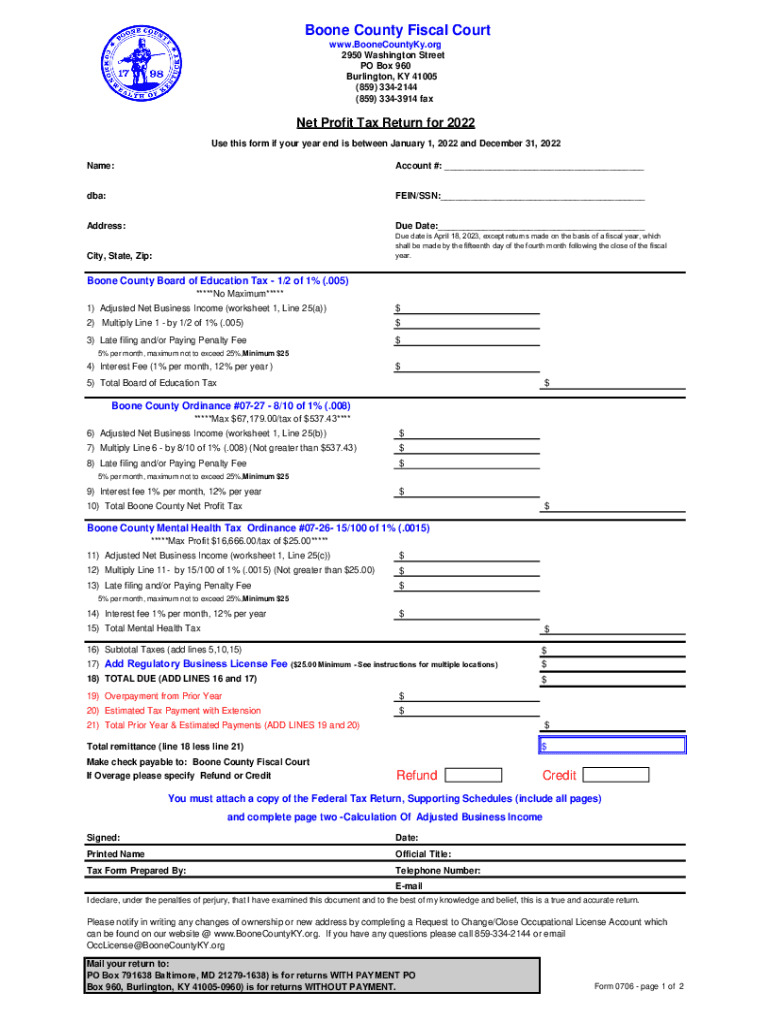

KY 0706 - Boone County 2022 free printable template

Get, Create, Make and Sign KY 0706 - Boone County

Editing KY 0706 - Boone County online

Uncompromising security for your PDF editing and eSignature needs

KY 0706 - Boone County Form Versions

How to fill out KY 0706 - Boone County

How to fill out KY 0706 - Boone County

Who needs KY 0706 - Boone County?

Instructions and Help about KY 0706 - Boone County

Hello and welcome to sex TV one of the questions I get asked very often is what's the difference between gross profit and net profit, so I thought I'd explained it in today's episode, so I'm going to be using this jar of water and these fall color tumblers to help explain the differences if you imagine that this job of water represents the revenue that you've been able to generate this month the revenue from the sale of your goods or your services whatever is your business does and this revenue is both for the money you've actually received from the sales that month all the money you're going to receive this big tumbler represents the cost of goods sold the cost of sale you wouldn't have any costs if you didn't have any revenue so if you remember that that's your cost of sale you need to pay for the cost of sales from the revenue that you've been able to generate that month, so we started off in revenue we took away our cost of sale and now what we've got in here is gross profit so the money that you've got left after you've paid it's actually delivering whatever it is you sold obviously if your cost of sale was very, very high your gross profit would be lower if your cost of sale is very low then your gross profit would be higher now if you imagine that this blue tumbler represents all your fixed costs these are the costs that you would incur regardless whether you made any sales or not there'll be things like a rental rate your light and heat or your payroll costs mobile phones insurances all those things you have to spend every year including your accountancy fees regardless whether you've made any sales or not, so we've taken our revenue taking away our cost of sales which has now left us with our gross profit, and now we're going to take away all our fixed costs and what you've got left is your net profit or operating profit unfortunately you do have to pay tax on what you've got in this little jug now after you've taken away a cost of sales and your fixed costs you have to give it to the revenue, so this green tumbler represents the tax that would be due on your net profit, so that is what you have got left and this is representing the money that you can take away to enjoy your life the way you want to I like to call it your purple pot of fun, so that's the money that you can take out of your business after you pay for your cost of sale and all your fixed costs, and you've put all the text that will be due on your net profit and this is what you've got left for all of your hard work tell you all the risks and making all the right decisions at the right time now SAS would love it if you would like us to help you to fill your purple pot of fun right up to the rim so get in touch

