NM TRD RPD-41386 2016-2025 free printable template

Show details

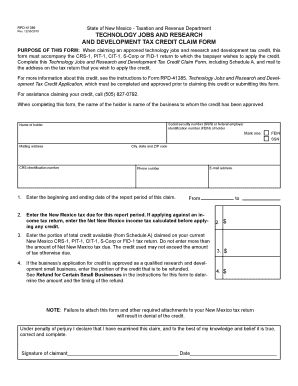

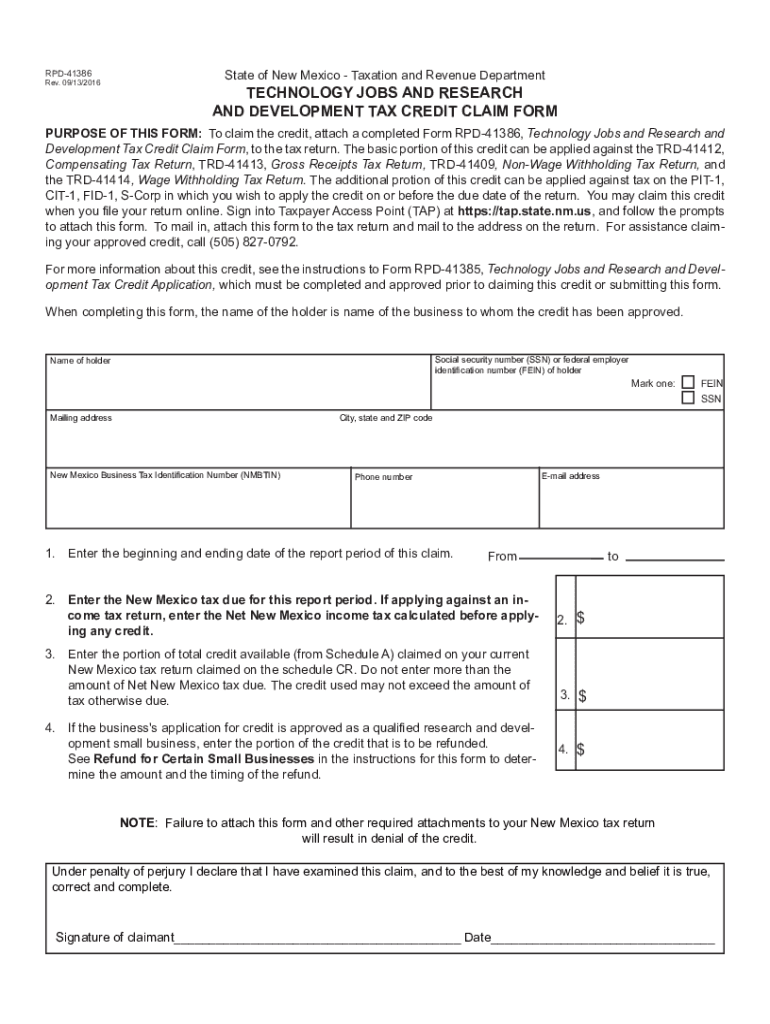

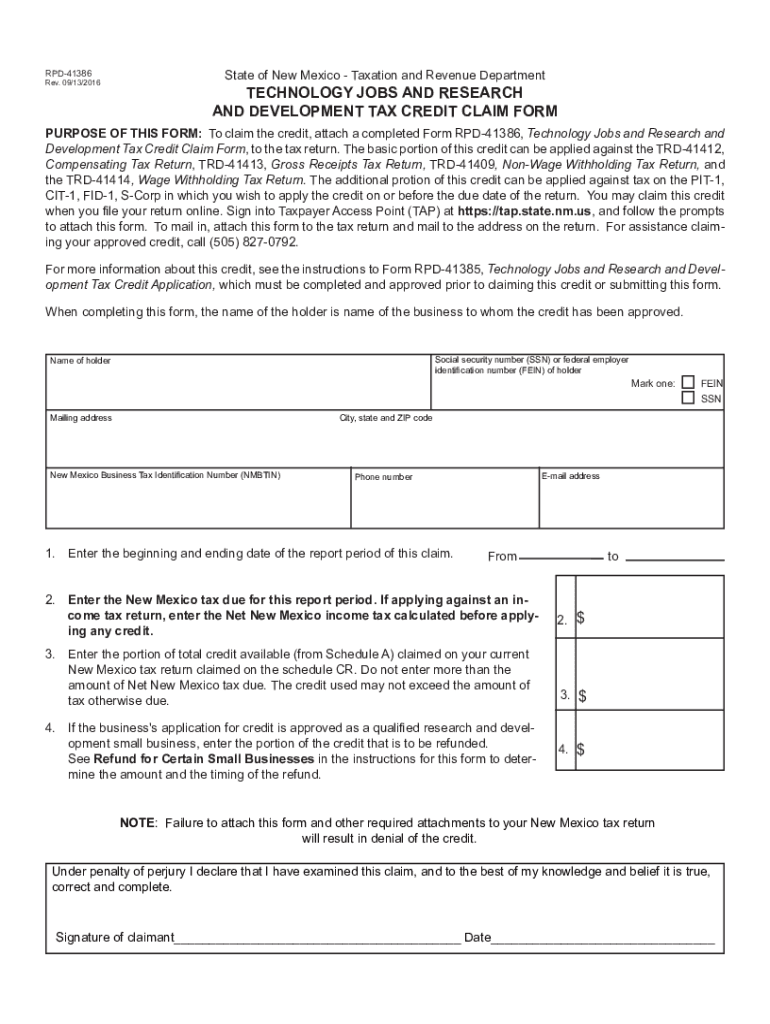

RPD41386Rev. 09/13/2016State of New Mexico Taxation and Revenue DepartmentTECHNOLOGY JOBS AND RESEARCH AND DEVELOPMENT TAX CREDIT CLAIM REPURPOSE OF THIS FORM: To claim the credit, attach a completed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41386

Edit your NM TRD RPD-41386 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41386 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD RPD-41386 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM TRD RPD-41386. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41386 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41386

How to fill out NM TRD RPD-41386

01

Gather necessary personal and business information such as name, address, and tax identification number.

02

Obtain the NM TRD RPD-41386 form either online or from the state tax office.

03

Fill out the top section with your personal details and contact information.

04

Indicate the type of tax credit or refund you are applying for in the designated area.

05

Provide detailed information about the transactions or activities that qualify you for the credit or refund.

06

Double-check all entered information for accuracy and completeness.

07

Sign and date the form to certify that the information provided is true and correct.

08

Submit the completed form either by mail to the specified address or electronically if applicable.

Who needs NM TRD RPD-41386?

01

Individuals or businesses seeking a tax credit or refund in New Mexico.

02

Taxpayers who have engaged in specific activities that qualify for the state tax incentives.

03

Anyone required to report changes affecting their tax liabilities in New Mexico.

Fill

form

: Try Risk Free

People Also Ask about

What is the rural job tax credit in New Mexico?

B. The purpose of the rural job tax credit is to encourage businesses to start new businesses in rural areas of the state. (2) two qualifying periods for each qualifying job performed or based at a location in a tier two area.

What is the new tax credit for employees?

For 2021, the employee retention credit (ERC) is a quarterly tax credit against the employer's share of certain payroll taxes. The tax credit is 70% of the first $10,000 in wages per employee in each quarter of 2021. That means this credit is worth up to $7,000 per quarter and up to $28,000 per year, for each employee.

Who qualifies for New Mexico tax rebate?

