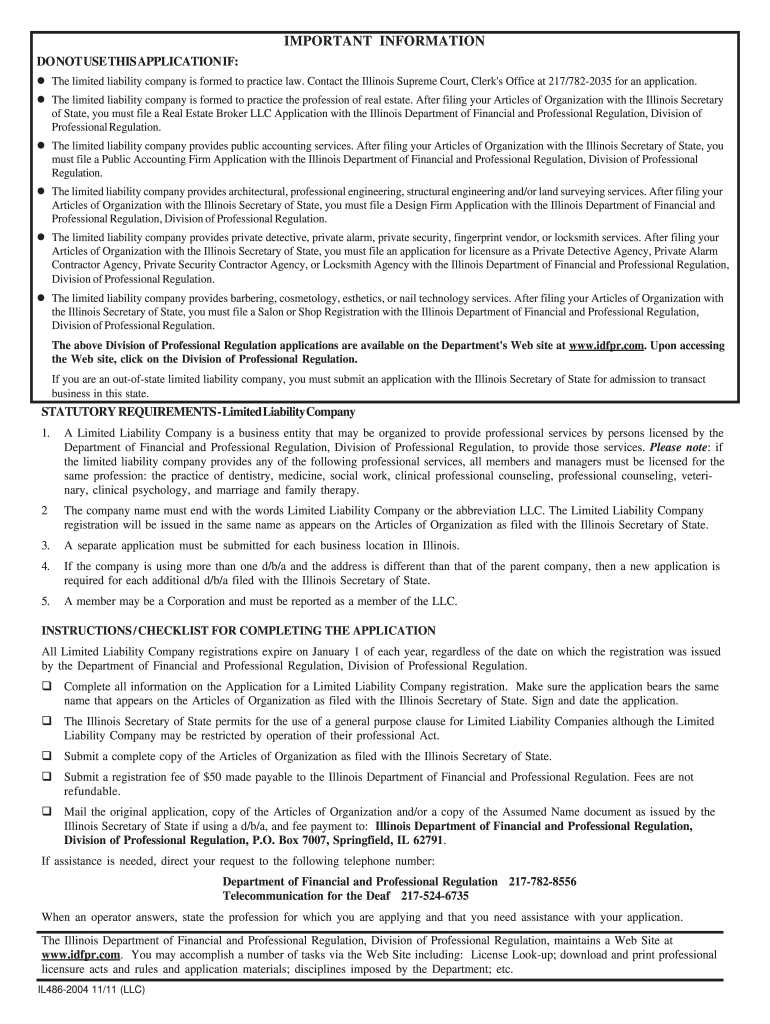

Idfpr.com. You may accomplish a number of tasks via the Web Site including License Look-up download and print professional licensure acts and rules and application materials disciplines imposed by the Department etc. IL486-2004 11/11 LLC FOR OFFICIAL USE ONLY APPLICATION FOR A LIMITED LIABILITY COMPANY REGISTRATION IMPORTANT NOTICE Completion of this form is necessary for consideration for licensure under 805 ILCS 180/1 et. IMPORTANT INFORMATION DO NOT USE THIS APPLICATION IF The limited...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL Financial Form 486

Edit your IL Financial Form 486 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL Financial Form 486 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL Financial Form 486 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL Financial Form 486. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL Financial Form 486-2004 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL Financial Form 486

How to fill out IL Financial Form 486

01

Obtain the IL Financial Form 486 from the appropriate state or government website.

02

Read the instructions carefully before starting to fill out the form.

03

Start by entering your personal information in the designated fields, such as your name, address, and social security number.

04

Provide details about your financial situation, including income sources, expenses, and assets.

05

Complete any additional sections that are relevant to your financial status or situation.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form according to the instructions provided, either by mail or electronically as required.

Who needs IL Financial Form 486?

01

Individuals or families applying for financial assistance or benefits in Illinois.

02

Those who are required to disclose their financial situation for state programs.

