IRS 656-B 2022 free printable template

Show details

Complete one Form 656 for your individual tax debts and one Form 656 for your business tax debts. Each Form 656 will require the 186 application fee and initial payment. Do not send original documents. Fill out Form 656. The Form 656 identifies the tax years and type of tax you would like to compromise. The Form 656-L is not included as part of this package. To request a Form 656-L visit www. irs. gov or a local IRS office or call toll-free 1-800-TAX-FORM 1-800-829-3676. One Form 656 will be for...the individual tax debts while the second Form 656 will be for the LLC employment tax debts incurred after January 1 2009 and excise tax debts after January 1 2008. Form 656 Booklet Offer in Compromise CONTENTS What you need to know. 1 Paying for your offer. 3 How to apply. You will complete one Form 656 for yourself listing all your joint and any separate tax debts and your spouse will complete one Form 656 listing all his or her joint tax debt s plus any separate tax debt s for a total of...two Forms 656. However it is recommended. Include the 186 application fee and initial payment personal check cashier s check or money order with your Form 656. Payoffs and balances. Copies of relevant supporting documentation of the special circumstances described in the Explanation of Circumstances on Form 656 if applicable. You can get forms and publications by calling 1-800-TAX-FORM 1-800-829-3676 by visiting your local IRS office or at www*irs*gov* Taxpayer resources The Taxpayer Advocate...Service TAS is an independent organization within the Internal Revenue Service that helps taxpayers and protects taxpayer rights. We help taxpayers whose problems with the IRS are causing financial difficulties who ve tried but haven t been able to resolve their problems with the IRS or believe an IRS system or procedure isn t working as it should. And the service is free. Your local advocate s number is in your local directory and at taxpayeradvocate. irs. gov* You can also call us at...1-877-777-4778. For more information about TAS and your rights under the Taxpayer Bill of Rights go to taxpayeradvocate. irs. gov* TAS is your voice at the IRS* Low Income Taxpayer Clinics LITCs are independent from the IRS* LITCs serve individuals whose income is below a certain level and who need to resolve a tax problem with the IRS* LITCs provide professional representation before the IRS or in court on audits appeals tax collection disputes and other issues for free or for a small fee. For...more information and to find an LITC near you see the LITC page at www. taxpayeradvocate. irs. gov/litcmap or IRS Publication 4134 Low Income Taxpayer Clinic List. This Publication is also available by calling the IRS toll-free at 1-800-829-3676 or visiting your local IRS office. Your offer will be immediately returned without Note If it is determined you have not filed all tax returns any initial payment sent with your offer will be applied to your tax debt and your offer will be returned along...with your application fee.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 656-B

How to edit IRS 656-B

How to fill out IRS 656-B

Instructions and Help about IRS 656-B

How to edit IRS 656-B

When preparing IRS Form 656-B, you may need to make corrections or alterations to your entries. Editing the form is straightforward when using a digital tool. Utilize pdfFiller to access the form, enabling you to edit fields easily by clicking on the text boxes to enter information or to make necessary adjustments. After editing, you will be able to save your changes securely for future reference or submission.

How to fill out IRS 656-B

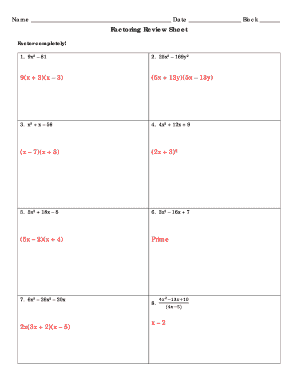

Completing IRS Form 656-B requires accurate information regarding your tax situation and financial status. Follow these steps to fill out the form correctly:

01

Begin by entering your personal information, including your name, address, and Social Security number.

02

Indicate the type of unpaid taxes you are addressing and provide the amount owed.

03

Detail your financial information, including income, expenses, and assets to support your claim.

Ensuring you provide complete information will enhance the IRS's ability to process your application efficiently.

About IRS 656-B 2022 previous version

What is IRS 656-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 656-B 2022 previous version

What is IRS 656-B?

IRS Form 656-B is a formal application for an Offer in Compromise with the Internal Revenue Service. This form is intended for individuals who wish to settle their tax debts for less than the full amount owed to the IRS. It provides a structured means to demonstrate financial hardship and negotiate a lower tax liability.

What is the purpose of this form?

The purpose of IRS Form 656-B is to request an Offer in Compromise, allowing taxpayers to provide evidence of their inability to pay the full tax debt. By submitting this form, taxpayers present their financial situation, hoping the IRS will agree to accept a reduced payment as full settlement of their tax liabilities.

Who needs the form?

Taxpayers who owe more to the IRS than they can realistically pay should consider filing IRS Form 656-B. This includes individuals facing financial difficulties due to unemployment, significant medical expenses, or other hardships that limit their ability to pay their tax debts.

When am I exempt from filling out this form?

