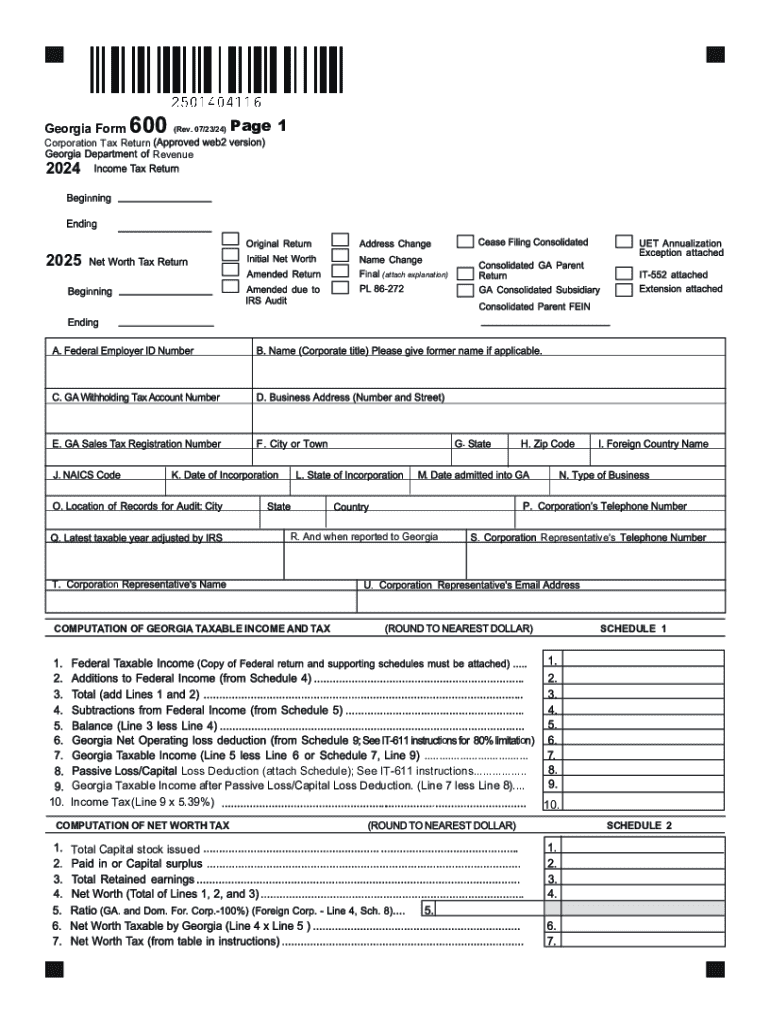

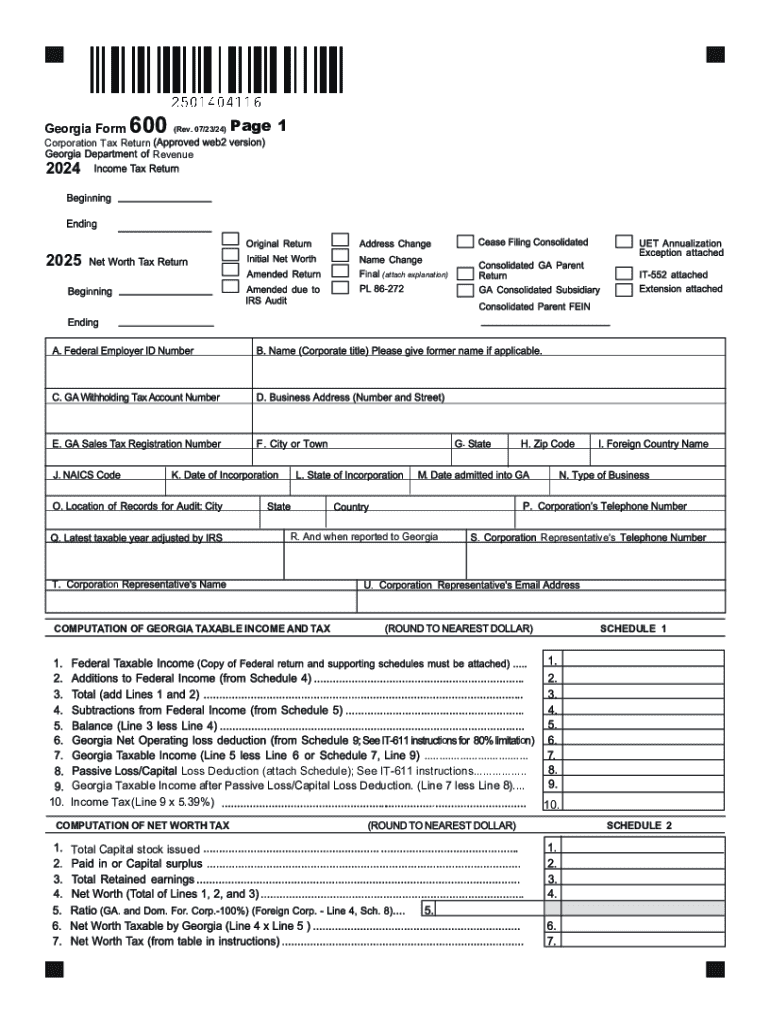

GA DoR 600 2024-2025 free printable template

Show details

Georgia Form 600 Corporation Tax Return 202 5HY Page 1 Revenue n n 202 in (attach explanation) in 5 $QGZKHQUHSRUWHGWR*HRUJLD ion . Representative’s . COMPUTATION OF GEORGIA TAXABLE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2024 georgia form 600

Edit your 2024 form 600 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ga form 600 return get form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ga form 600 return blank online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2024 ga form 600. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR 600 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2024 ga form 600

How to fill out GA DoR 600

01

Gather all necessary personal and financial information.

