HI RP Form 19-71 - Hawaii County 2023 free printable template

Show details

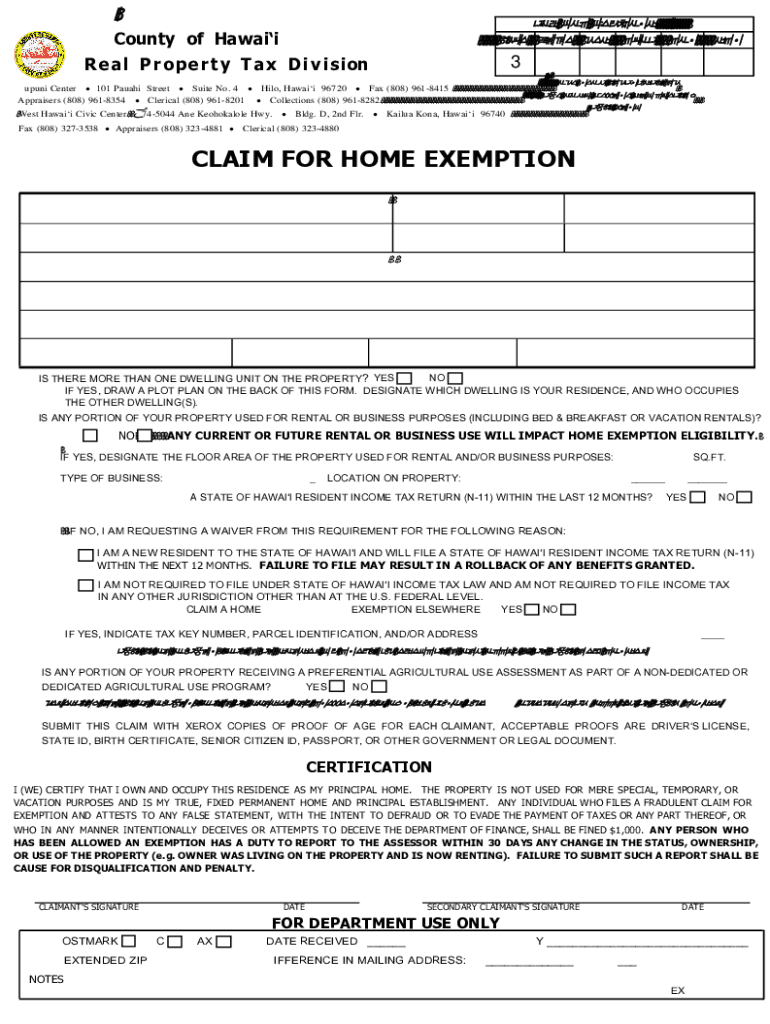

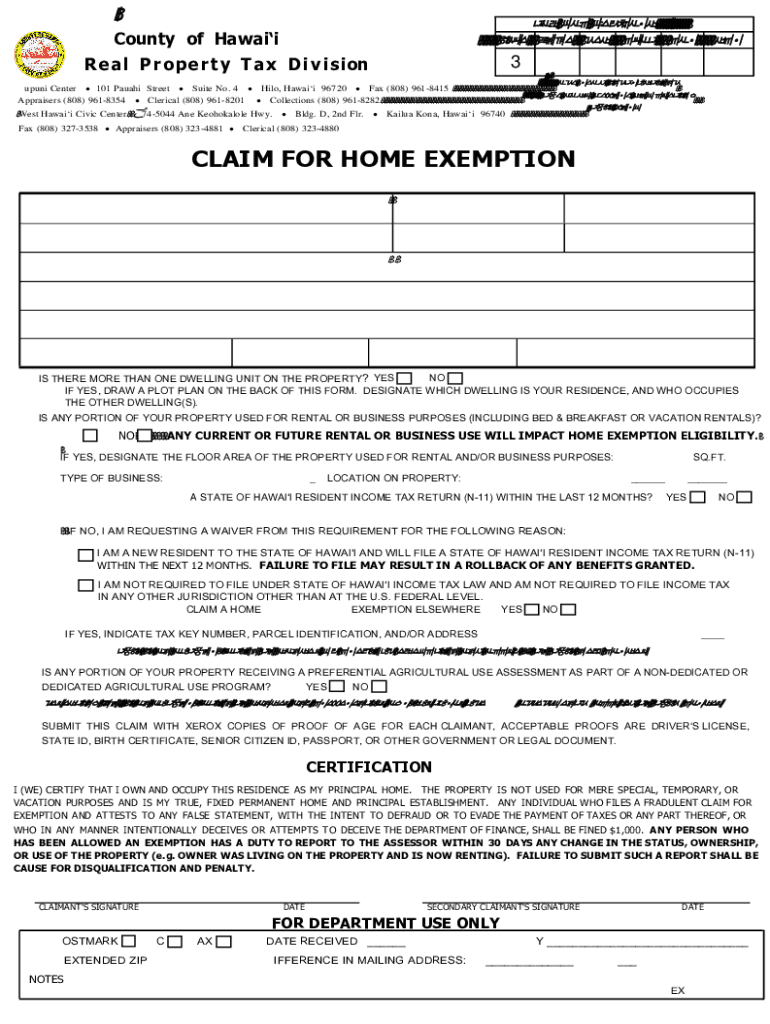

County of Hawaii

R e an l P r o p e r t y T an × D i v i s ion CASE NO. ___RP FORM 1971 (Rev. 5/2023)TAX MAP KEY/PARCEL ID

ISLE ZONE SEC PLAT PARENT. OF FINANCECPR3.

