MA DoR 355S 2021-2025 free printable template

Show details

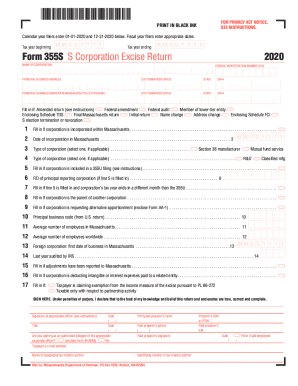

2016 FORM 355S PAGE 2 EXCISE CALCULATION Taxable Massachusetts tangible property if applicable from Schedule C line 4. File pg. 1 FOR PRIVACY ACT NOTICE SEE INSTRUCTIONS. PRINT IN BLACK INK Calendar year filers enter 01-01-2016 and 12-31-2016 below. Fiscal year filers enter appropriate dates. Tax year beginning 3 Tax year ending 3 Form 355S S Corporation Excise Return FEDERAL IDENTIFICATION NUMBER FID NAME OF CORPORATION PRINCIPAL BUSINESS ADDRESS CITY/TOWN/POST OFFICE STATE ZIP 4 Fill in if...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mass 355s form

Edit your ma form 355s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 355s massachusetts form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 355s online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 355s massachusetts. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 355S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 355s tax form

How to fill out MA DoR 355S

01

Start by obtaining the MA DoR 355S form from the Massachusetts Department of Revenue website.

02

Provide your name, address, and Social Security number at the top of the form.

03

Fill in the tax period for which you are filing the form.

04

Enter your total income and any adjustments to income in the designated sections.

05

Calculate your deductions and enter the total amount.

06

Determine your tax liability using the tax tables provided with the form.

07

Complete any additional sections regarding credits or payments.

08

Review the form for accuracy and completeness.

09

Sign and date the form at the bottom.

10

Submit the completed form to the appropriate Massachusetts Department of Revenue address.

Who needs MA DoR 355S?

01

Individuals filing their personal income tax returns in Massachusetts.

02

Taxpayers who are claiming certain tax credits, deductions, or exemptions.

03

Those who have income from sources such as wages, self-employment, or investments.

Video instructions and help with filling out and completing form 355s

Instructions and Help about mass 355s online

Fill

form 355s instructions

: Try Risk Free

People Also Ask about mass form 355s pdf

What is the excise tax on an S Corp in Massachusetts?

For traditional corporations, the corporate excise tax generally is the sum of an 8.00% tax on income attributable to Massachusetts and a tax of $2.60 per $1,000 of the greater of either taxable Massachusetts tangible personal property or taxable net worth. There is a minimum excise tax for corporations of $456.

What is Form 355S?

All corporations and financial institutions that reasonably estimate their excise to be in excess of $1,000 for the taxable year are required to make estimated payments. Form 355-ES, 2023 Corporate Estimated Tax Payment Instructions and Worksheet. Must be filed electronically through MassTaxConnect.

What is the minimum tax on Form 355 in Massachusetts?

Massachusetts Form 355 Excise Tax includes a tax of $2.60 per $1,000 on taxable Massachusetts tangible property or taxable net worth, whichever applies, and a tax of 8.0% on income attributable to Massachusetts.

What is the form for a Massachusetts S Corp?

Massachusetts S corporations must annually file Form 355S or Form 63 FI. A Massachusetts S corporation that is included in a 355U also files Form 355S or 63FI but that return will generally be informational only. S corporations must also include with the annual filing: A Massachusetts Schedule S.

What forms do I need to file as an S Corp?

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

What is MA Form 355S?

S corporations will file Form 355S indicating on the face of such return that they are subject to combined reporting for their income measure of excise and exclude from that separate return the income that is reported on the group's Form 355U (Schedule E is not required unless the taxpayer has income from a source

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 355s pdf in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form 355s fillable as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get form 355s massachusetts form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the massachusetts property schedule. Open it immediately and start altering it with sophisticated capabilities.

How do I edit form excise massachusetts in Chrome?

Install the pdfFiller Google Chrome Extension to edit ma form 355s pdf and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is MA DoR 355S?

MA DoR 355S is a form used by the Massachusetts Department of Revenue for reporting income and taxes for certain entities, generally regarding corporate excise tax.

Who is required to file MA DoR 355S?

Corporations doing business in Massachusetts, as well as foreign corporations that have income derived from Massachusetts sources, are required to file MA DoR 355S.

How to fill out MA DoR 355S?

To fill out MA DoR 355S, a taxpayer should carefully follow the instructions provided with the form, ensuring to accurately report all relevant income, deductions, and tax credits.

What is the purpose of MA DoR 355S?

The purpose of MA DoR 355S is to compute the corporate excise tax liability for corporations operating in or doing business with Massachusetts.

What information must be reported on MA DoR 355S?

MA DoR 355S requires reporting of corporate income, apportionment factors, deductions, tax credits, and any other relevant financial information to calculate tax liability.

Fill out your form 355s 2021-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excise Line Search is not the form you're looking for?Search for another form here.

Keywords relevant to form 355s instructions form

Related to 355s pg form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

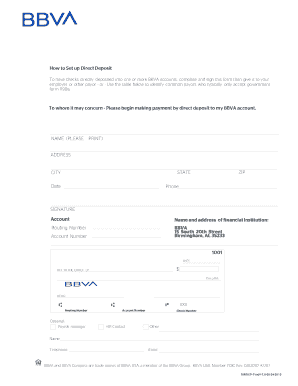

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.