IRS 433-D 2022 free printable template

Show details

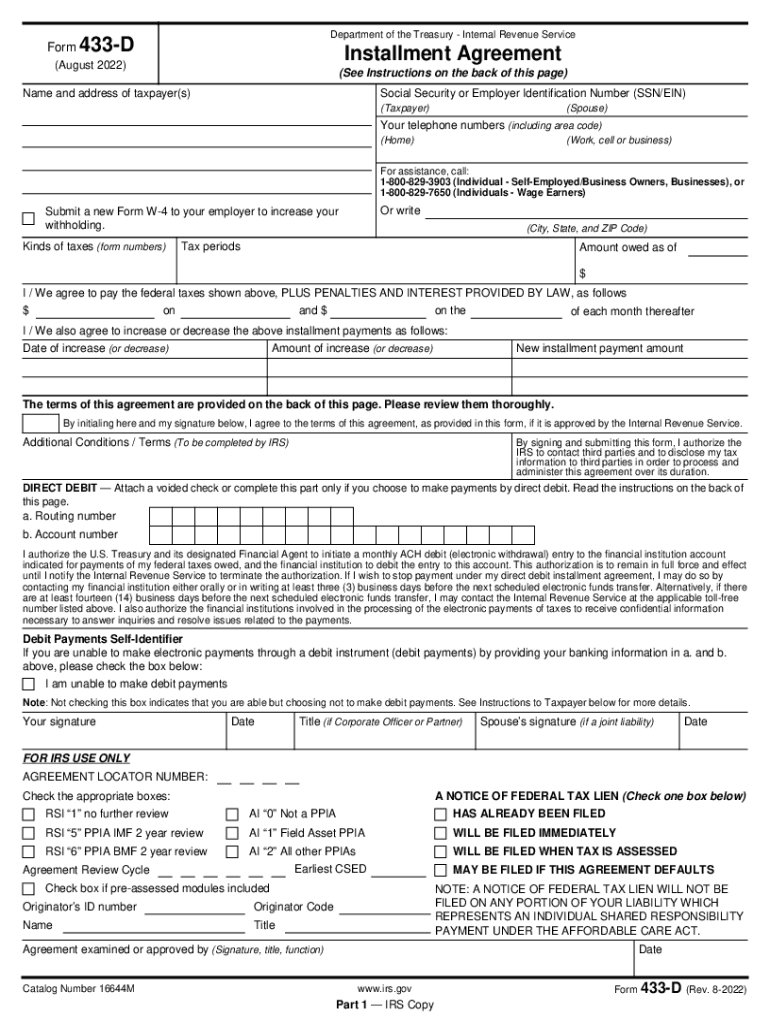

FormDepartment of the Treasury Internal Revenue Service433DInstallment Agreement(August 2022)(See Instructions on the back of this page)Name and address of taxpayer(s)Social Security or Employer Identification

