What is schedule CA 540?

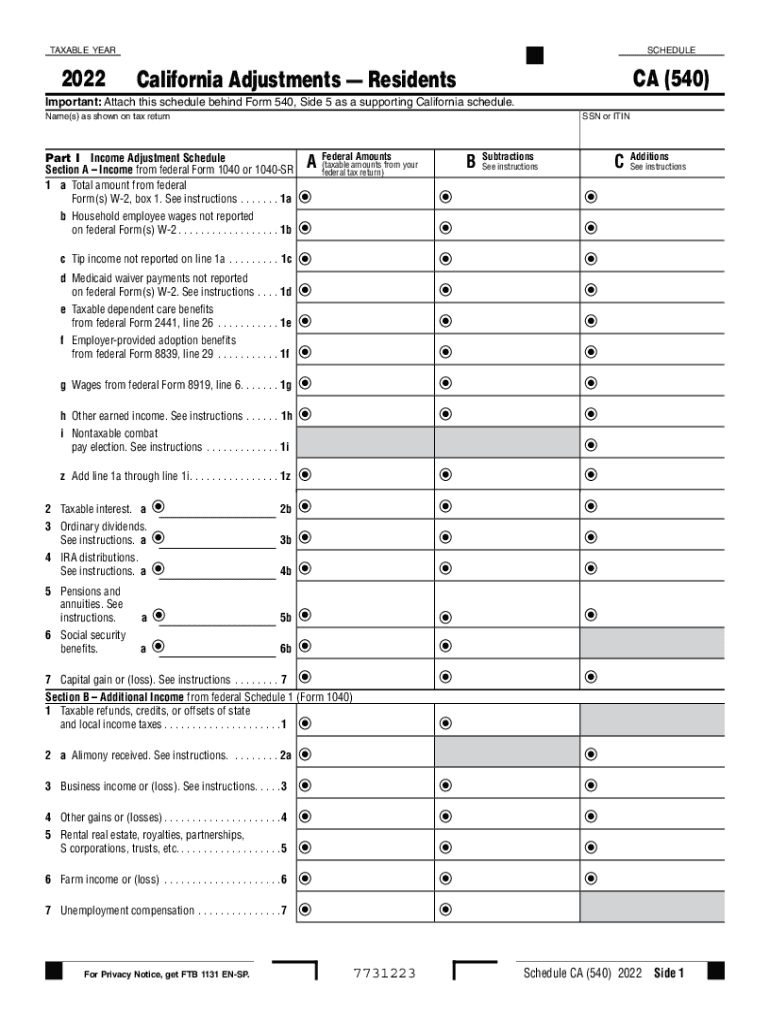

Schedule CA 540 is an attachment to tax form 540 known as the California Resident Income Tax Return. The schedule consists of three pages to report to the state tax service details regarding the taxpayer's federal income.

Who should file schedule CA 540?

All California resident taxpayers must provide this form 540 and the California Adjustments (Residents) attachment. An applicant may file a separate form for their spouse or a joint one reporting general income.

What information do you need when you file schedule CA 540?

The schedule consists of two parts. Both contain columns to provide data on Federal amounts reported with form 1040, including subtractions and additions.

- Part 1 is an Income Adjustment Schedule. You should provide information about your regular taxable income (wages, tips, salaries, ordinary dividends, IRA distributions, social security benefits, pensions, compensations), additional income, and any adjustments to your income during the tax year.

- Part 2 focuses on adjustments to federal itemized deductions. Here you should communicate about taxes and interests you paid, your medical and dental expenses, charity gifts, casualty and theft losses.

To get the detailed schedule ca 540 instructions, check the State of California Franchise State Board website (https://www.ftb.ca.gov/forms).

How do you fill out the schedule 540 ca?

To save time while preparing your documents, complete your schedule ca (540) electronically:

- Use the Get Form button to open your 540 schedule ca in the online editor.

- Click Start to fill out the first blank field in the sample.

- Click Next or use the Enter key to move to the next section without missing any fields.

- Click Done when finished editing your document.

- Save your schedule ca 540, print it, or order the USPS document delivery with just a click.

Is schedule CA 540 accompanied by other forms?

You must submit your schedule ca 540 with Californian form 540. Please note that you should prepare and send your 540 schedule ca only after completing and filing the IRS form 1040. The Federal tax return must always be submitted and accepted first.

When is schedule CA 540 due?

The due date for the 540 schedule ca is the same as for the form CA 540. Taxpayers must submit it by April 18, 2022. Taxpayers who can't provide their reports on time can claim an extension.

Where do I send schedule CA 540 after completing it?

Send the schedule and the form to the following address:

Franchise Tax Board

PO Box 942867

Sacramento CA 94267-0001