Any New Mexico resident who filed a 2021 New Mexico Personal Income Tax return and who was not declared as a dependent on another taxpayer's return will receive the rebates automatically. There is no application to receive the rebates.

What are NM business credits?

New Mexico offers business-related tax credits to corporations and individuals who meet the requirements set out in the statutes for each credit. The statutes creating the credits also designate the taxes against which the credit may be applied.

What is the New Mexico employee tax credit?

New Mexico Tax Credits: Get Up To $26,000 Per Employee for Employee Retention. The amount of the 50 percent credit can be calculated using wages (including Qualified Health Plan Expenses) up to $10,000 per employee.

How does the R&D tax credit work?

The federal research and development (R&D) tax credit results in a dollar for dollar reduction in a company's tax liability for certain domestic expenses. Qualifying expenditures generally include the design, development or improvement of products, processes, techniques, formulas or software.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NM TRD RPD-41386 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including NM TRD RPD-41386, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute NM TRD RPD-41386 online?

pdfFiller has made filling out and eSigning NM TRD RPD-41386 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the NM TRD RPD-41386 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your NM TRD RPD-41386 in seconds.

What is NM TRD RPD-41386?

NM TRD RPD-41386 is a tax form used in New Mexico for reporting specific financial information related to tax obligations.

Who is required to file NM TRD RPD-41386?

Individuals and businesses in New Mexico who have certain tax liabilities or financial activities that fall under the reporting requirements of this form are required to file.

How to fill out NM TRD RPD-41386?

To fill out NM TRD RPD-41386, start by gathering all necessary financial records, complete each section of the form with accurate information, and ensure to cross-check for any required signatures before submission.

What is the purpose of NM TRD RPD-41386?

The purpose of NM TRD RPD-41386 is to ensure compliance with state tax laws by providing the New Mexico Taxation and Revenue Department with essential financial information from taxpayers.

What information must be reported on NM TRD RPD-41386?

Information that must be reported includes taxpayer identification details, financial transactions, tax calculations, and any other relevant data as specified by the form's instructions.

Fill out your NM TRD RPD-41386 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41386 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.