03

Applicants seeking support from programs like Medicaid or other state welfare services.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to file an annual report for an LLC in Illinois?

Illinois LLC taxes and fees The following are taxation requirements and ongoing fees for Illinois LLCs: Annual report. Illinois requires LLCs to file an annual report during the 60-day period before the first day of the anniversary month of the incorporation date. The annual report fee is $250.

Does Illinois allow Series LLC?

Illinois is one of only eight states where businesses can establish Series under limited liability companies (“LLCs”). This gives Illinois businesses an interesting option. A Series LLC is a unique structure that combines the flexibility of a partnership with the liability limitation of an LLC.

Does Illinois require an operating agreement for LLC?

Illinois does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

How is a Series LLC taxed in Illinois?

Illinois Series LLC LLCs are considered pass-through entities for taxation, which means that the owner or owners report business profits and losses on their individual tax returns. Although an LLC provides the limited liability of a corporation, this entity is easier to form.

How do I report LLC income to IRS?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

How long does it take to get LLC approved in Illinois?

Illinois LLC Approval Times Mail filings: In total, mail filing approvals for Illinois LLCs take 3-4 weeks. This accounts for the 10-15 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Illinois LLCs take 7-10 business days.

How do I pay taxes on an LLC in Illinois?

For typical LLCs (those not electing to be taxed as corporations) the tax is 1.5% of net income. The tax is payable to the Illinois Department of Revenue (IDOR). Use Form IL-1065 to pay the tax. In some cases, the owners of an LLC choose to have their business treated like a corporation for tax purposes.

Do you have to pay for LLC Every year in Illinois?

Illinois-based LLCs are required to file an Annual Report every year. The filing fee for your annual report is $75, and there is a $100 fee if it is not filed within 60 days of its due date.

Do I file LLC and personal taxes together?

Limited liability companies (LLCs) can also choose to be treated as a corporation by the IRS, whether they have one or multiple owners. In that situation, they must also file their taxes using Form 1120, which means the owners must file their personal and business taxes separately.

How do I file taxes for an LLC in Illinois?

Begin by registering your business with IDOR either online (through the MyTaxIllinois website) or on paper (Form REG-1). Once you've registered, you'll need to file withholding taxes on a periodic basis (for example monthly) either online or using Form IL-501. You'll also need to periodically file Form IL-941.

Do you have to register your LLC Every year in Illinois?

The State of Illinois requires you to file an annual report for your LLC. You can file the annual report online at the SOS website or by mail using Form LLC-50.1.

How do I add a series to my LLC in Illinois?

In Illinois, a Series LLC needs to be authorize to establish a series. This is done by filing the appropriate Series LLC paperwork with the state. After that is completed, the Master LLC can file a Certificate of Designation. This document allows you to create separate Series LLCs under the Master LLC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IL Financial Form 486?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the IL Financial Form 486 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit IL Financial Form 486 online?

With pdfFiller, it's easy to make changes. Open your IL Financial Form 486 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit IL Financial Form 486 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like IL Financial Form 486. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is IL Financial Form 486?

IL Financial Form 486 is a financial disclosure form required by the Illinois State Board of Education for certain entities to report their financial activities and ensure transparency.

Who is required to file IL Financial Form 486?

Entities such as school districts, educational cooperatives, and any organization receiving state funding in Illinois are typically required to file IL Financial Form 486.

How to fill out IL Financial Form 486?

To fill out IL Financial Form 486, obtain the form from the Illinois State Board of Education's website, provide accurate financial data as requested, and ensure all required fields are completed before submission.

What is the purpose of IL Financial Form 486?

The purpose of IL Financial Form 486 is to provide accountability and transparency in the financial operations of entities receiving state funding, ensuring proper use of public resources.

What information must be reported on IL Financial Form 486?

The form requires reporting information such as revenue sources, expenditures, balance sheets, and any financial activities related to the entity's operations.

Fill out your IL Financial Form 486 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL Financial Form 486 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.