IRS Publication 596 2022 free printable template

Show details

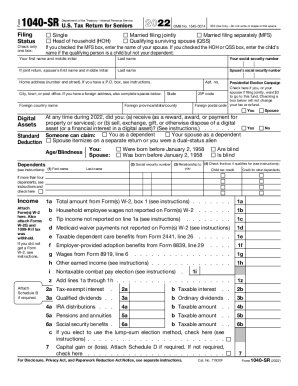

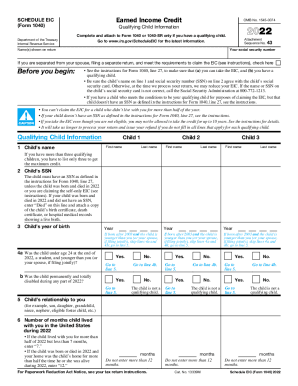

Department of the Treasury Internal Revenue ServicePublication 596 Cat. No. 15173AEarned Income Credit (EIC) For use in preparing2022 ReturnsContents What\'s New for 2022. . . . . . . . . . . . .

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Publication 596

Edit your IRS Publication 596 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Publication 596 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Publication 596 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Publication 596. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 596 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Publication 596

How to fill out IRS Publication 596

01

Obtain IRS Publication 596 from the IRS website or local IRS office.

02

Read the introduction to understand the purpose of the publication.

03

Identify your eligibility for the Earned Income Tax Credit (EITC).

04

Gather necessary documents such as income statements, Social Security numbers, and prior tax returns.

05

Complete the required worksheet in the publication to calculate your EITC.

06

Follow the instructions to fill out your tax return using the calculated EITC.

07

Double-check your entries for accuracy before submitting your tax return.

Who needs IRS Publication 596?

01

Individuals and families who earn low to moderate income.

02

Taxpayers looking to claim the Earned Income Tax Credit (EITC).

03

Individuals who are unsure of their eligibility for EITC and need guidance.

Fill

form

: Try Risk Free

People Also Ask about

What is the new earned income credit for 2022?

In 2022, the credit is worth up to $6,935. The credit amount rises with earned income until it reaches a maximum amount, then gradually phases out. Families with more children are eligible for higher credit amounts. You cannot get the EITC if you have investment income of more than $10,300 in 2022.

What is Publication 596 for the IRS?

For tax returns prior to 2021: Publication 596 is the IRS publication issued to help taxpayers understand Earned Income Credit (EIC). It includes eligibility requirements, worksheets, the EIC table, and several detailed examples.

How to apply for the Child Tax Credit 2022?

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

What are the 6 requirements for claiming a child as a dependent?

The child must be: (a) under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), (b) under age 24 at the end of the year, a full- time student, and younger than you (or your spouse, if filing jointly), or (c) any age if permanently and totally disabled.

Who qualifies for Earned Income Credit 2022?

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2022. Have a valid Social Security number by the due date of your 2022 return (including extensions)

What disqualifies you from earned income credit?

Eligibility is limited to low-to-moderate income earners If you do not have a qualifying child, you must also be at least 25 or older but under 65, not qualify as a dependent of another person and lived in the United States for more than half of the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IRS Publication 596 online?

Filling out and eSigning IRS Publication 596 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit IRS Publication 596 online?

With pdfFiller, it's easy to make changes. Open your IRS Publication 596 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit IRS Publication 596 on an iOS device?

Create, modify, and share IRS Publication 596 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is IRS Publication 596?

IRS Publication 596 provides information on the Earned Income Tax Credit (EITC), including eligibility requirements and how to claim the credit.

Who is required to file IRS Publication 596?

Taxpayers who wish to claim the Earned Income Tax Credit must file IRS Publication 596 along with their tax returns.

How to fill out IRS Publication 596?

To fill out IRS Publication 596, taxpayers need to gather their income information, check their eligibility for the EITC, and follow the instructions provided in the publication to complete the required forms.

What is the purpose of IRS Publication 596?

The purpose of IRS Publication 596 is to provide guidance on the Earned Income Tax Credit, helping taxpayers understand eligibility, the calculation of the credit, and how to claim it properly.

What information must be reported on IRS Publication 596?

Taxpayers must report their earned income, adjusted gross income, and qualifying child information, as well as complete any relevant calculations necessary to determine eligibility for the EITC.

Fill out your IRS Publication 596 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Publication 596 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.