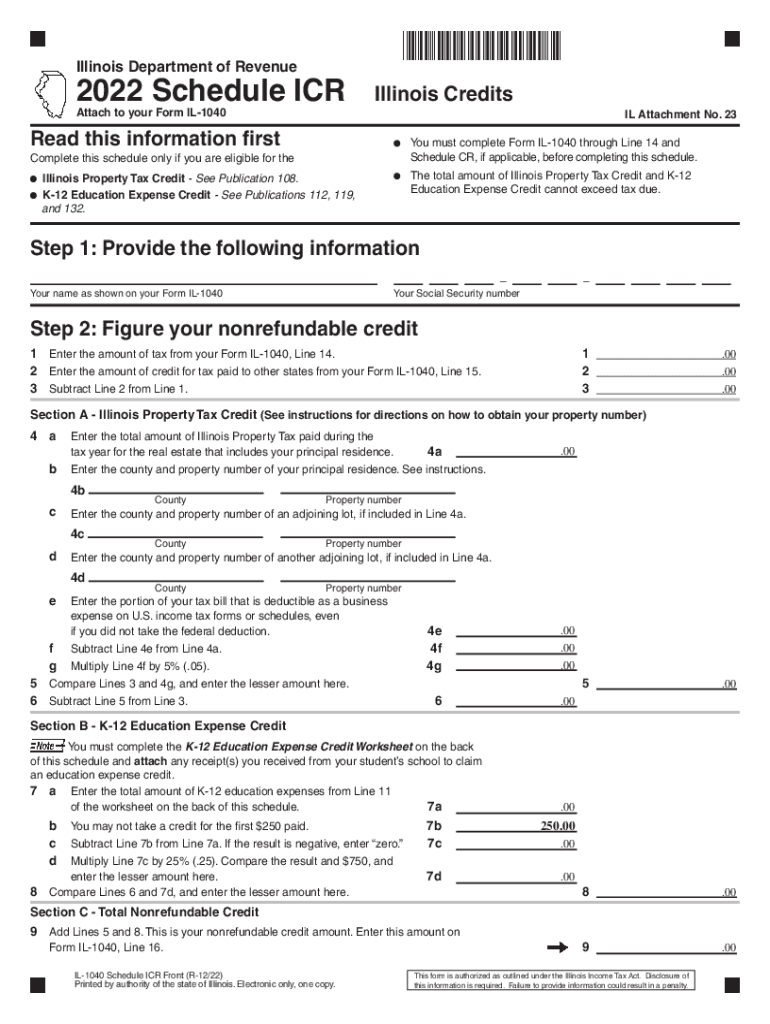

IL IL-1040 Schedule ICR 2022 free printable template

Instructions and Help about IL IL-1040 Schedule ICR

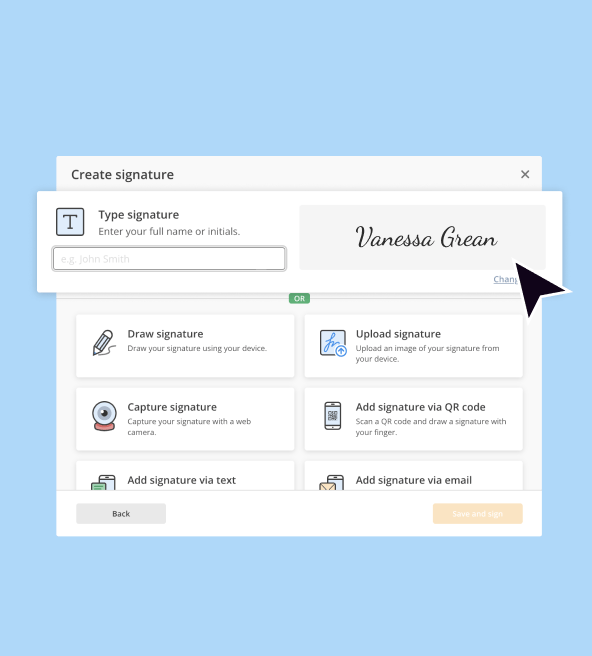

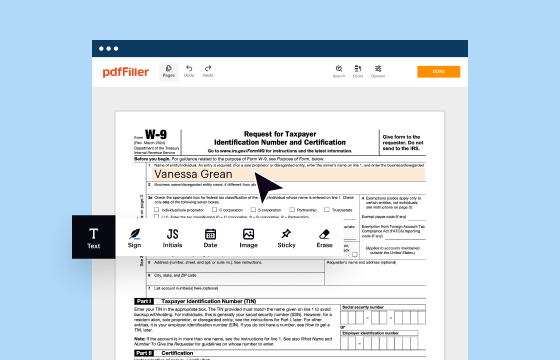

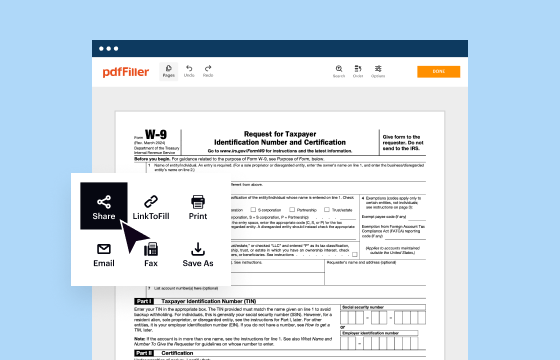

How to edit IL IL-1040 Schedule ICR

How to fill out IL IL-1040 Schedule ICR

About IL IL-1040 Schedule ICR 2022 previous version

What is IL IL-1040 Schedule ICR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IL IL-1040 Schedule ICR

What should I do if I realize I've made a mistake on my IL IL-1040 Schedule ICR after submitting it?

If you've made a mistake on your IL IL-1040 Schedule ICR, you should file an amended return using the appropriate form. Ensure to detail the corrections clearly and attach any necessary documentation. It's crucial to keep copies of any correspondence for your records.

How can I check the status of my IL IL-1040 Schedule ICR submission?

To check the status of your IL IL-1040 Schedule ICR submission, you may use the online tracking system provided by the Illinois Department of Revenue. Make sure you have your Social Security number and other relevant details ready for verification.

What should I do if my IL IL-1040 Schedule ICR is e-filed but I receive a rejection notice?

If your IL IL-1040 Schedule ICR is rejected upon e-filing, review the rejection codes included in the notice for specific details about what went wrong. Correct those errors and re-submit the form as soon as possible to ensure compliance.

Are there special rules for filing the IL IL-1040 Schedule ICR if I am a nonresident?

Nonresidents filing the IL IL-1040 Schedule ICR must follow specific guidelines, including reporting only Illinois-source income. Additionally, they may need to include additional documentation, so it's essential to consult the state's regulations for nonresident filers.

What should I know about data security when filing the IL IL-1040 Schedule ICR electronically?

When e-filing your IL IL-1040 Schedule ICR, ensure you are using secure internet connections and reputable software. The Illinois Department of Revenue employs data encryption; however, it is vital to keep your personal information secure to prevent potential identity theft.