CO Income Tax Filing Guide 2023 free printable template

Show details

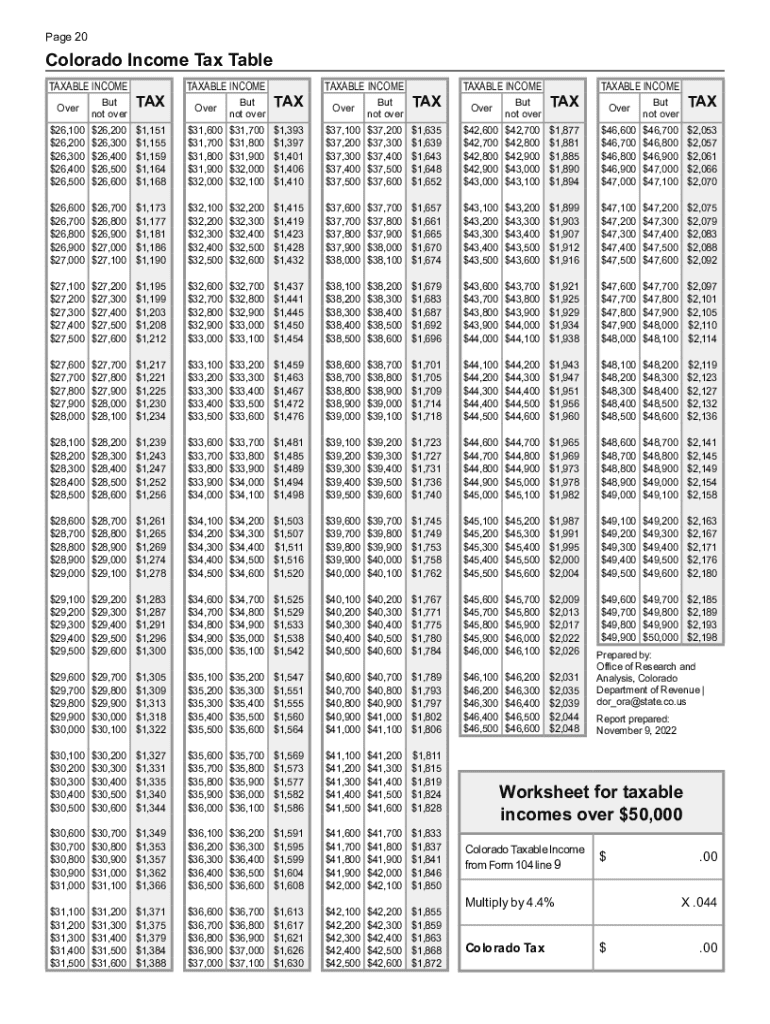

Any two individuals who legally file a joint federal income tax return must also file their Colorado income tax return jointly. Review the instructions on form DR 0375 for more information. You must submit the DR 0375 with your return. 2022 Colorado Income Tax Table with tax rate of 4. W-2s and 1099s When filing a paper return all W-2s and/or 1099s that show Colorado income tax withholding must be included with the form. When filing an electronic return attach scanned copies of all W-2s and/or...1099s that show Colorado income tax withholding to the e-filed tax return. If you are unable to attach W-2s and/ or 1099s to your e-filed return submit through Page 10 Online. Colorado. gov. Filing Information Who Must File This Tax Return Each year you must evaluate if you should file a Colorado income tax return. Generally you must file this return if you are required to file a federal income tax return with the IRS for this year or will have a Colorado income tax liability for this year and...you are A full-year resident of Colorado or A part-year Colorado resident who received taxable income while residing here you must file the DR 0104 along with the DR 0104PN or Not a resident of Colorado but received income from sources within Colorado you must file the DR 0104 along with the DR 0104PN. 49 Page 3 How To Use This Filing Guide This filing guide will assist you with completing your Colorado Income Tax Return. Please read through this guide before starting your return. Once you...finish the form file it with a computer smartphone or tablet using our free and secure Revenue Online service at Colorado. Failure to file electronically may result in delays processing your return. Please include a copy of each Strategic Capital Tax Credit Certificate Line 20 Colorado Income Tax Withheld Enclose your Colorado withholding forms where indicated or if filing electronically scan and submit them through Revenue Online E-Filer Attachments. Individuals must submit the DR 0106K with...their return. Please visit Tax. Colorado. gov for more information. The Colorado Department of Revenue verifies the credit claims of partners and shareholders by reviewing the partnership or S corporation s return. The DR 0106K may be submitted through Revenue Online through tax software or may be included with a paper return. Page 4 Line by Line Instructions for the DR 0104 First complete the federal income tax return you will file with the IRS. You will use information from that return on your...Colorado income tax return. Colorado income tax is based on your federal taxable income which has already considered your deductions. Co. us. If the preceptor receives notification from the Department that the taxpayer is entitled to claim the credit file a Colorado income tax return and claim the credit on the return. You must submit the DR 0366 with your return. Line 44 Retrofitting a Residence to Increase a Residence s Visitability Credit An income tax credit of up to 5 000 is available to...help people with an illness impairment or disability retrofit their residence for greater accessibility and independence.

