IRS 940 2022 free printable template

Instructions and Help about IRS 940

How to edit IRS 940

How to fill out IRS 940

About IRS previous version

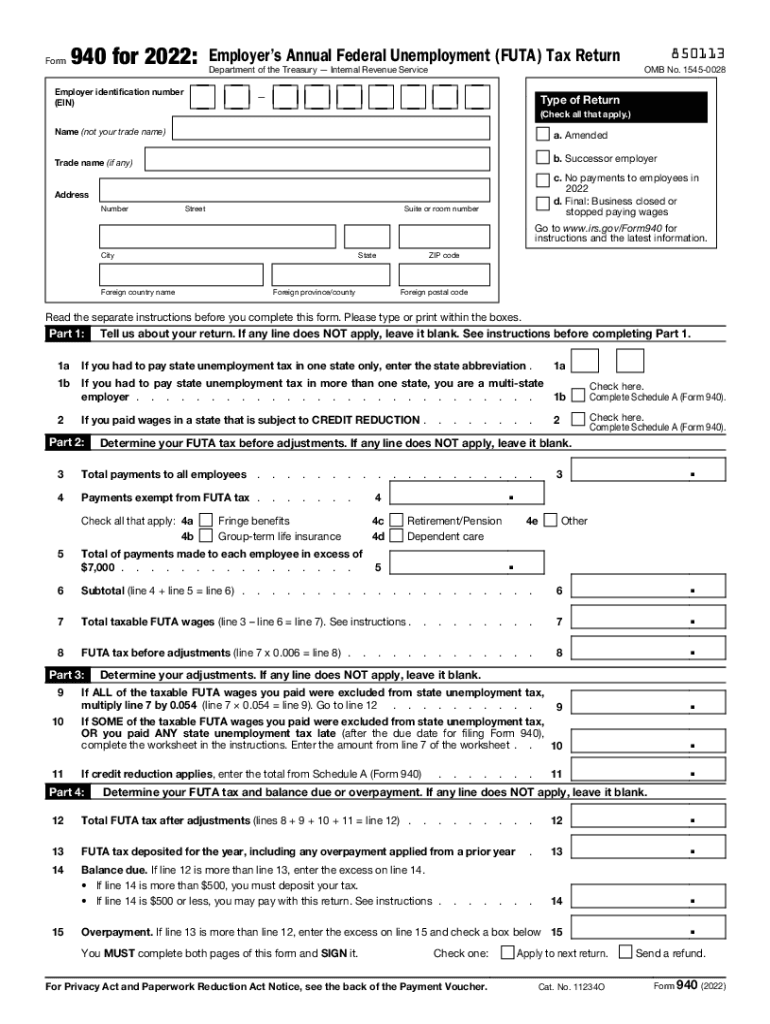

What is IRS 940?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

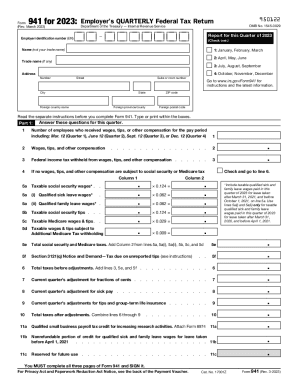

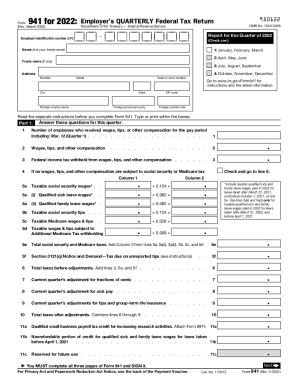

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 940

How can I correct mistakes made on my IRS 940 form after submission?

To correct mistakes on your IRS 940 form, you must file an amended return using Form 940-X. It is essential to follow the instructions provided for this form, including detailing the corrections and submitting it to the appropriate address. Ensure that any significant changes do not conflict with previous filings.

What steps should I take if my IRS 940 submission is rejected when e-filing?

In the event of a rejection when e-filing your IRS 940, review the specific error codes provided during the rejection notice. Common issues may include discrepancies in information or formatting errors. Correct these errors as per the guidelines and resubmit your form promptly to meet filing requirements.

What should I know about e-signatures when filing the IRS 940?

When it comes to e-signatures for the IRS 940, electronic signatures are generally accepted if the filing is done through tax preparation software that complies with IRS regulations. Make sure to review the software's details regarding e-signature how-tos and keep records as per IRS recommendations for e-file submissions.

What are common errors to avoid when filing the IRS 940?

Common errors when filing the IRS 940 include inaccuracies in the employer identification number (EIN), incorrect calculation of taxable wages, and failing to report all employees accurately. Double-check all entries against your payroll records before submitting to avoid unnecessary complications.

How can I ensure my IRS 940 is compatible with my e-filing software?

To ensure compatibility of your IRS 940 with your e-filing software, check the software's specifications and confirm that it supports IRS forms for the current tax year. Regular updates to the software can also enhance compatibility and prevent issues during the filing process.

See what our users say