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 433-D

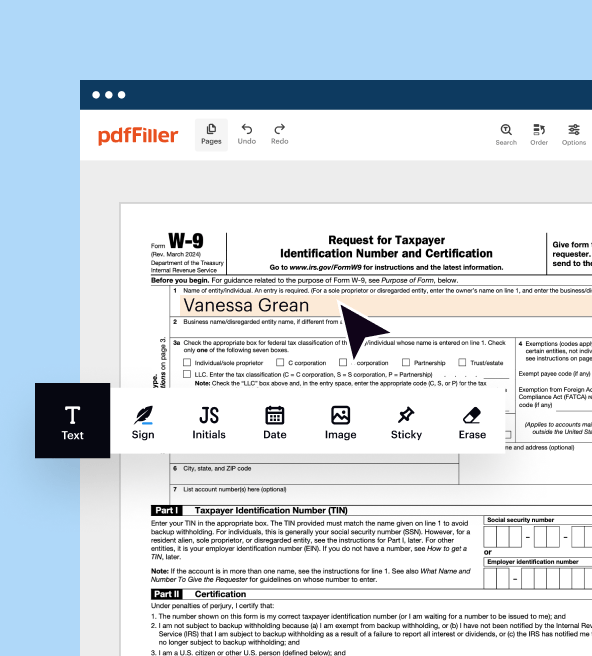

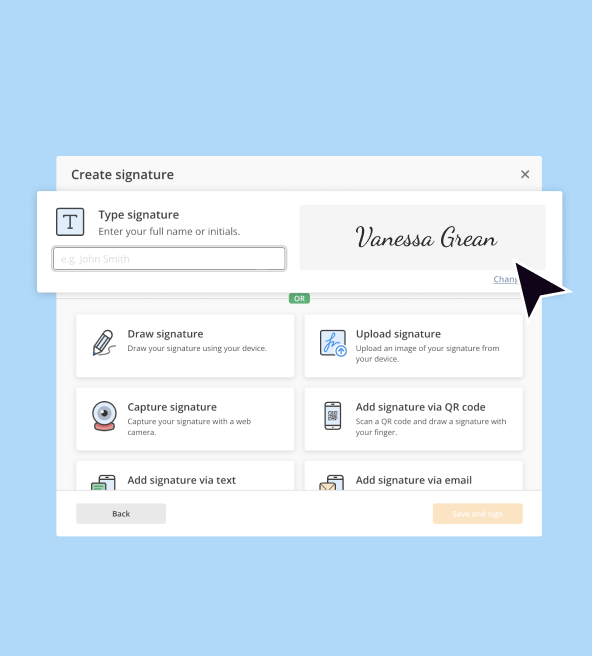

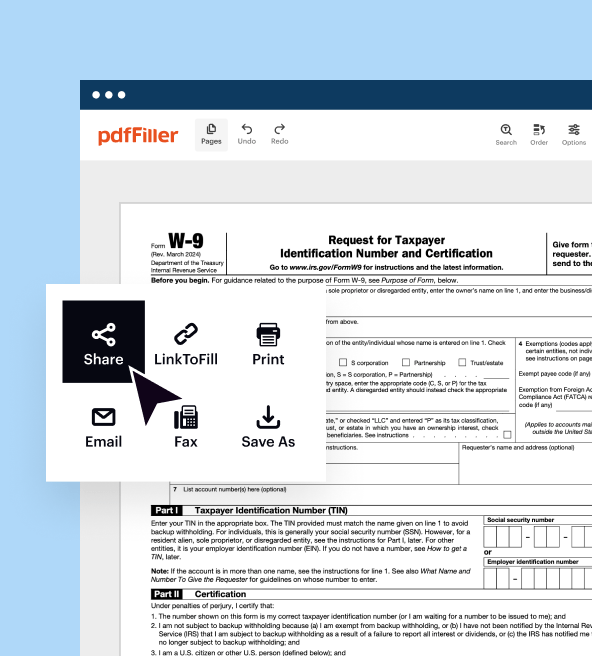

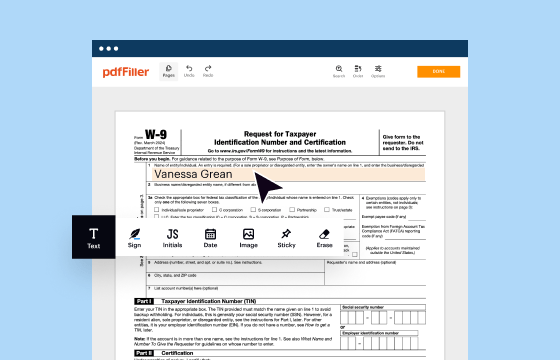

How to edit IRS 433-D

How to fill out IRS 433-D

Instructions and Help about IRS 433-D

How to edit IRS 433-D

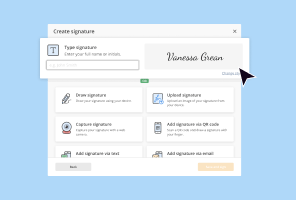

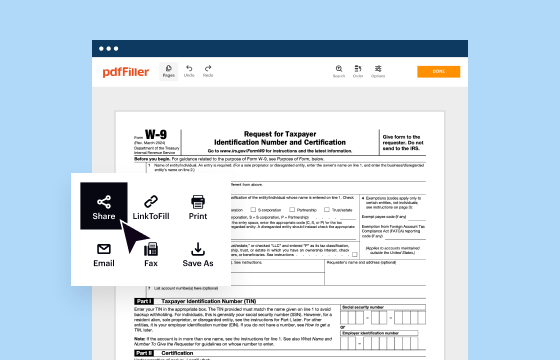

To edit IRS 433-D, download the form from the IRS website or a reliable source. Use a PDF editor like pdfFiller, which allows you to fill in or change information directly on the form. Ensure that all edits adhere to IRS guidelines to prevent unacceptable submissions.

How to fill out IRS 433-D

To fill out IRS 433-D, follow these steps:

01

Gather your personal and financial information, including income details and expenses.

02

Open the form using a PDF editor or by printing it out.

03

Carefully enter your information in the designated fields, ensuring accuracy.

04

Review your entries for any errors or omissions.

05

Sign and date the form before submission.

About IRS 433-D 2022 previous version

What is IRS 433-D?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 433-D 2022 previous version

What is IRS 433-D?

IRS 433-D is a form used by taxpayers to propose an installment agreement to pay back taxes owed to the IRS. This form outlines your financial situation and allows the IRS to determine the feasibility of your proposed payment plan.

What is the purpose of this form?

The purpose of IRS 433-D is to provide a comprehensive view of your financial status, enabling you to request a monthly payment plan. It documents your income, expenses, assets, and liabilities, which the IRS reviews to determine your ability to repay your tax debt over time.

Who needs the form?

Taxpayers who owe back taxes and wish to establish an installment agreement with the IRS must file IRS 433-D. This form is typically required for those unable to pay their tax obligations in full when due and who are seeking a structured repayment option.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 433-D if you are qualifying for a streamlined installment agreement. In such cases, the IRS may not require the detailed financial information typically provided in this form, provided your tax liability is within certain thresholds.

