IRS 990 - Schedule A 2022 free printable template

Show details

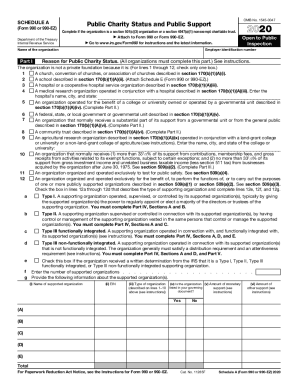

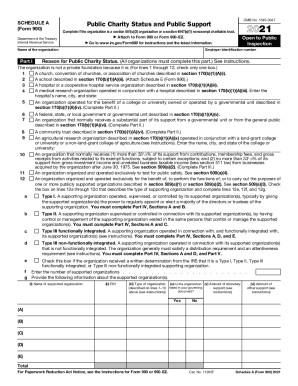

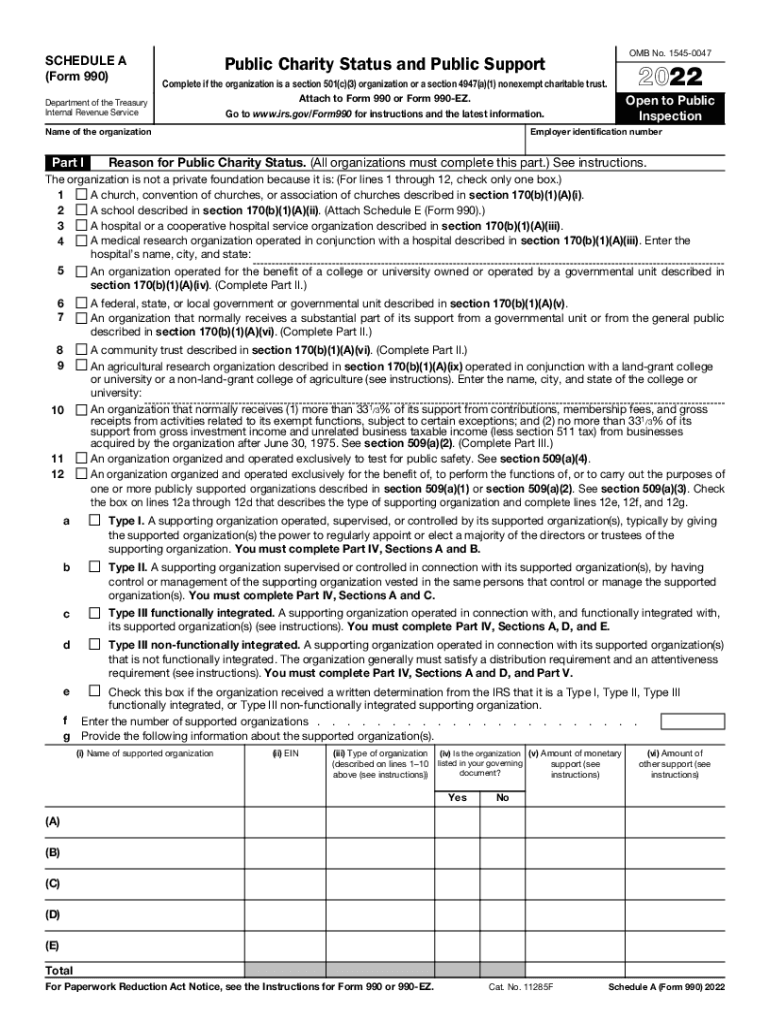

SCHEDULE A Form 990 Department of the Treasury Internal Revenue Service Complete if the organization is a section 501 c 3 organization or a section 4947 a 1 nonexempt charitable trust. Attach to Form 990 or Form 990-EZ. Go to www.irs.gov/Form990 for instructions and the latest information. Name of the organization Part I OMB No. 1545-0047 Public Charity Status and Public Support Open to Public Inspection Employer identification number Reason for Public Charity Status. Cat. No. 11285F Schedule A...Form 990 2022 Page 2 Support Schedule for Organizations Described in Sections 170 b 1 A iv and 170 b 1 A vi Complete only if you checked the box on line 5 7 or 8 of Part I or if the organization failed to qualify under Part III. Attach Schedule E Form 990. A hospital or a cooperative hospital service organization described in section 170 b 1 A iii. First 5 years. If the Form 990 is for the organization s first second third fourth or fifth tax year as a section 501 c 3 organization check this box...and stop here. As defined in section 4958 c 3 C a family member of a substantial contributor or a 35 controlled entity with regard to a substantial contributor If Yes complete Part I of Schedule L Form 990. G Provide the following information about the supported organization s. i Name of supported organization ii EIN iii Type of organization described on lines 1 10 above see instructions iv Is the organization v Amount of monetary listed in your governing support see document instructions Yes...vi Amount of other support see No A B C D E Total For Paperwork Reduction Act Notice see the Instructions for Form 990 or 990-EZ. 7 If Yes complete Part I of Schedule L Form 990. 5b 5c 9a Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified persons as defined in section 4946 other than foundation managers and organizations b Did one or more disqualified persons as defined on line 9a hold a controlling interest in any entity in which...the supporting organization had an interest If Yes provide detail in Part VI. All organizations must complete this part. See instructions. The organization is not a private foundation because it is For lines 1 through 12 check only one box. A church convention of churches or association of churches described in section 170 b 1 A i. A school described in section 170 b 1 A ii. A medical research organization operated in conjunction with a hospital described in section 170 b 1 A iii. Enter the...hospital s name city and state An organization operated for the benefit of a college or university owned or operated by a governmental unit described in section 170 b 1 A iv. Complete Part II. A federal state or local government or governmental unit described in section 170 b 1 A v. described in section 170 b 1 A vi. Complete Part II. A community trust described in section 170 b 1 A vi. Complete Part II. An agricultural research organization described in section 170 b 1 A ix operated in...conjunction with a land-grant college or university or a non-land-grant college of agriculture see instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 - Schedule A

