MA DoR 355S 2016 free printable template

Show details

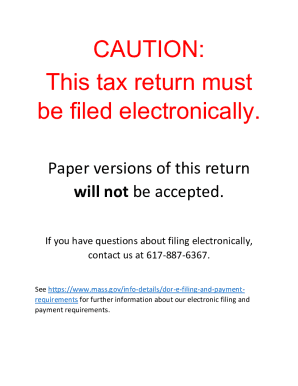

2016 FORM 355S PAGE 2 EXCISE CALCULATION Taxable Massachusetts tangible property if applicable from Schedule C line 4. File pg. 1 FOR PRIVACY ACT NOTICE SEE INSTRUCTIONS. PRINT IN BLACK INK Calendar year filers enter 01-01-2016 and 12-31-2016 below. Fiscal year filers enter appropriate dates. Tax year beginning 3 Tax year ending 3 Form 355S S Corporation Excise Return FEDERAL IDENTIFICATION NUMBER FID NAME OF CORPORATION PRINCIPAL BUSINESS ADDRESS CITY/TOWN/POST OFFICE STATE ZIP 4 Fill in if...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR 355S

Edit your MA DoR 355S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR 355S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA DoR 355S online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MA DoR 355S. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 355S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR 355S

How to fill out MA DoR 355S

01

Gather all necessary personal and financial information before starting.

02

Download the MA DoR 355S form from the Massachusetts Department of Revenue website.

03

Start by filling out your personal information, including your name, address, and Social Security number.

04

Indicate your filing status for the tax year (e.g., single, married, etc.).

05

Report your total income by filling in the appropriate sections, including wages, interest, and other income sources.

06

Complete the deductions section, ensuring to apply for any eligible deductions.

07

Calculate your tax liability using the tax tables provided in the form or the online calculator.

08

Review the form for accuracy and ensure all sections are filled in completely.

09

Sign and date the form, and provide any required attachments before submission.

10

Submit the completed form by mailing it to the specified address or filing electronically if available.

Who needs MA DoR 355S?

01

The MA DoR 355S form is needed by individuals who are residents of Massachusetts and are filing a state income tax return.

02

It is specifically for individuals who had a total income that does not exceed a certain threshold, allowing for simplified filing.

03

Taxpayers who wish to claim specific deductions or credits should also complete this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the excise tax on an S Corp in Massachusetts?

For traditional corporations, the corporate excise tax generally is the sum of an 8.00% tax on income attributable to Massachusetts and a tax of $2.60 per $1,000 of the greater of either taxable Massachusetts tangible personal property or taxable net worth. There is a minimum excise tax for corporations of $456.

What is Form 355S?

All corporations and financial institutions that reasonably estimate their excise to be in excess of $1,000 for the taxable year are required to make estimated payments. Form 355-ES, 2023 Corporate Estimated Tax Payment Instructions and Worksheet. Must be filed electronically through MassTaxConnect.

What is the minimum tax on Form 355 in Massachusetts?

Massachusetts Form 355 Excise Tax includes a tax of $2.60 per $1,000 on taxable Massachusetts tangible property or taxable net worth, whichever applies, and a tax of 8.0% on income attributable to Massachusetts.

What is the form for a Massachusetts S Corp?

Massachusetts S corporations must annually file Form 355S or Form 63 FI. A Massachusetts S corporation that is included in a 355U also files Form 355S or 63FI but that return will generally be informational only. S corporations must also include with the annual filing: A Massachusetts Schedule S.

What forms do I need to file as an S Corp?

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

What is MA Form 355S?

S corporations will file Form 355S indicating on the face of such return that they are subject to combined reporting for their income measure of excise and exclude from that separate return the income that is reported on the group's Form 355U (Schedule E is not required unless the taxpayer has income from a source

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MA DoR 355S on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing MA DoR 355S.

How can I fill out MA DoR 355S on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your MA DoR 355S, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit MA DoR 355S on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as MA DoR 355S. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is MA DoR 355S?

MA DoR 355S is a tax form used in Massachusetts for reporting personal income tax for certain types of taxpayers, typically corporations.

Who is required to file MA DoR 355S?

Corporations doing business in Massachusetts or having income derived from sources within the state are required to file MA DoR 355S.

How to fill out MA DoR 355S?

To fill out MA DoR 355S, corporations need to provide their identification information, income details, deductions, and any applicable tax credits. Guidance is available in the form's instructions.

What is the purpose of MA DoR 355S?

The purpose of MA DoR 355S is to calculate and report the personal income tax owed by corporations operating in Massachusetts.

What information must be reported on MA DoR 355S?

MA DoR 355S requires reporting of income, deductions, and credits, along with the corporation's name, tax identification number, and other relevant financial information.

Fill out your MA DoR 355S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR 355s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.