pdfFiller is not affiliated with any government organization

Instructions and Help about CO Income Tax Filing Guide

How to edit CO Income Tax Filing Guide

How to fill out CO Income Tax Filing Guide

Instructions and Help about CO Income Tax Filing Guide

How to edit CO Income Tax Filing Guide

To edit the CO Income Tax Filing Guide, first download the form from the Colorado Department of Revenue website or obtain a copy from a physical location. You can use pdfFiller’s editing tools to make necessary adjustments directly on the form. Once the necessary changes are made, save your document for your records and further use.

How to fill out CO Income Tax Filing Guide

To fill out the CO Income Tax Filing Guide, gather all required documentation, including your federal tax returns and pertinent income statements. Follow these steps:

01

Open the CO Income Tax Filing Guide document.

02

Provide your personal information, including your name, address, and Social Security number.

03

Enter income details from your federal return and any additional Colorado-specific income information.

04

Complete the sections regarding deductions and credits applicable to your situation.

05

Review the form for accuracy before submitting.

About CO Income Tax Filing Guide 2023 previous version

What is CO Income Tax Filing Guide?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO Income Tax Filing Guide 2023 previous version

What is CO Income Tax Filing Guide?

CO Income Tax Filing Guide is a state tax form used by residents of Colorado to report income, claim deductions, and calculate state tax liability. This form ensures compliance with Colorado tax regulations and is used to facilitate the collection of state revenue.

What is the purpose of this form?

The purpose of the CO Income Tax Filing Guide is to provide a structured format for Colorado taxpayers to detail their income and claim any relevant deductions, thus determining their state tax responsibilities. Proper completion is critical to ensure accurate tax calculations and compliance with state law.

Who needs the form?

Anyone who is a resident of Colorado and is required to file a state income tax return will need to complete the CO Income Tax Filing Guide. This includes individuals with earned income, self-employment income, or unearned income exceeding the state’s filing threshold.

When am I exempt from filling out this form?

You may be exempt from completing the CO Income Tax Filing Guide if your income falls below the required filing threshold set by the state or if you are a minor and your income is only from interest or dividend sources that are also below the threshold. Additionally, certain types of income may not require reporting.

Components of the form

The form consists of several key components, including personal information sections, income declarations, deductions and credits sections, and areas for additional taxes if applicable. Each component serves to gather comprehensive financial data needed for accurate tax assessment.

Due date

The due date for filing the CO Income Tax Filing Guide typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the due date may be extended to the next business day, and it is important to verify any changes for the specific tax year.

Form vs. Form

Information regarding the comparison of this form against other tax forms, such as federal tax returns or other state-specific forms, may be necessary to ensure comprehensive tax compliance. However, each form serves its unique purpose, tailored to respective jurisdictions' requirements.

What payments and purchases are reported?

The CO Income Tax Filing Guide requires reporting of all taxable income, including wages, salaries, tips, interest, rental income, and any other taxable earnings. Additionally, certain business expenses may be deductible, impacting the overall tax calculation.

How many copies of the form should I complete?

Typically, you will need to complete one original copy of the CO Income Tax Filing Guide for your records and submit a copy to the Colorado Department of Revenue. Make sure to keep a copy for your personal documentation and any future reference.

What are the penalties for not issuing the form?

Failing to file the CO Income Tax Filing Guide when required can result in penalties, including fines and interest charges on any unpaid taxes. The state may also initiate collection procedures to recover owed amounts, potentially impacting your credit rating.

What information do you need when you file the form?

When filing the CO Income Tax Filing Guide, you will need your Social Security number, filing status, income documentation such as W-2s and 1099s, and records of any deductions or credits you plan to claim. Having complete and accurate documentation is essential for a successful filing process.

Is the form accompanied by other forms?

Depending on your financial situation, the CO Income Tax Filing Guide may need to be filed alongside supplemental forms for specific credits or deductions. Additional forms can include itemized deduction schedules or state tax credit applications, which provide further details necessary for your tax return.

Where do I send the form?

The completed CO Income Tax Filing Guide should be mailed to the Colorado Department of Revenue at the address provided on the form. Ensure that you verify the correct mailing address for your specific situation, as it may vary based on your county or type of return.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.