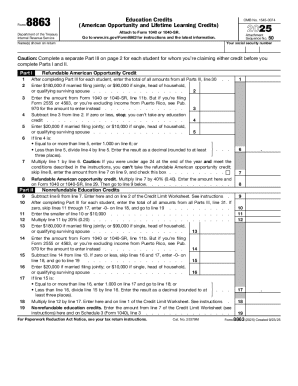

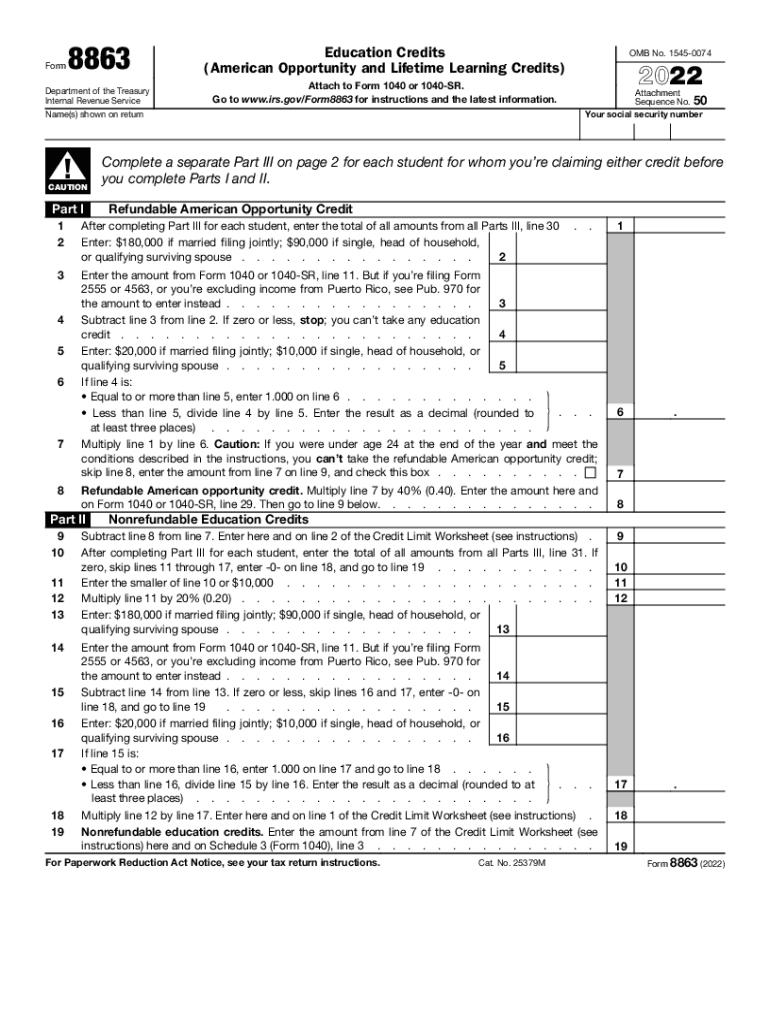

IRS 8863 2022 free printable template

Instructions and Help about IRS 8863

How to edit IRS 8863

How to fill out IRS 8863

About IRS 8 previous version

What is IRS 8863?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8863

What should I do if I realize I've made a mistake after submitting my IRS 8863?

If you discover an error after filing your IRS 8863, you need to amend your return. Use Form 1040-X to correct the mistake. Be sure to attach the corrected IRS 8863 form with your 1040-X. This ensures the IRS can properly process the amendment.

How can I verify the status of my IRS 8863 submission?

To check the status of your IRS 8863, use the IRS 'Where's My Refund?' tool if you e-filed. If you mailed your form, allow several weeks for processing and then contact the IRS directly. Having your information handy will help expedite the inquiry.

Are there any special considerations for filing IRS 8863 if I am a nonresident?

Nonresident aliens have different filing requirements for IRS 8863. You may need to follow specific IRS guidelines for foreign students or those without a Social Security number. Ensure you check your eligibility and correct deductions as it may differ from residents.

What should I keep in mind about data privacy when filing my IRS 8863 electronically?

When e-filing your IRS 8863, ensure that the software you use is encrypted and complies with IRS security guidelines. Retain records of your submission securely to protect your personal information from unauthorized access or fraud.

See what our users say