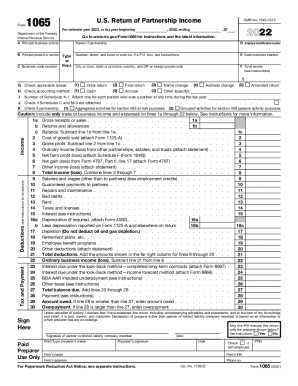

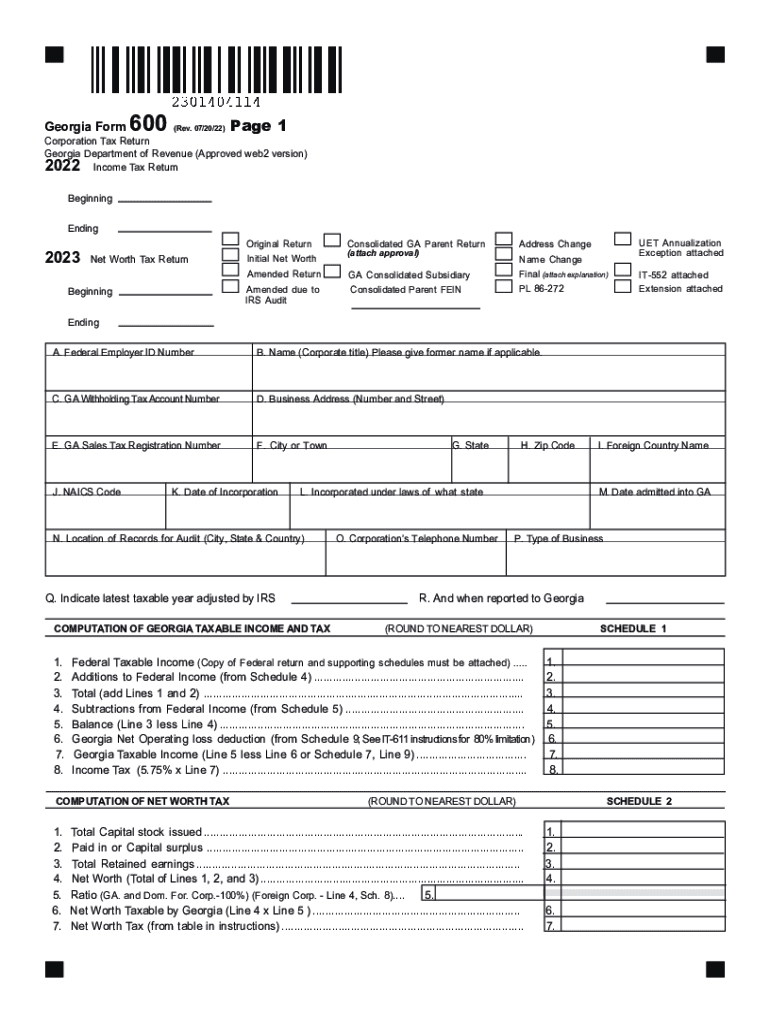

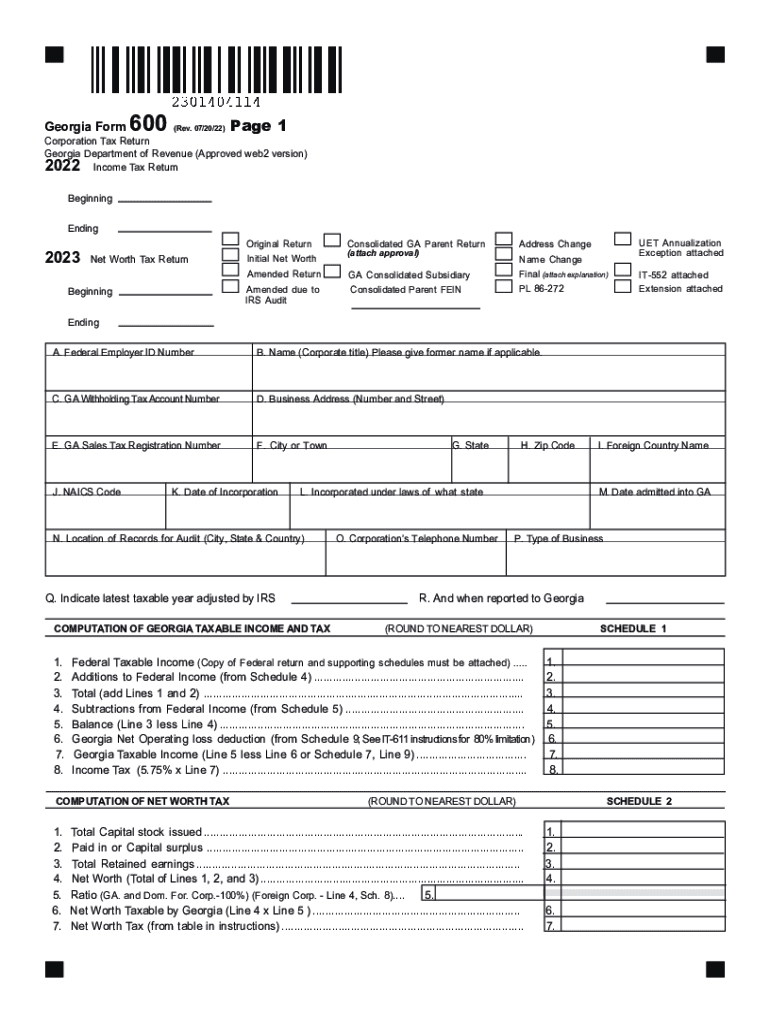

GA DoR 600 2022 free printable template

Show details

Georgia Form600(Rev. 07/20/22)Page 1Corporation Tax Return Georgia Department of Revenue (Approved web2 version) 2022 Income Tax Return Beginning Ending2023Consolidated GA Parent ReturnAddress ChangeAmended