Components of the form

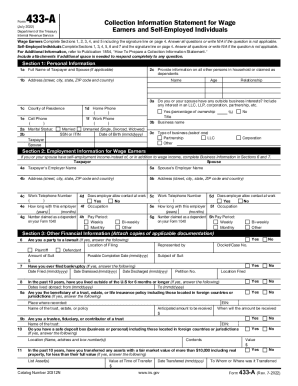

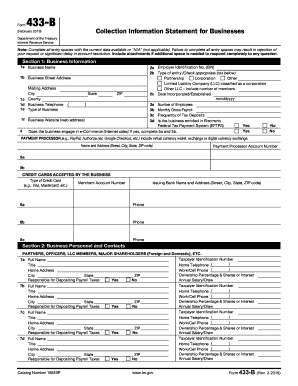

IRS 433-D consists of several sections that capture personal and financial information. Key components include:

01

Your identification details and tax information.

02

Income sources and amounts.

03

Monthly living expenses.

04

Assets, including bank accounts and properties.

05

Liabilities such as loans and credit balances.

What are the penalties for not issuing the form?

Failing to submit IRS 433-D when seeking an installment agreement can lead to various penalties, including increased interest on unpaid taxes and possible enforcement actions by the IRS. Additionally, your ability to negotiate a payment plan may be hindered without completing this form.

What information do you need when you file the form?

When filing IRS 433-D, you need to prepare the following information:

01

Your Social Security number or Employer Identification Number.

02

Details of your income, including all sources of employment or business activities.

03

A list of your monthly expenses.

04

Information on assets such as bank statements, property values, and any other relevant financial documentation.

Is the form accompanied by other forms?

IRS 433-D may need to be accompanied by other forms if you are applying for certain types of payment plans or if additional financial disclosures are required by the IRS. Always check the current IRS guidelines to ensure compliance with filing requirements.

Where do I send the form?

You must send IRS 433-D to the address listed in the instructions on the form. This generally depends on your geographical location and can vary based on whether you are filing electronically or via mail. Always verify the correct submitting address on the official IRS website.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Great, Especially for do it yourself. Love it

Seems like a great program but not user friendly when trying to self-teach

See what our users say