3/($6(5($\',16758&7,216

Around

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hawaii form home exemption

Edit your hawaii county exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii claim home exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hawaii form property tax online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 19 71. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI RP Form 19-71 - Hawaii County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rp form 19 71

How to fill out HI RP Form 19-71 - Hawaii County

01

Obtain the HI RP Form 19-71 from the Hawaii County official website or local government office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Provide your personal information in the designated fields, including your name, address, and contact details.

04

Indicate the purpose for which you are applying for the form, if required.

05

Fill in any additional information as requested on the form, ensuring accuracy.

06

Review the completed form to check for any errors or omissions.

07

Sign and date the form in the appropriate section.

08

Submit the form either in person or by mail to the designated government office in Hawaii County.

Who needs HI RP Form 19-71 - Hawaii County?

01

Individuals applying for permits, licenses, or other official requests in Hawaii County.

02

Residents who require documentation for property assessments or tax purposes.

03

Business owners seeking to register their business or apply for licenses.

Fill

rp 19 71 form

: Try Risk Free

People Also Ask about hi form exemption

Who are exempted from paying real property tax?

“Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

What age do you stop paying property taxes in Alabama?

In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead exemption.

How much is the homestead exemption in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

What is Honolulu home exemption?

If you live in your home or condo as your primary residence in Honolulu County, which is the island of Oahu, you need to claim your Home Exemption. This tax break will save you thousands of dollars in property taxes.

At what age do you stop paying property taxes in Oregon?

“Charitatable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

Who qualifies for property tax exemption Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

How do I know if I qualify for a property tax exemption?

Homestead Types Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad valorem taxes. Taxpayer is permanently and totally disabled – exempt from all ad valorem taxes.

What is home exemption in Hawaii?

BENEFITS OF THE HOME EXEMPTION PROGRAM The basic home exemption for homeowners under the age of 60 is $40,000, for homeowners 60 to 69 years of age, $80,000 and for homeowners 70 years of age or over, $100,000 with age calculated as of January 1, the date of the assessment.

How do I apply for real property tax exemption?

Under Section 206 of the Local Government Code, taxpayers claiming exemption from RPT should do so with their local government and provide sufficient evidence and supporting documents proving eligibility for the exemption. In addition, they must do so within 30 days from the date of declaration of such property.

What does home exemption mean in Hawaii?

Beginning tax year 2020-2021, the home exemption will be $100,000 for homeowners under the age of 65 as well as for homeowners who do not have their birthdate on file. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance.

How to apply for property tax exemption in Honolulu?

You file the claim for homeowner exemption with the Real Property Assessment Division (RPAD), Department of Budget and Fiscal Services, City and County of Honolulu, on or before September 30th preceding the tax year for which such exemption is claimed.

What is Honolulu real property tax exemption?

Beginning with the 2020 assessment (2020-2021 tax year) the basic home exemption for homeowners under 65 will be $100,000. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance. For homeowners 65 years and older the home exemption will be $140,000.

How can I avoid property taxes in Hawaii?

Property Tax Exemptions in Hawaii You are eligible for the home exemption if you own and occupy the property as your principal home and file or intend to file your resident HI state income tax return or apply for a waiver of this requirement.

What types of properties are exempt from property taxes?

Eligibility. You may be eligible for this program if: You are at least 62 years of age by April 15th of the year you file.

How do I file property tax exemption in Honolulu?

HOW TO FILE: This completed home exemption claim must be hand-delivered to RPAD or Satellite City Halls, or mailed to RPAD at 842 Bethel Street, Basement, Honolulu, HI 96813 or 1000 Uluohia St #206, Kapolei, HI 96707. Hand- deliveries will receive receipted copies as proof of filing.

At what age do you stop paying property taxes in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000, for homeowners 60 to 69 years of age, $80,000 and for homeowners 70 years of age or over, $100,000 with age calculated as of January 1, the date of the assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit hawaii rp exemption on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing hawaii 19 71 right away.

How do I edit hawaii county home exemption on an iOS device?

Create, modify, and share claim home exemption using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete hawaii form property claim on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your hawaii county exemption form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is HI RP Form 19-71 - Hawaii County?

HI RP Form 19-71 is a form used in Hawaii County for reporting and processing real property tax information.

Who is required to file HI RP Form 19-71 - Hawaii County?

Property owners and individuals seeking exemptions or special assessments for their real property are required to file HI RP Form 19-71.

How to fill out HI RP Form 19-71 - Hawaii County?

To fill out HI RP Form 19-71, provide the required property details, personal information, and any applicable exemption claims, ensuring all fields are completed accurately.

What is the purpose of HI RP Form 19-71 - Hawaii County?

The purpose of HI RP Form 19-71 is to collect necessary information for assessing property taxes and determining eligibility for exemptions or special assessments.

What information must be reported on HI RP Form 19-71 - Hawaii County?

The information that must be reported includes the property owner's name, property address, tax map key number, type of property, and any claim for exemptions.

Fill out your HI RP Form 19-71 - Hawaii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hawaii Form 19 71 is not the form you're looking for?Search for another form here.

Keywords relevant to hawaii rp form

Related to hawaii form 19

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.