NM TRD RPD-41386 2015 free printable template

Show details

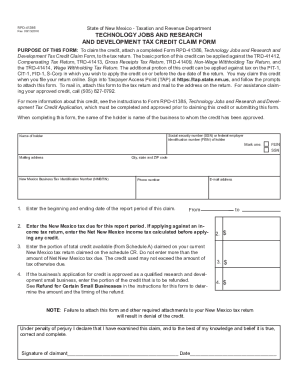

State of New Mexico Taxation and Revenue Department RPD41386 Rev. 12/30/2015 TECHNOLOGY JOBS AND RESEARCH AND DEVELOPMENT TAX CREDIT CLAIM FORM PURPOSE OF THIS FORM: When claiming an approved technology

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41386

Edit your NM TRD RPD-41386 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41386 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM TRD RPD-41386 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM TRD RPD-41386. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41386 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41386

How to fill out NM TRD RPD-41386

01

Gather all necessary financial documents, including income statements and expenses.

02

Begin by entering your personal information in the designated fields.

03

Carefully fill out the income section by listing all sources of income.

04

Next, detail your expenses, ensuring to categorize them appropriately.

05

Calculate your total income and total expenses, then determine your net income.

06

Review all entries for accuracy before submission.

07

Sign and date the form as required.

Who needs NM TRD RPD-41386?

01

Individuals or businesses who are reporting their income and expenses for tax purposes in New Mexico.

02

Tax professionals assisting clients in preparing their tax returns.

03

Anyone seeking to apply for certain tax credits or rebates offered by the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the rural job tax credit in New Mexico?

B. The purpose of the rural job tax credit is to encourage businesses to start new businesses in rural areas of the state. (2) two qualifying periods for each qualifying job performed or based at a location in a tier two area.

What is the new tax credit for employees?

For 2021, the employee retention credit (ERC) is a quarterly tax credit against the employer's share of certain payroll taxes. The tax credit is 70% of the first $10,000 in wages per employee in each quarter of 2021. That means this credit is worth up to $7,000 per quarter and up to $28,000 per year, for each employee.

Who qualifies for New Mexico tax rebate?

Any New Mexico resident who filed a 2021 New Mexico Personal Income Tax return and who was not declared as a dependent on another taxpayer's return will receive the rebates automatically. There is no application to receive the rebates.

What are NM business credits?

New Mexico offers business-related tax credits to corporations and individuals who meet the requirements set out in the statutes for each credit. The statutes creating the credits also designate the taxes against which the credit may be applied.

What is the New Mexico employee tax credit?

New Mexico Tax Credits: Get Up To $26,000 Per Employee for Employee Retention. The amount of the 50 percent credit can be calculated using wages (including Qualified Health Plan Expenses) up to $10,000 per employee.

How does the R&D tax credit work?

The federal research and development (R&D) tax credit results in a dollar for dollar reduction in a company's tax liability for certain domestic expenses. Qualifying expenditures generally include the design, development or improvement of products, processes, techniques, formulas or software.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NM TRD RPD-41386 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including NM TRD RPD-41386, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete NM TRD RPD-41386 online?

pdfFiller has made filling out and eSigning NM TRD RPD-41386 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit NM TRD RPD-41386 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your NM TRD RPD-41386, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

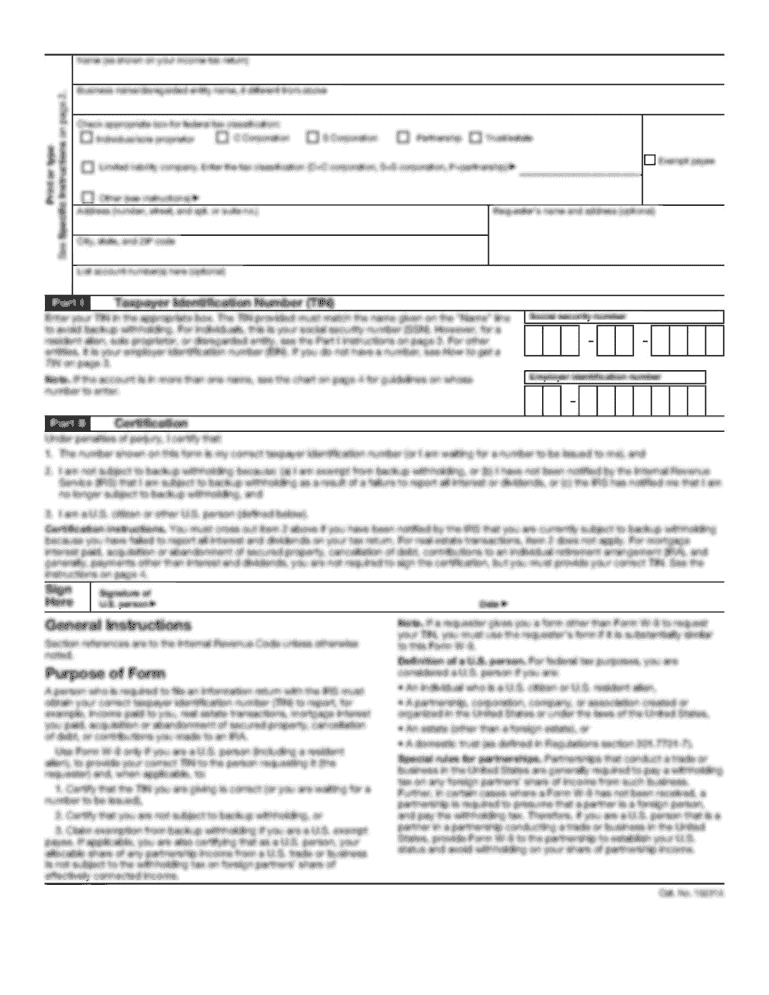

What is NM TRD RPD-41386?

NM TRD RPD-41386 is a form used by taxpayers in New Mexico to report certain tax-related information as required by the New Mexico Taxation and Revenue Department.

Who is required to file NM TRD RPD-41386?

Entities or individuals who have specific tax obligations in New Mexico, as outlined by the New Mexico Taxation and Revenue Department, are required to file NM TRD RPD-41386.

How to fill out NM TRD RPD-41386?

To fill out NM TRD RPD-41386, taxpayers must provide required identification information, report relevant income or tax data, and comply with any specific instructions or guidelines provided by the form.

What is the purpose of NM TRD RPD-41386?

The purpose of NM TRD RPD-41386 is to ensure compliance with state tax laws by providing the New Mexico Taxation and Revenue Department with necessary information regarding tax obligations.

What information must be reported on NM TRD RPD-41386?

Information that must be reported on NM TRD RPD-41386 includes taxpayer identification details, income amounts, tax deductions, and any other relevant financial data as specified by the form.

Fill out your NM TRD RPD-41386 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41386 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.