HI RP Form 19-71 - Hawaii County 2022 free printable template

Show details

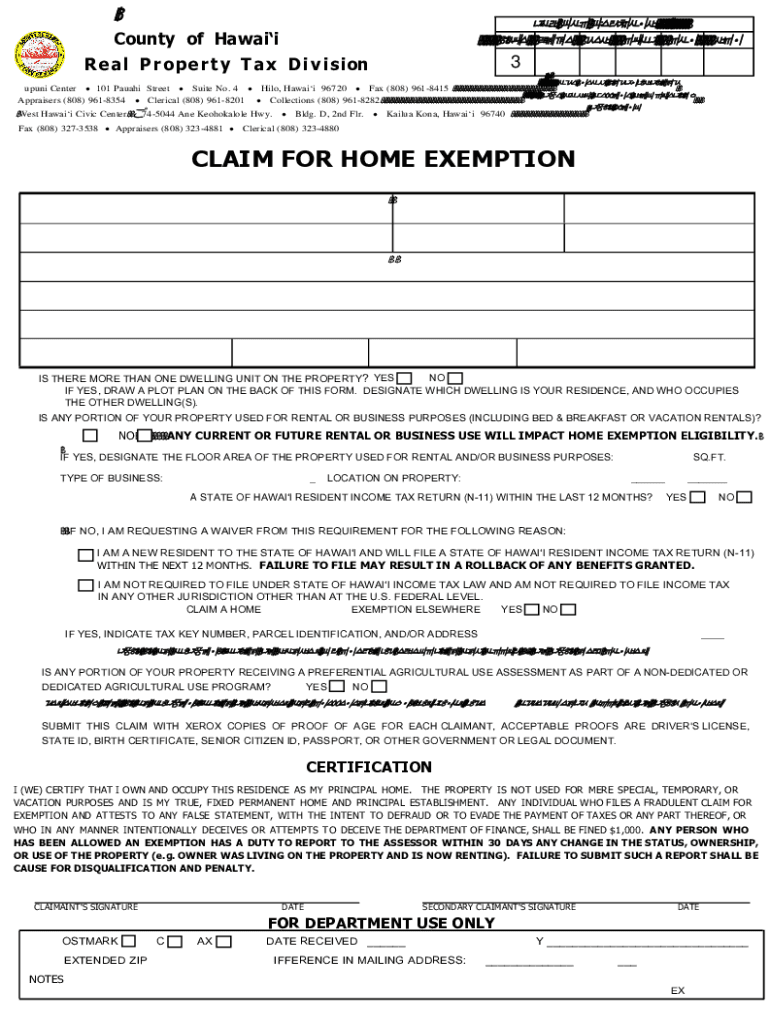

County of Hawaii R e an l P r o p e r t y T an × D i v i s ion CASE NO. ___RP FORM 1971 (Rev. 8/2022)TAX MAP KEY/PARCEL ID ISLE ZONE SEC PLAT PARENT. OF FINANCECPR3. 3/($6(5($',16758&7,216 Around

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI RP Form 19-71 - Hawaii

Edit your HI RP Form 19-71 - Hawaii form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI RP Form 19-71 - Hawaii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI RP Form 19-71 - Hawaii online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI RP Form 19-71 - Hawaii. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI RP Form 19-71 - Hawaii County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI RP Form 19-71 - Hawaii

How to fill out HI RP Form 19-71 - Hawaii County

01

Obtain the HI RP Form 19-71 from the Hawaii County website or local government office.

02

Fill in the 'Applicant Information' section with your name, address, and contact details.

03

Provide relevant property details, including the property address and tax map key number.

04

Indicate the specific purpose for which the form is being submitted (e.g., exemption request).

05

If applicable, attach any necessary supporting documents to substantiate your request.

06

Review the completed form for accuracy and make sure all sections are filled out.

07

Sign and date the form at the designated section.

08

Submit the form to the appropriate Hawaii County office by mail or in-person.

Who needs HI RP Form 19-71 - Hawaii County?

01

Property owners in Hawaii County seeking tax exemptions or other benefits related to their property.

02

Individuals or entities that need to report changes in property ownership or use that may affect tax status.

03

Residents who qualify for specific relief programs related to property taxes in Hawaii County.

