OH SD 100 (Formerly SD 100X) 2022 free printable template

Show details

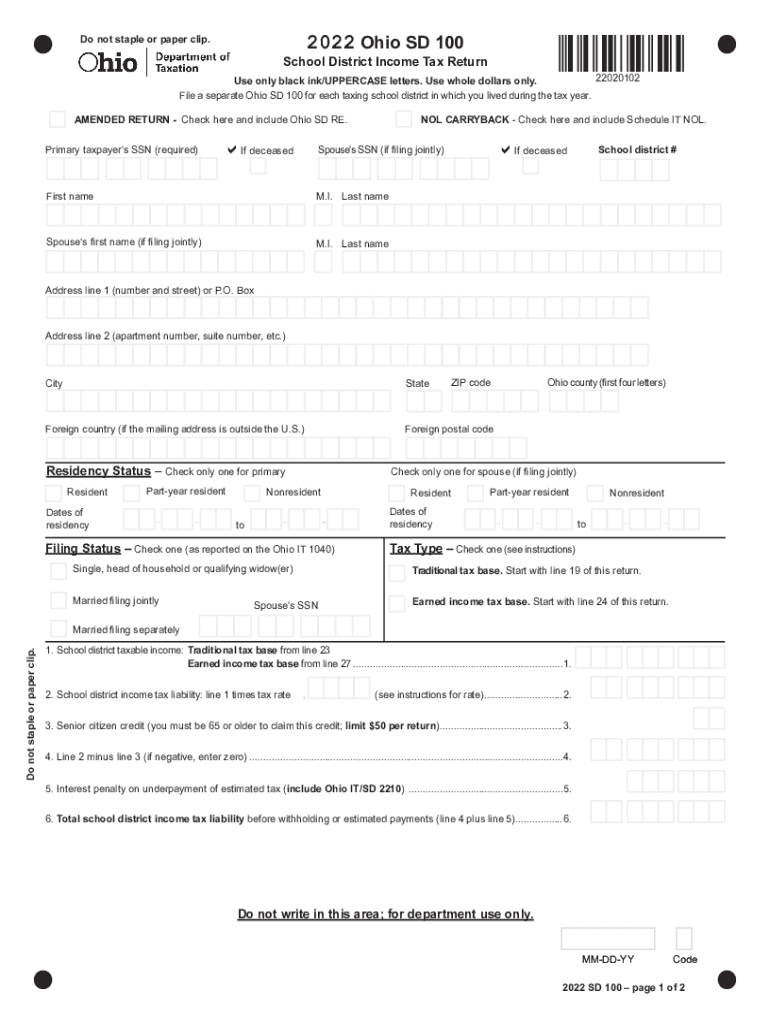

5. 6. Total school district income tax liability before withholding or estimated payments line 4 plus line 5. Part A - Total Withholding 1. Total of all school district income tax withheld for the school district entered above. 2022 Ohio SD 100 Do not staple or paper clip. School District Income Tax Return 22020102 Use only black ink/UPPERCASE letters. Include Ohio SD 40P if original return or Ohio SD 40XP if amended return and make check payable to School District Income Tax. Do not send cash....Do not use this voucher to make a payment for an amended school district income tax return. Use Ohio SD 40XP. Start with line 19 of this return. Married filing jointly Earned income tax base. Start with line 24 of this return. Spouse s SSN 1. Include the voucher below with your payment for your ORIGINAL 2022 school district income tax return. Important Make payment payable to School District Income Tax Include the tax year the last four digits of your SSN and the school district number on the...Memo line of your payment. ORIGINAL PAYMENT Cut on the dotted lines. Use only black ink. OHIO SD 40P Tax Year Original School District Income Tax Payment Voucher Last name M. Use whole dollars only. File a separate Ohio SD 100 for each taxing school district in which you lived during the tax year. AMENDED RETURN - Check here and include Ohio SD RE* Primary taxpayer s SSN required If deceased NOL CARRYBACK - Check here and include Schedule IT NOL* Spouse s SSN if filing jointly First name M. I....Last name Spouse s first name if filing jointly Address line 1 number and street or P. O. Box Address line 2 apartment number suite number etc* State Foreign country if the mailing address is outside the U*S* Foreign postal code Residency Status Check only one for primary Resident Dates of residency Part-year resident - Check only one for spouse if filing jointly Nonresident to Ohio county first four letters ZIP code City Filing Status Check one as reported on the Ohio IT 1040 Tax Type Check...one see instructions Single head of household or qualifying widow er Traditional tax base. School district taxable income Traditional tax base from line 23. see instructions for rate. 2. 3. Senior citizen credit you must be 65 or older to claim this credit limit 50 per return. 3. 4. Line 2 minus line 3 if negative enter zero. 4. 5. Interest penalty on underpayment of estimated tax include Ohio IT/SD 2210. 6. Do not write in this area for department use only. MM-DD-YY Code 2022 SD 100 page 1 of...2 SSN SD 6a* Amount from line 6 on page 1. 6a* schedule and income statements. 7. 8. Estimated and extension payments from Ohio SD 100ES and SD 40P and credit carryforward from last year s return*. 8. 9. Amended return only amount previously paid with original and/or amended return*. 9. 12. Line 10 minus line 11. Place a - in the box if negative. 12. If line 12 is MORE THAN line 6a go to line 16. OTHERWISE continue to line 13. 13. Tax due line 6a minus line 12. If line 12 is negative ignore the...- and add line 12 to line 6a*.