Taxpayers may be exempt from filing IRS Form 656-B if their total tax liability is less than $10,000 or if they are currently in bankruptcy proceedings. Additionally, those who can afford to pay their tax debt in full do not need to file this form.

Components of the form

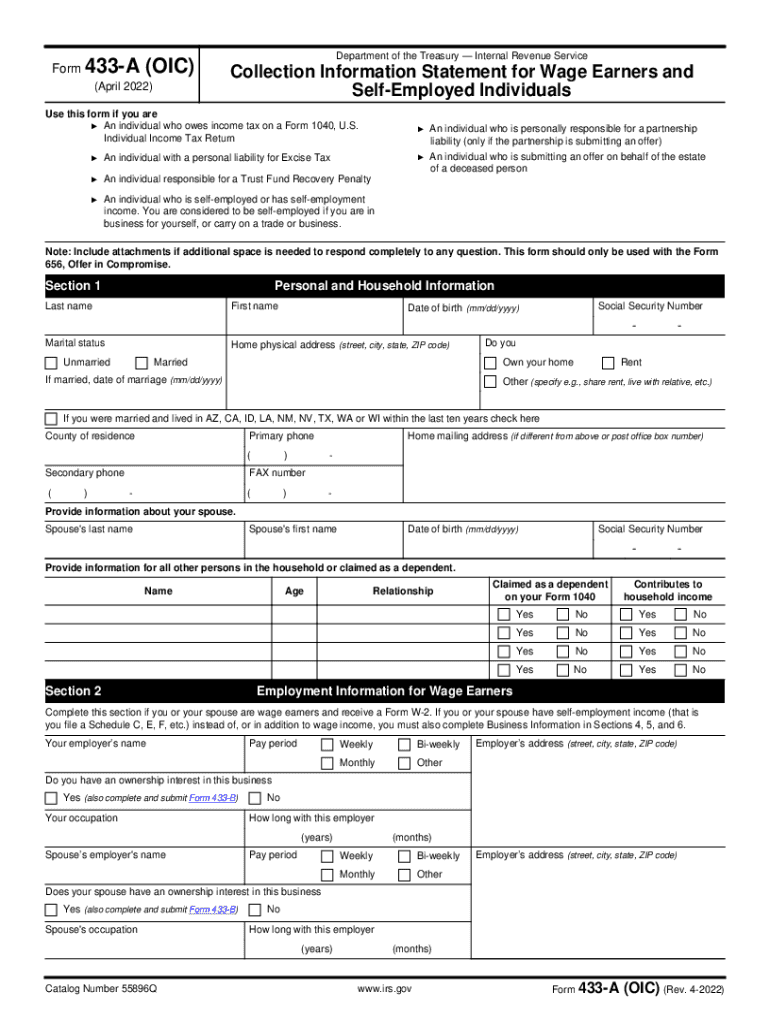

IRS Form 656-B consists of several key components, including taxpayer information, the offer amount, a detailed explanation of current financial condition, and documentation requirements. Each section must be completed accurately to ensure that the IRS can assess the request effectively.

What are the penalties for not issuing the form?

Failing to submit IRS Form 656-B when required can lead to continued collection actions from the IRS, including wage garnishments and asset seizures. Moreover, taxpayers may miss the opportunity to enter into an offer agreement, resulting in financial strain from unresolved tax obligations.

What information do you need when you file the form?

When filing IRS Form 656-B, you will need several key pieces of information. This includes your personal identifying information, the total amount of tax debt, and a comprehensive outline of your financial situation, including income, assets, and liabilities. Documentation proving financial hardship, such as pay stubs and bank statements, may also be required.

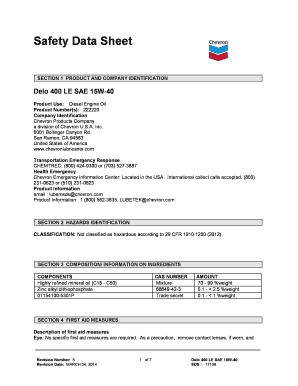

Is the form accompanied by other forms?

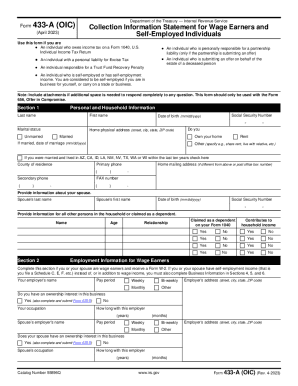

IRS Form 656-B may require accompanying documentation to support your offer, including IRS Form 433-A (OIC), which details your financial assets and liabilities. Be sure to check the submission guidelines to include all necessary forms and accompanying paperwork to avoid delays.

Where do I send the form?

The completed IRS Form 656-B must be sent to the appropriate address based on your location. Generally, this is the address listed in the form instructions. Be sure to check the latest IRS guidelines for submitting offers to ensure your application is sent to the correct processing center.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Perfect... Thank you so much. Expensive but the experience has been worth the cost.

it is so much easily to redact any confidential information.

See what our users say