LA LAT 5A 2022 free printable template

Show details

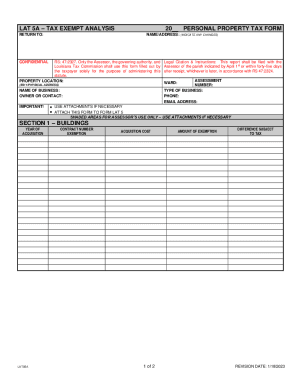

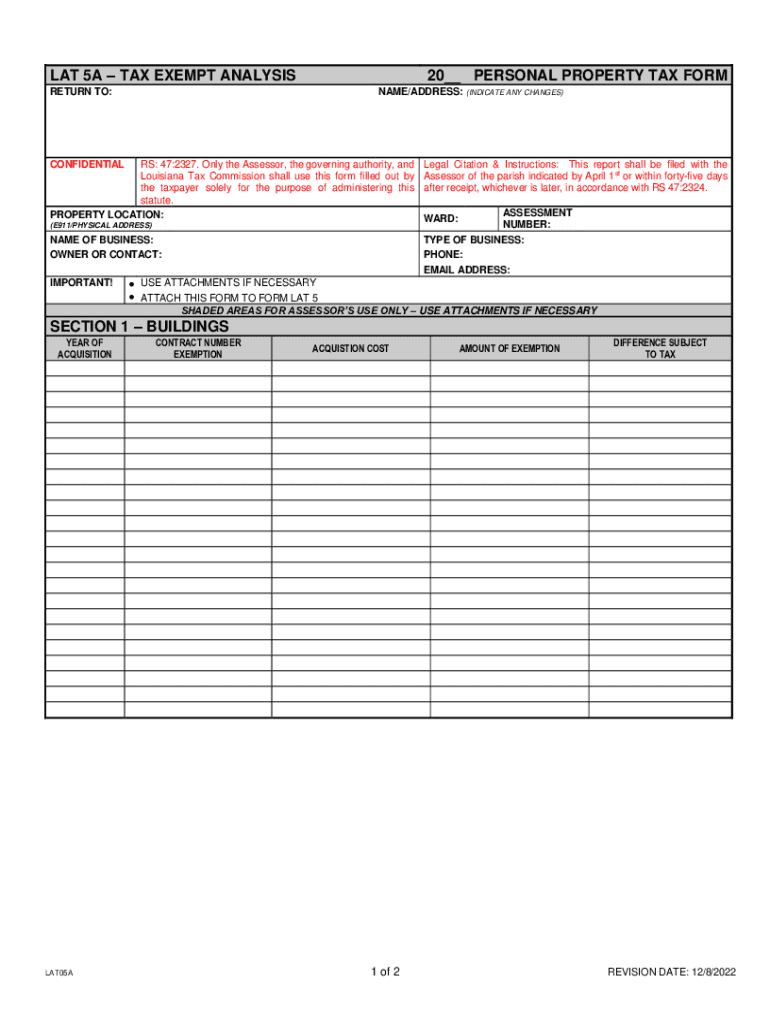

LAT 5A TAX EXEMPT ANALYSIS RETURN TO:20__ PERSONAL PROPERTY TAX FORM NAME/ADDRESS: (INDICATE ANY CHANGES)CONFIDENTIAL RS: 47:2327. Only the Assessor, the governing authority, and Louisiana Tax Commission

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA LAT 5A

Edit your LA LAT 5A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA LAT 5A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing LA LAT 5A online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit LA LAT 5A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LAT 5A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA LAT 5A

How to fill out LA LAT 5A

01

Begin by gathering all necessary personal information such as your name, address, and contact details.

02

Read the instructions carefully to understand what information is requested.

03

Fill in your identification details, ensuring accuracy in spelling and numerical entries.

04

Provide any requested financial or income information in the designated sections.

05

Review each section for completeness and correctness.

06

Sign and date the form where required.

07

Submit the completed form according to the provided submission guidelines.

Who needs LA LAT 5A?

01

Individuals applying for certain benefits or services that require documentation of personal or financial information.

02

Participants in specific programs that necessitate the completion of the LA LAT 5A form.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as a homestead in Louisiana?

In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. Regardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value. If you change primary residence, you must notify the assessor.

How does the Louisiana homestead exemption work?

In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. Regardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value. If you change primary residence, you must notify the assessor.

How much do you save with homestead exemption in Louisiana?

The homestead exemption law gives property owners a tax break on their property taxes. The amount of savings that you would receive is generally about $750-$800 per year depending on your assessed value and the millage rate in your area.

How are Louisiana property taxes calculated?

Louisiana Property Tax Rates The property tax rates that appear on bills are denominated in millage rate. A mill is equal to $1 of tax for every $1,000 of net assessed taxable value. If your net assessed taxable value is $10,000 and your total millage rate is 50, your taxes owed will be $500.

What is lat 5 in Louisiana?

SECTION 5 – CONSIGNED GOODS, LEASED, LOANED, OR RENTED EQUIPMENT, FURNITURE, ETC.

At what age do you stop paying property taxes in Louisiana?

a) Owned and occupied by a person who is 65 years of age or older. b) Owned and occupied by a person who has a 50% or greater military service-related disability. c) Last owned and occupied by a member of the armed forces who was killed or is missing in action, or who is a prisoner of war.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my LA LAT 5A in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your LA LAT 5A and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit LA LAT 5A in Chrome?

Install the pdfFiller Google Chrome Extension to edit LA LAT 5A and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the LA LAT 5A in Gmail?

Create your eSignature using pdfFiller and then eSign your LA LAT 5A immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is LA LAT 5A?

LA LAT 5A is a form used in Los Angeles for reporting specific tax or financial information to the city.

Who is required to file LA LAT 5A?

Businesses operating in Los Angeles that meet certain revenue thresholds or are involved in specific activities may be required to file LA LAT 5A.

How to fill out LA LAT 5A?

To fill out LA LAT 5A, businesses must provide their identification information, financial details, and any applicable tax information as specified in the form's instructions.

What is the purpose of LA LAT 5A?

The purpose of LA LAT 5A is to ensure compliance with local tax regulations and provide the city with necessary financial information for tax assessment purposes.

What information must be reported on LA LAT 5A?

Information required on LA LAT 5A typically includes business identification details, revenue figures, expense information, and any other relevant financial data as per the city's guidelines.

Fill out your LA LAT 5A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA LAT 5a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.