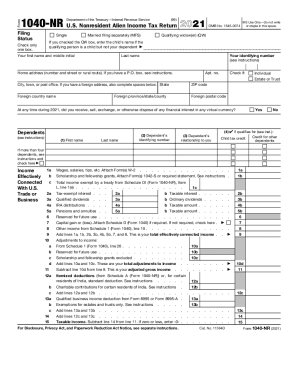

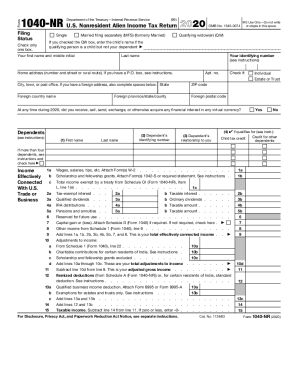

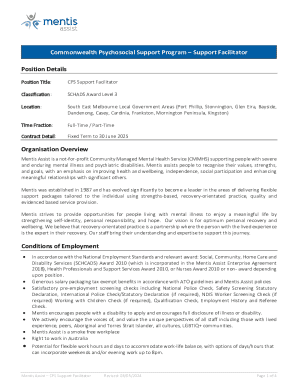

IRS 1040-NR 2022 free printable template

Instructions and Help about IRS 1040-NR

How to edit IRS 1040-NR

How to fill out IRS 1040-NR

About IRS 1040-NR 2022 previous version

What is IRS 1040-NR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-NR

How can I correct mistakes after filing the IRS 1040-NR?

If you need to correct mistakes on your IRS 1040-NR, you can submit Form 1040-X, Amended U.S. Individual Income Tax Return. It's essential to indicate the specific changes, the reasons for the corrections, and ensure that you're addressing any adjustments accordingly. This process will help you maintain accurate records with the IRS.

What should I do if I haven't received confirmation of my IRS 1040-NR submission?

To verify the receipt of your IRS 1040-NR, you can use the IRS 'Where's My Refund?' tool if you're expecting a refund. If you e-filed and didn't receive an acknowledgment, checking common e-file rejection codes can help identify submission issues. Consider contacting the IRS for further confirmation of your submission status.

Are there specific privacy concerns related to filing the IRS 1040-NR?

Yes, when filing the IRS 1040-NR, it’s vital to be aware of privacy and data security. Ensure that sensitive information is transmitted securely, especially if filing electronically. The IRS recommends using e-signatures and maintaining secure records to protect personal data against potential breaches.

What common errors should I avoid when filing the IRS 1040-NR?

Common errors when filing the IRS 1040-NR include incorrect Social Security numbers, mismatched names, and failing to report all income sources. Double-check your entries and review the form thoroughly to avoid such mistakes. Utilizing compatible software can also reduce errors by highlighting potential issues before submission.

What steps should I follow if I receive a notice from the IRS regarding my 1040-NR?

If you receive an IRS notice related to your 1040-NR, it's crucial to read it carefully and respond promptly. Gather necessary documentation to support your case, and consider consulting a tax professional for assistance. Documentation may include copies of your filed forms and any relevant correspondence to clarify your situation with the IRS.

See what our users say