Fill

form

: Try Risk Free

People Also Ask about

Who are exempted from paying real property tax?

“Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

What age do you stop paying property taxes in Alabama?

In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead exemption.

How much is the homestead exemption in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

What is Honolulu home exemption?

If you live in your home or condo as your primary residence in Honolulu County, which is the island of Oahu, you need to claim your Home Exemption. This tax break will save you thousands of dollars in property taxes.

At what age do you stop paying property taxes in Oregon?

“Charitatable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

Who qualifies for property tax exemption Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

How do I know if I qualify for a property tax exemption?

Homestead Types Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad valorem taxes. Taxpayer is permanently and totally disabled – exempt from all ad valorem taxes.

What is home exemption in Hawaii?

BENEFITS OF THE HOME EXEMPTION PROGRAM The basic home exemption for homeowners under the age of 60 is $40,000, for homeowners 60 to 69 years of age, $80,000 and for homeowners 70 years of age or over, $100,000 with age calculated as of January 1, the date of the assessment.

How do I apply for real property tax exemption?

Under Section 206 of the Local Government Code, taxpayers claiming exemption from RPT should do so with their local government and provide sufficient evidence and supporting documents proving eligibility for the exemption. In addition, they must do so within 30 days from the date of declaration of such property.

What does home exemption mean in Hawaii?

Beginning tax year 2020-2021, the home exemption will be $100,000 for homeowners under the age of 65 as well as for homeowners who do not have their birthdate on file. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance.

How to apply for property tax exemption in Honolulu?

You file the claim for homeowner exemption with the Real Property Assessment Division (RPAD), Department of Budget and Fiscal Services, City and County of Honolulu, on or before September 30th preceding the tax year for which such exemption is claimed.

What is Honolulu real property tax exemption?

Beginning with the 2020 assessment (2020-2021 tax year) the basic home exemption for homeowners under 65 will be $100,000. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance. For homeowners 65 years and older the home exemption will be $140,000.

How can I avoid property taxes in Hawaii?

Property Tax Exemptions in Hawaii You are eligible for the home exemption if you own and occupy the property as your principal home and file or intend to file your resident HI state income tax return or apply for a waiver of this requirement.

What types of properties are exempt from property taxes?

Eligibility. You may be eligible for this program if: You are at least 62 years of age by April 15th of the year you file.

How do I file property tax exemption in Honolulu?

HOW TO FILE: This completed home exemption claim must be hand-delivered to RPAD or Satellite City Halls, or mailed to RPAD at 842 Bethel Street, Basement, Honolulu, HI 96813 or 1000 Uluohia St #206, Kapolei, HI 96707. Hand- deliveries will receive receipted copies as proof of filing.

At what age do you stop paying property taxes in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000, for homeowners 60 to 69 years of age, $80,000 and for homeowners 70 years of age or over, $100,000 with age calculated as of January 1, the date of the assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send HI RP Form 19-71 - Hawaii to be eSigned by others?

Once your HI RP Form 19-71 - Hawaii is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the HI RP Form 19-71 - Hawaii in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your HI RP Form 19-71 - Hawaii in seconds.

How do I complete HI RP Form 19-71 - Hawaii on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your HI RP Form 19-71 - Hawaii, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is HI RP Form 19-71 - Hawaii County?

HI RP Form 19-71 is a form used in Hawaii County for reporting real property tax exemption claims and related information.

Who is required to file HI RP Form 19-71 - Hawaii County?

Individuals who are claiming a real property tax exemption in Hawaii County are required to file HI RP Form 19-71.

How to fill out HI RP Form 19-71 - Hawaii County?

To fill out HI RP Form 19-71, provide accurate personal information, details about the property, the nature of the exemption being claimed, and any required supporting documentation.

What is the purpose of HI RP Form 19-71 - Hawaii County?

The purpose of HI RP Form 19-71 is to allow property owners to apply for and document eligibility for various real property tax exemptions available in Hawaii County.

What information must be reported on HI RP Form 19-71 - Hawaii County?

The form requires information such as the property owner's name, property address, tax map key number, type of exemption being claimed, and any relevant income or occupancy details.

Fill out your HI RP Form 19-71 - Hawaii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI RP Form 19-71 - Hawaii is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.