How to edit IRS 990 - Schedule A

How to fill out IRS 990 - Schedule A

Instructions and Help about IRS 990 - Schedule A

How to edit IRS 990 - Schedule A

To edit IRS 990 - Schedule A, start by downloading the form from the IRS website. Using pdfFiller, you can upload the form and make necessary changes directly in your browser. This tool allows for easy annotation, text addition, and signing, ensuring that your edits are saved and ready for submission.

How to fill out IRS 990 - Schedule A

Filling out IRS 990 - Schedule A involves several steps to ensure accuracy. Begin by gathering financial information related to your organization and its fundraising activities. Use the following steps:

01

Download the IRS 990 - Schedule A form from the IRS website.

02

Review the instructions provided with the form for clarity on each section.

03

Complete each section based on your organization's specific details.

04

Use pdfFiller to input data, sign, and save the document.

05

Submit the form as per the IRS guidelines.

About IRS 990 - Schedule A 2022 previous version

What is IRS 990 - Schedule A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 - Schedule A 2022 previous version

What is IRS 990 - Schedule A?

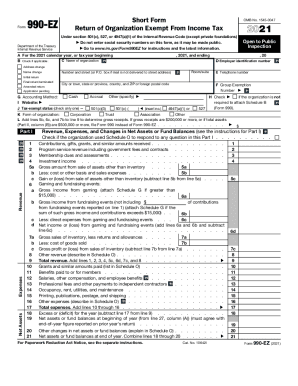

IRS 990 - Schedule A is a supplemental form utilized by organizations to provide information about their public charity status. It is primarily used by tax-exempt organizations to report their eligibility under IRS rules. This form is essential for maintaining transparency in fundraising operations.

What is the purpose of this form?

The purpose of IRS 990 - Schedule A is to determine whether an organization qualifies as a public charity. By completing the form, organizations report their revenue sources, activities, and compliance with regulations. This helps inform the IRS and the public about the financial health and operational practices of the organization.

Who needs the form?

Organizations that are classified as tax-exempt under section 501(c)(3) and those wishing to maintain their public charity status must complete IRS 990 - Schedule A. This includes charities and nonprofit organizations actively seeking donations and public support.

When am I exempt from filling out this form?

Organizations may be exempt from completing IRS 990 - Schedule A if they meet certain criteria, such as meeting the gross receipts thresholds established by the IRS or if they operate under a fiscal sponsor that files on their behalf.

Components of the form

IRS 990 - Schedule A contains components such as financial statements, revenue sources, and detailed information on the organization's programs and services. Sections include a summary of public support and ownership details. Understanding each component ensures correct reporting.

What are the penalties for not issuing the form?

The penalties for failing to file IRS 990 - Schedule A can be severe, including fines that accrue monthly. If an organization continues to neglect filing requirements, they may also risk losing their tax-exempt status.

What information do you need when you file the form?

When filing IRS 990 - Schedule A, you'll need detailed financial records, including revenue and expenses, a list of board members, and documentation of the organization's public support. Preparing these documents in advance streamlines the filing process.

Is the form accompanied by other forms?

IRS 990 - Schedule A is often submitted alongside the main Form 990 or Form 990-EZ. Depending on the organization's activities and financial status, additional schedules may also be required to provide a complete picture of compliance and financial health.

Where do I send the form?

Completed IRS 990 - Schedule A should be sent to the address specified in the filing instructions for Form 990. This varies based on the organization's location and the form's version. Always check the IRS website for the most accurate and up-to-date submission guidelines.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

This service provided me with great details. I especially like the feature that helps me align my word but I would like it helped me with aligning

Pretty Simple App to make quick fillable PDFs!!!!!!

See what our users say