IL Financial Form 486- 2014 free printable template

Get, Create, Make and Sign illinois financial application limited

How to edit illinois financial application limited online

Uncompromising security for your PDF editing and eSignature needs

IL Financial Form 486-2004 Form Versions

How to fill out illinois financial application limited

How to fill out IL Financial Form 486

Who needs IL Financial Form 486?

Instructions and Help about illinois financial application limited

Okay classroom welcome back to accounting 230 we're not going to talk about the income statement before we talk specifically about the income statement I want to point out revenues minus expenses equal net income that's basically the income statement our revenues are prior our sales of those items that we go out and sell to make money for our business minus the expenses that we have equal or net income typical type of expenses would be salary expense rent expense supplies expense okay those are some very typical type of expenses that we would incur so our revenues minus expenses give us our net income now the income statement is a formal financial statement the last video we went over was the balance sheet okay that's also a formal financial statement, but the balance sheet remember shows assets equal liabilities plus equity okay it shows us how we get those assets all right, and it can be a comparative and classified balance sheet comparative meaning is showing between years an income statement can also be compared they can also show multiple years of numbers here of amounts all right so let's look at specifically the details within the income statement a typical income statement is going to show the sales that we have during a time period so typically this time period is going to be for a year so what were the sales for a year, so now I put sales here, and I just put X's because I didn't put dollar amounts in there, but obviously they're going to be dollar amounts in here okay for big corporations it can be millions and millions of dollars okay next costs of goods sold the cost of the item you sold so for example let's say that we're selling tables let's say we sold a table for $1000 okay, so that would be sales at a thousand well that's not really our profit from that what did it cost us to get that table or to manufacture that table that's what cost of goods sold is the cost of the item that we're selling so for example in this case this big table that we're selling it we sold it for $1000, but it may have cost us $700 to 95, so the sales is a thousand the cost of that item that we just sold a 700 so then our gross profit from selling that item would be $300 in my example okay so in an income state once again they're going to show sales minus cost of goods sold give us our gross profit after that we're going to subtract out all of our other operating expenses those normal day-to-day normal business type expenses that we incur after that we'll subtract out such things as interest expense other income and expense items there are all sorts of those things we're not going to go over those right now but there can be some other income and expense items that don't fit within these categories up here okay they're not things that we normally do in our business on a day-to-day offer in our day-to-day operations okay and then lastly our taxes expense obviously taxes need to be paid for our business, so that is an expense, so we'd have that there so all...

People Also Ask about

Do you have to file an annual report for an LLC in Illinois?

Does Illinois allow Series LLC?

Does Illinois require an operating agreement for LLC?

How is a Series LLC taxed in Illinois?

How do I report LLC income to IRS?

How long does it take to get LLC approved in Illinois?

How do I pay taxes on an LLC in Illinois?

Do you have to pay for LLC Every year in Illinois?

Do I file LLC and personal taxes together?

How do I file taxes for an LLC in Illinois?

Do you have to register your LLC Every year in Illinois?

How do I add a series to my LLC in Illinois?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the illinois financial application limited in Gmail?

How can I edit illinois financial application limited on a smartphone?

Can I edit illinois financial application limited on an iOS device?

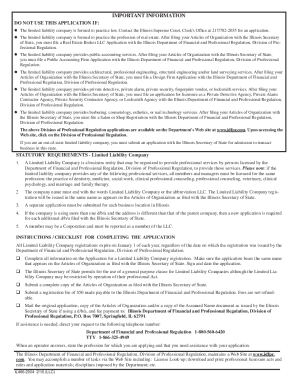

What is IL Financial Form 486?

Who is required to file IL Financial Form 486?

How to fill out IL Financial Form 486?

What is the purpose of IL Financial Form 486?

What information must be reported on IL Financial Form 486?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.