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA DoR 600

Edit your GA DoR 600 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA DoR 600 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit GA DoR 600 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit GA DoR 600. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR 600 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA DoR 600

How to fill out GA DoR 600

01

Obtain the GA DoR 600 form from the Georgia Department of Revenue website or your local office.

02

Fill in your personal information, including name, address, and contact details at the top of the form.

03

Select the correct type of tax return you are filing in the designated section.

04

Enter your income details in the specified fields, such as total income, deductions, and credits.

05

Calculate your total tax liability based on the provided instructions.

06

Include any additional required documents or schedules as attachments.

07

Review all information for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the completed form either online, by mail, or in person as instructed.

Who needs GA DoR 600?

01

Individuals and businesses in Georgia who are required to file a state income tax return.

02

Taxpayers seeking refunds or credits related to state taxes.

03

Anyone needing to report income earned in Georgia for the tax year.

Fill

form

: Try Risk Free

People Also Ask about

How will I know if my tax return is rejected?

After you submit your return The email will be sent to the email address you used when you created your account. If the IRS rejects your return, the email will list the reasons for rejection (error) and provide a link you should use to resolve the rejection issue.

What happens if my tax refund is rejected by my bank?

In this case, the IRS will send you a paper check for the entire refund instead of a direct deposit. You incorrectly enter an account or routing number and the number passes the validation check, but your designated financial institution rejects and returns the deposit to the IRS.

How do I fix Efile rejection?

In response to the rejection of an electronically filed return that's missing the Form 8962, individuals may refile a complete return by completing and attaching Form 8962 or a written explanation of the reasons for its absence.

How long does it take to get taxes rejected?

If you e-filed your return in January, it'll stay in Pending status until the IRS starts processing the backlog of returns. After January, e-filed returns generally sit in Pending status for 24-48 hours before coming back as either Accepted or Rejected.

How do I know if my tax return was approved?

Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

How many times can you e-file after being rejected?

Very odd-usually the IRS will force you to print and mail after 5 rejected e-file attempts.

What do I do if my efile is rejected?

If your return is rejected, you must correct any errors and resubmit your return as soon as possible. If your return is rejected at the end of the filing season, you have 5 days to correct any errors and resubmit your return.

Why would my bank reject a direct deposit?

A deposit is normally rejected for one of two reasons: The address we hold for you doesn't match the one registered with your bank, or. The payment fails online.

How long does it take the IRS to accept a rejected return?

If you e-filed your return in January, it'll stay in Pending status until the IRS starts processing the backlog of returns. After January, e-filed returns generally sit in Pending status for 24-48 hours before coming back as either Accepted or Rejected.

How does the IRS know if I give a gift?

Filing Form 709: First, the IRS primarily finds out about gifts if you report them using Form 709. As a requirement, gifts exceeding $15,000 must be reported on this form.

How long does it take for a bank to reject a direct deposit?

In the event that your bank account is closed or invalid, Payroll Services will receive notification of the direct deposit rejection within 1-4 days after payday.

What happen if your tax return is rejected?

Remember, if your original return was filed by the due date and was rejected, there's no need for you to worry. The IRS considers your return on time as long as you made the corrections and file it again within five business days.

How long does it take for IRS to approve or reject return?

(updated July 7, 2022) We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return.

How long does it take to get refund after bank rejects it?

Once the IRS receives the rejected deposit from the bank, it should take between 1-3 weeks to receive your check.

Why does the IRS keep rejecting my efile?

Tax returns get rejected frequently because a name or number on the return doesn't match information in the IRS or Social Security Administration databases. Typos and misspellings can be quick and easy to fix. You might even be able to correct the issue online and e-file again.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit GA DoR 600 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your GA DoR 600 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the GA DoR 600 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your GA DoR 600 in minutes.

How do I complete GA DoR 600 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your GA DoR 600, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is GA DoR 600?

GA DoR 600 is a form used for reporting income tax in the state of Georgia. It is specifically designed for individuals or entities that need to declare and report specific types of income for tax purposes.

Who is required to file GA DoR 600?

Individuals or entities that earn certain types of income in Georgia, such as business income, rental income, or income from self-employment, may be required to file GA DoR 600.

How to fill out GA DoR 600?

To fill out GA DoR 600, provide your personal or business information, report all applicable income, calculate your taxable amount, and follow the instructions for deductions and credits as applicable.

What is the purpose of GA DoR 600?

The purpose of GA DoR 600 is to collect information from taxpayers regarding their income and to ensure compliance with state income tax laws in Georgia.

What information must be reported on GA DoR 600?

The information that must be reported on GA DoR 600 includes the taxpayer's identification details, total income, deductions, credits, and any other relevant income sources required by Georgia tax law.

Fill out your GA DoR 600 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR 600 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.