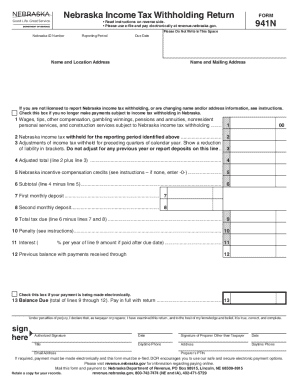

NE DoR 941N 2022 free printable template

Get, Create, Make and Sign NE DoR 941N

Editing NE DoR 941N online

Uncompromising security for your PDF editing and eSignature needs

NE DoR 941N Form Versions

How to fill out NE DoR 941N

How to fill out NE DoR 941N

Who needs NE DoR 941N?

Instructions and Help about NE DoR 941N

Hi if you're looking to fill in and write a Nebraska power of attorney form you've come to the right place all you need to do is come to this web page scroll down just a bit, and you can see all five of the main forms really quick going over them all you have the durable financial which allows you to choose someone else to handle any type of monetary or financial action on your behalf the medical PAP attorney which is for all medical treatment options or facility just in case you can't speak for yourself vehicle motorboat this is for all activity in relation to a motor vehicle or obviously a motorboat that you own in relation to selling it or titling registration and all that stuff within the state you have the tax which is for all state tax filings and then on the bottom left here you have the parental which allows a parent to choose someone else that's within the family to handle a care of a minor, so I need to do is click on the thumbnail of the form that you want click on the bullet right here will open right up and all you have to do is just fill in the blanks they'll all be highlighted so for example whoever the representative is I your name, so it's that easy all you need is adobe PDF which I'm sure most computers have and as you can see is only four pages so once you get to the end you do not want to sign it you want to wait until that you get in front of a notary public so that they can witness the signatures you need this or else the form is not legal, and you can find a notary public at every branch bank in the United States and usually if you have an account they'll do it for free but if you don't, I know Bank of America charges somewhere around eight to ten dollars for the service and that's it that's how you can fill in a Nebraska pay attorney form

People Also Ask about

How do I get a tax exempt number in Nebraska?

What is Nebraska withholding tax?

What is Nebraska nonresident income tax?

How do I find my Nebraska employer account number?

What is the number for Nebraska withholding?

What is Nebraska withholding ID number?

How do I get a Nebraska tax ID number?

Is it better to claim 1 or 0 allowances?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NE DoR 941N online?

How do I edit NE DoR 941N online?

How do I fill out NE DoR 941N on an Android device?

What is NE DoR 941N?

Who is required to file NE DoR 941N?

How to fill out NE DoR 941N?

What is the purpose of NE DoR 941N?

What information must be reported on NE DoR 941N?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.