pdfFiller is not affiliated with any government organization

Instructions and Help about OH SD 100 Formerly SD 100X

How to edit OH SD 100 Formerly SD 100X

How to fill out OH SD 100 Formerly SD 100X

Instructions and Help about OH SD 100 Formerly SD 100X

How to edit OH SD 100 Formerly SD 100X

To edit the OH SD 100 Formerly SD 100X, you can use pdfFiller, which allows users to modify the text, fields, and other elements of the form. Begin by uploading the document to the platform. Once uploaded, select the areas you want to edit and make the appropriate changes. After editing, ensure to save the form in your desired format or prepare it for submission.

How to fill out OH SD 100 Formerly SD 100X

To fill out the OH SD 100 Formerly SD 100X form, follow these steps:

01

Download the form from a reliable source or access it through pdfFiller.

02

Provide your name, address, and other identification details required in the designated fields.

03

Input the amounts of payments and purchases that need to be reported.

Once completed, review the form for accuracy and ensure all required signatures are present. Submitting an incomplete form can lead to delays or penalties.

About OH SD 100 Formerly SD 100X 2022 previous version

What is OH SD 100 Formerly SD 100X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Penalties for not issuing the form

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH SD 100 Formerly SD 100X 2022 previous version

What is OH SD 100 Formerly SD 100X?

OH SD 100 Formerly SD 100X is a tax form used in Ohio for the reporting of certain payments made to individuals or entities. This form is typically utilized by businesses to report payments made for services rendered or other taxable transactions.

What is the purpose of this form?

The purpose of the OH SD 100 Formerly SD 100X is to document and report specific financial transactions to ensure compliance with state tax laws. It helps the Ohio Department of Taxation track income that may be subject to state income tax.

Who needs the form?

Businesses and organizations that make reportable payments, such as independent contractors or certain vendors, need to complete the OH SD 100 Formerly SD 100X. If your organization has made payments that meet the state’s reporting thresholds, you are required to file this form.

When am I exempt from filling out this form?

You may be exempt from filling out the OH SD 100 Formerly SD 100X if your payments are below a certain threshold set by the Ohio Department of Taxation, or if your entity does not meet the criteria for reporting required payments. It's advisable to consult the state regulations to confirm your exemption status.

Components of the form

The OH SD 100 Formerly SD 100X includes various sections that require specific information, including the payer's details, the payee's information, and a detailed breakdown of the payments being reported. Additional components may include spaces for signatures and dates of submission.

Penalties for not issuing the form

If you fail to issue the OH SD 100 Formerly SD 100X when required, you may face penalties from the Ohio Department of Taxation. These penalties vary based on the nature and severity of the oversight and can include fines and additional tax obligations.

What information do you need when you file the form?

When filing the OH SD 100 Formerly SD 100X, you will need to provide the following information:

01

The payer’s business name, address, and tax identification number.

02

The payee’s name, address, and taxpayer identification number.

03

A detailed list of the payments made, including amounts and types of services provided.

Having accurate and complete information is critical to ensure compliance and avoid penalties.

Is the form accompanied by other forms?

The OH SD 100 Formerly SD 100X may not necessarily need to be accompanied by other forms. However, if your organization is filing additional tax documents or required schedules, ensure that all necessary forms are included with your submission.

Where do I send the form?

The completed OH SD 100 Formerly SD 100X should be sent to the Ohio Department of Taxation. The address for submissions can be found on the form itself or on the official Ohio Department of Taxation website. Ensure that you send the form to the correct address to avoid processing delays.

See what our users say