People Also Ask about

What is occupational license fee in Kentucky?

What is the occupational tax in Kentucky?

What is the income tax in Boone County Kentucky?

How much is the Boone County occupational license fee?

What is an occupational tax in Kentucky?

What is the mental health tax in Boone County KY?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KY 0706 - Boone County directly from Gmail?

How do I fill out KY 0706 - Boone County using my mobile device?

Can I edit KY 0706 - Boone County on an iOS device?

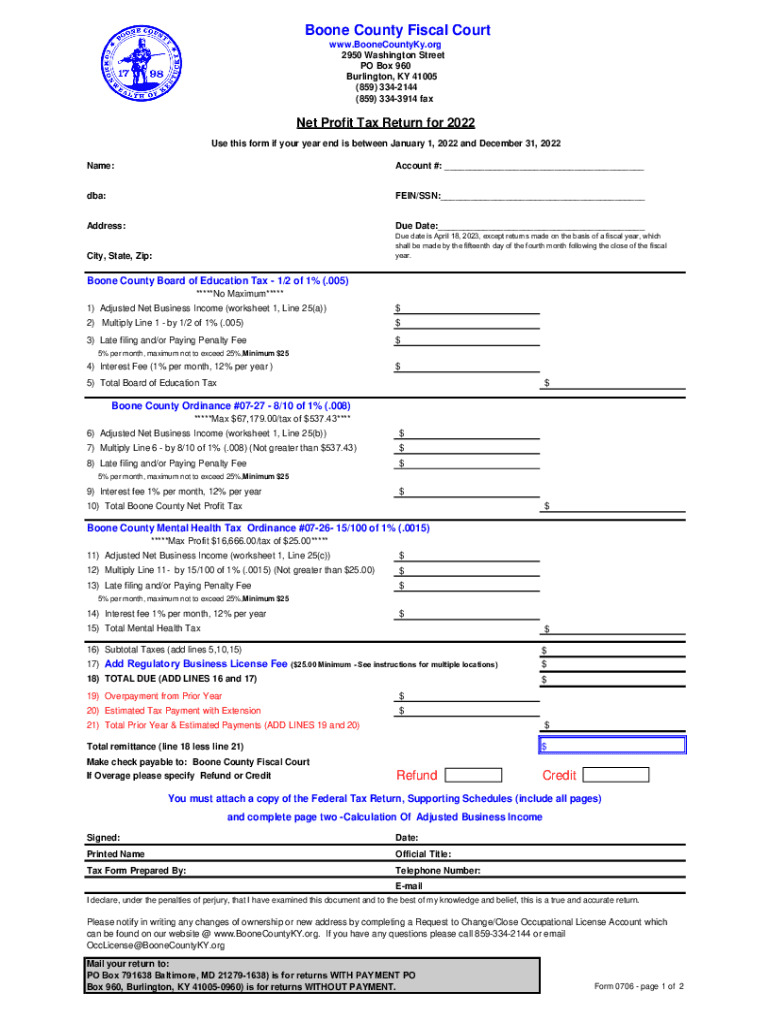

What is KY 0706 - Boone County?

Who is required to file KY 0706 - Boone County?

How to fill out KY 0706 - Boone County?

What is the purpose of KY 0706 - Boone County?

What information must be reported on KY 0706 - Boone County?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.