Get the free Contract to Audit Accounts (Form LGC-205)

Show details

This memorandum outlines the procedures and requirements for local government officials and certified public accountants in North Carolina regarding the audit process for the 2010-2011 fiscal year,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contract to audit accounts

Edit your contract to audit accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contract to audit accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contract to audit accounts online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit contract to audit accounts. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contract to audit accounts

How to fill out Contract to Audit Accounts (Form LGC-205)

01

Obtain the Contract to Audit Accounts (Form LGC-205) from the appropriate authority or website.

02

Fill in the identifying information at the top of the form, including the entity's name and contact details.

03

Specify the purpose of the audit in the designated section.

04

Provide the date range for the audit period.

05

List the auditors or firm details who will be conducting the audit.

06

Include any specific instructions or requirements for the audit.

07

Review the form for accuracy and completeness.

08

Sign and date the form in the appropriate section.

09

Submit the completed form to the relevant agency or authority as instructed.

Who needs Contract to Audit Accounts (Form LGC-205)?

01

Entities or organizations that are required to undergo an audit for financial accountability.

02

Non-profits seeking to ensure transparency and compliance with funding requirements.

03

Government agencies needing to assess the financial status of their suborganisations.

04

Businesses looking to maintain good standing with creditors or stakeholders.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of unqualified audit report?

Disadvantages of Unqualified Report The absence of extra information. Limited scope. Assume that compliance. The emphasis is not on the importance of materiality.

How do you conduct a contract audit?

7 Best Practices for Conducting Contract Audits Establish Clear Objectives. Determine the Scope of the Audit. Assemble the Right Team. Conduct Detailed Contract Reviews. Communicate Effectively With Stakeholders. Document and Report Findings. Develop a Follow-Up Plan.

What are the consequences of a qualified audit report to a company?

A clean opinion can enhance the company's reputation and boost investor confidence. On the other hand, a qualified, adverse, or disclaimer of opinion can raise red flags about the company's financial health and governance. On top of this, the type of audit opinion can hugely impact the company's access to capital.

What is the impact of the audit to the company?

Audits have a positive effect on companies by serving as guardrails for management on accounting financial reporting practices. Auditors also provide an independent perspective and resource for audit committees in their role in the financial reporting process.

What are the consequences of an audit?

Accuracy-Related Audit Penalties If the IRS audit reveals that you have not followed the tax laws, you can incur an accuracy-related penalty which is 20% of the understated tax. For instance, if you filed your tax return so that it showed you owed $10,000 less than you do, the accuracy-related penalty will be $2,000.

How do you format an audit report?

Title should mention that it is an 'Independent Auditor's Report'. Mention that responsibility of the Auditor is to express an unbiased opinion on the financial statements and issue an audit report. State the basis on which the opinion as reported has been achieved. Facts of the basis should be mentioned.

What are the two primary reasons for an auditor to issue a qualified opinion?

There are two common reasons why auditors issue qualified opinions. Departure from GAAP: The company didn't follow accepted accounting practices when recording certain transactions. Scope limitation: A scope limitation means the auditor could not verify certain financial transactions.

Is a qualified audit report good or bad?

A qualified opinion is issued when the auditor has identified material misstatements in the financial statements, but these misstatements are not pervasive. In simpler words, the financial statements are still largely reliable despite the identified issues.

Who is required to get its accounts audited?

As mentioned before, you are required to have a tax audit done if your total income from all businesses is over Rs. 1 crore and that from all professions are over Rs. 50 lakh. However, if you are a business owner and a professional, your audit is not on the basis of your cumulative income.

What are the consequences of a qualified audit report?

A qualified audit opinion may have consequences for the audited company: It raises questions about the reliability of the company's financial reporting and internal controls. It may shake investor and stakeholder confidence in the business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

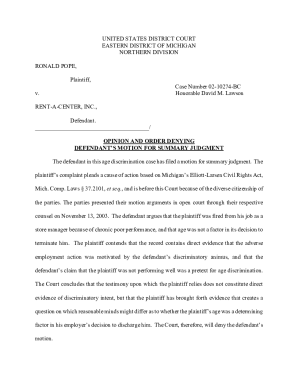

What is Contract to Audit Accounts (Form LGC-205)?

Contract to Audit Accounts (Form LGC-205) is a form used by local governments in Texas to formalize the appointment of an independent auditor to review their financial records.

Who is required to file Contract to Audit Accounts (Form LGC-205)?

Local governments and municipalities in Texas that are required by law to have their financial accounts audited must file Contract to Audit Accounts (Form LGC-205).

How to fill out Contract to Audit Accounts (Form LGC-205)?

To fill out Contract to Audit Accounts (Form LGC-205), provide the necessary details including the name of the auditing firm, scope of the audit, terms of the contract, and the signature of the responsible local government official.

What is the purpose of Contract to Audit Accounts (Form LGC-205)?

The purpose of Contract to Audit Accounts (Form LGC-205) is to ensure transparency and accountability in local government financial reporting by establishing a formal agreement for an independent audit.

What information must be reported on Contract to Audit Accounts (Form LGC-205)?

The information that must be reported includes the name and address of the local government, details of the auditing firm, the audit period, and any specific requirements related to the audit.

Fill out your contract to audit accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contract To Audit Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.