02

Start by providing your full name at the top of the form.

03

Enter your Social Security number accurately.

04

Fill in your mailing address, ensuring it is current.

05

Complete the section regarding your income sources.

06

Detail your expenses in the appropriate sections.

07

Review all provided information for accuracy.

08

Sign and date the form before submission.

Who needs GA DoR 600?

01

Individuals seeking financial assistance or support.

02

Residents in the state that requires the GA DoR 600 for state aid.

03

Applicants applying for social services or programs that require documentation of financial status.

Fill

form

: Try Risk Free

People Also Ask about

How will I know if my tax return is rejected?

After you submit your return The email will be sent to the email address you used when you created your account. If the IRS rejects your return, the email will list the reasons for rejection (error) and provide a link you should use to resolve the rejection issue.

What happens if my tax refund is rejected by my bank?

In this case, the IRS will send you a paper check for the entire refund instead of a direct deposit. You incorrectly enter an account or routing number and the number passes the validation check, but your designated financial institution rejects and returns the deposit to the IRS.

How do I fix Efile rejection?

In response to the rejection of an electronically filed return that's missing the Form 8962, individuals may refile a complete return by completing and attaching Form 8962 or a written explanation of the reasons for its absence.

How long does it take to get taxes rejected?

If you e-filed your return in January, it'll stay in Pending status until the IRS starts processing the backlog of returns. After January, e-filed returns generally sit in Pending status for 24-48 hours before coming back as either Accepted or Rejected.

How do I know if my tax return was approved?

Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

How many times can you e-file after being rejected?

Very odd-usually the IRS will force you to print and mail after 5 rejected e-file attempts.

What do I do if my efile is rejected?

If your return is rejected, you must correct any errors and resubmit your return as soon as possible. If your return is rejected at the end of the filing season, you have 5 days to correct any errors and resubmit your return.

Why would my bank reject a direct deposit?

A deposit is normally rejected for one of two reasons: The address we hold for you doesn't match the one registered with your bank, or. The payment fails online.

How long does it take the IRS to accept a rejected return?

If you e-filed your return in January, it'll stay in Pending status until the IRS starts processing the backlog of returns. After January, e-filed returns generally sit in Pending status for 24-48 hours before coming back as either Accepted or Rejected.

How does the IRS know if I give a gift?

Filing Form 709: First, the IRS primarily finds out about gifts if you report them using Form 709. As a requirement, gifts exceeding $15,000 must be reported on this form.

How long does it take for a bank to reject a direct deposit?

In the event that your bank account is closed or invalid, Payroll Services will receive notification of the direct deposit rejection within 1-4 days after payday.

What happen if your tax return is rejected?

Remember, if your original return was filed by the due date and was rejected, there's no need for you to worry. The IRS considers your return on time as long as you made the corrections and file it again within five business days.

How long does it take for IRS to approve or reject return?

(updated July 7, 2022) We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return.

How long does it take to get refund after bank rejects it?

Once the IRS receives the rejected deposit from the bank, it should take between 1-3 weeks to receive your check.

Why does the IRS keep rejecting my efile?

Tax returns get rejected frequently because a name or number on the return doesn't match information in the IRS or Social Security Administration databases. Typos and misspellings can be quick and easy to fix. You might even be able to correct the issue online and e-file again.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2024 ga form 600 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 2024 ga form 600, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in 2024 ga form 600?

With pdfFiller, it's easy to make changes. Open your 2024 ga form 600 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit 2024 ga form 600 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 2024 ga form 600.

What is GA DoR 600?

GA DoR 600 is a form used in the state of Georgia for reporting and disclosing certain tax-related information regarding the sale of real estate and associated transactions.

Who is required to file GA DoR 600?

Any individual or entity involved in the sale or transfer of real estate in Georgia is required to file GA DoR 600.

How to fill out GA DoR 600?

To fill out GA DoR 600, you need to provide detailed information about the transaction, including parties involved, details of the property, sale price, and other relevant tax information as specified in the instructions provided with the form.

What is the purpose of GA DoR 600?

The purpose of GA DoR 600 is to ensure proper reporting of real estate transactions for state tax purposes and to facilitate compliance with tax laws.

What information must be reported on GA DoR 600?

GA DoR 600 requires reporting of information such as the names and addresses of the buyer and seller, the tax identification numbers, the property description, sale price, date of transfer, and any applicable exemptions or deductions.

Fill out your 2024 ga form 600 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2024 Ga Form 600 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.