Get the free CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT

Show details

This form is used to apply for a business credit account with Steel Erectors, Inc. It requires business contact information, credit line requested, business references, bank references, and information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign confidential credit application business

Edit your confidential credit application business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your confidential credit application business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit confidential credit application business online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit confidential credit application business. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

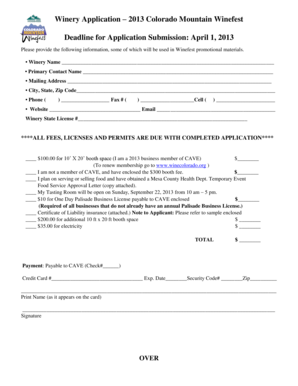

How to fill out confidential credit application business

How to fill out CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT

01

Begin by filling out the business name at the top of the application.

02

Provide the business address, including street, city, state, and zip code.

03

Enter the type of business structure (e.g., corporation, partnership, sole proprietorship).

04

Fill in the contact details of the primary business contact, including name, title, phone number, and email address.

05

Include the federal tax identification number or social security number for sole proprietors.

06

Disclose the business’s bank information, including the bank name, branch, account number, and contact number.

07

List trade references with contact details and account numbers if applicable.

08

Specify the amount of credit requested and the purpose of the credit.

09

Review the application for accuracy and completeness before signing.

10

Submit the application along with any required supporting documents.

Who needs CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT?

01

Businesses seeking to establish a line of credit for purchasing goods or services.

02

New businesses looking for financial support to start operations.

03

Companies planning to expand their operations and require funding for growth.

04

Organizations that prefer a confidential approach to applying for credit.

Fill

form

: Try Risk Free

People Also Ask about

What documents do you need to apply for a business credit card?

You'll usually need this basic information when applying: Your legal business name. The business name you'd like printed on the card. The type of business you own. Your business address. Your business's federal tax ID number (or your Social Security number if you have a sole proprietorship)

Do business credit cards verify income?

When you apply for a small business credit card, issuers ask about your revenue because they need evidence you have the financial means to settle your debts. Providing revenue helps issuers decide if you are likely to spend responsibly and can make payments on time.

Can I put expected income on a business credit card application?

Use sales projections: Some issuers will allow applicants to include revenue projections on an application. However, be sure to get explicit permission from the issuer first. Projected revenue may come from contracts, business plans and expected sales. Make sure to have documentation in case the issuer asks for it.

What to put on a business credit card application?

To complete your business credit card application, you'll need several pieces of personal and business information: Legal business name. Business address and phone number. Type of business, industry, and legal structure. Approximate annual revenue, years in business, and number of employees. Estimated monthly spending.

When applying for business credit, do they look at your personal credit?

When you apply for a small-business credit card, the card issuer will likely perform a hard inquiry, which will show up on your credit report. Issuers check your personal credit because it's a key factor in their decision to approve you for a card; your personal credit history helps issuers assess their risk.

What is a credit application for a business account?

A business credit application is a formal document that a company submits to a creditor when applying for a line of credit. This application provides essential information about the business and its finances, helping the creditor evaluate the company's creditworthiness and ability to repay the debt.

Can I put expected income on business credit card application?

Use sales projections: Some issuers will allow applicants to include revenue projections on an application. However, be sure to get explicit permission from the issuer first. Projected revenue may come from contracts, business plans and expected sales. Make sure to have documentation in case the issuer asks for it.

Can you estimate income on credit card application?

Some may ask for the actual sum of money you bring home before deductions and taxes are taken out (gross income) or after (net income). Take the time to provide an honest estimate. It is never a good idea to exaggerate your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

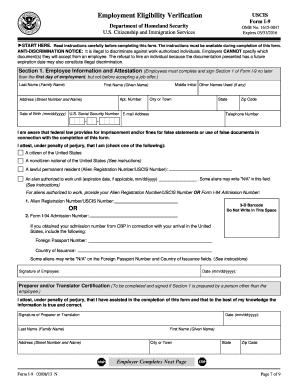

What is CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT?

A CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT is a form used by business entities to apply for credit while ensuring that their sensitive financial information is kept private and secure.

Who is required to file CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT?

Businesses seeking to establish a credit line or account with a lender or supplier are required to file a CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT.

How to fill out CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT?

To fill out the application, businesses need to provide relevant information such as legal business name, contact details, ownership structure, financial statements, and any other requested details to assess creditworthiness.

What is the purpose of CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT?

The purpose is to assess the creditworthiness of a business, allowing lenders or suppliers to make informed decisions regarding the extension of credit.

What information must be reported on CONFIDENTIAL CREDIT APPLICATION – BUSINESS ACCOUNT?

The application must report information such as business name, address, type of business, federal tax ID number, financial history, credit references, and ownership details.

Fill out your confidential credit application business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Confidential Credit Application Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.