LA LAT 5A 2023-2025 free printable template

Show details

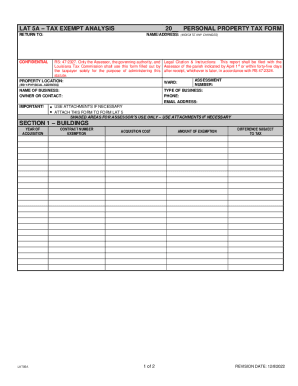

LAT 5A TAX EXEMPT ANALYSIS RETURN TO:20__ PERSONAL PROPERTY TAX FORM NAME/ADDRESS: (INDICATE ANY CHANGES)CONFIDENTIALRS: 47:2327. Only the Assessor, the governing authority, and Louisiana Tax Commission

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign la tax exempt form

Edit your la tax exempt form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your la tax exempt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing la tax exempt form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit la tax exempt form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LAT 5A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out la tax exempt form

How to fill out LA LAT 5A

01

Gather all necessary documentation related to your application.

02

Start by filling out your personal information accurately at the top of the form.

03

Follow the prompts for sections regarding your financial status, ensuring all numbers are accurate and current.

04

Provide detailed information for each question, referring to the instructions if needed.

05

Double-check all entries for accuracy and completeness before submitting.

06

Sign and date the form at the designated area once you have completed all sections.

Who needs LA LAT 5A?

01

Individuals applying for financial assistance programs.

02

Applicants seeking government aid or services.

03

Those required to report their financial information for eligibility.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as a homestead in Louisiana?

In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. Regardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value. If you change primary residence, you must notify the assessor.

How does the Louisiana homestead exemption work?

In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. Regardless of how many houses are owned, no one is entitled to more than one homestead exemption, which is a maximum of $7,500 of assessed value. If you change primary residence, you must notify the assessor.

How much do you save with homestead exemption in Louisiana?

The homestead exemption law gives property owners a tax break on their property taxes. The amount of savings that you would receive is generally about $750-$800 per year depending on your assessed value and the millage rate in your area.

How are Louisiana property taxes calculated?

Louisiana Property Tax Rates The property tax rates that appear on bills are denominated in millage rate. A mill is equal to $1 of tax for every $1,000 of net assessed taxable value. If your net assessed taxable value is $10,000 and your total millage rate is 50, your taxes owed will be $500.

What is lat 5 in Louisiana?

SECTION 5 – CONSIGNED GOODS, LEASED, LOANED, OR RENTED EQUIPMENT, FURNITURE, ETC.

At what age do you stop paying property taxes in Louisiana?

a) Owned and occupied by a person who is 65 years of age or older. b) Owned and occupied by a person who has a 50% or greater military service-related disability. c) Last owned and occupied by a member of the armed forces who was killed or is missing in action, or who is a prisoner of war.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit la tax exempt form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your la tax exempt form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute la tax exempt form online?

pdfFiller has made filling out and eSigning la tax exempt form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit la tax exempt form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute la tax exempt form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is LA LAT 5A?

LA LAT 5A is a form used for reporting certain tax-related information in the state of Louisiana.

Who is required to file LA LAT 5A?

Entities that engage in certain types of business activities in Louisiana, typically those with income that meets the specified thresholds, are required to file LA LAT 5A.

How to fill out LA LAT 5A?

To fill out LA LAT 5A, you need to provide your business information, report your income, deductions, and any applicable credits as indicated in the form's instructions.

What is the purpose of LA LAT 5A?

The purpose of LA LAT 5A is to collect tax information to ensure compliance with state tax regulations and to determine tax liabilities.

What information must be reported on LA LAT 5A?

LA LAT 5A requires reporting of business income, expenses, credits, and any other relevant financial information as dictated by the form's guidelines.

Fill out your la tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

La Tax Exempt Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.