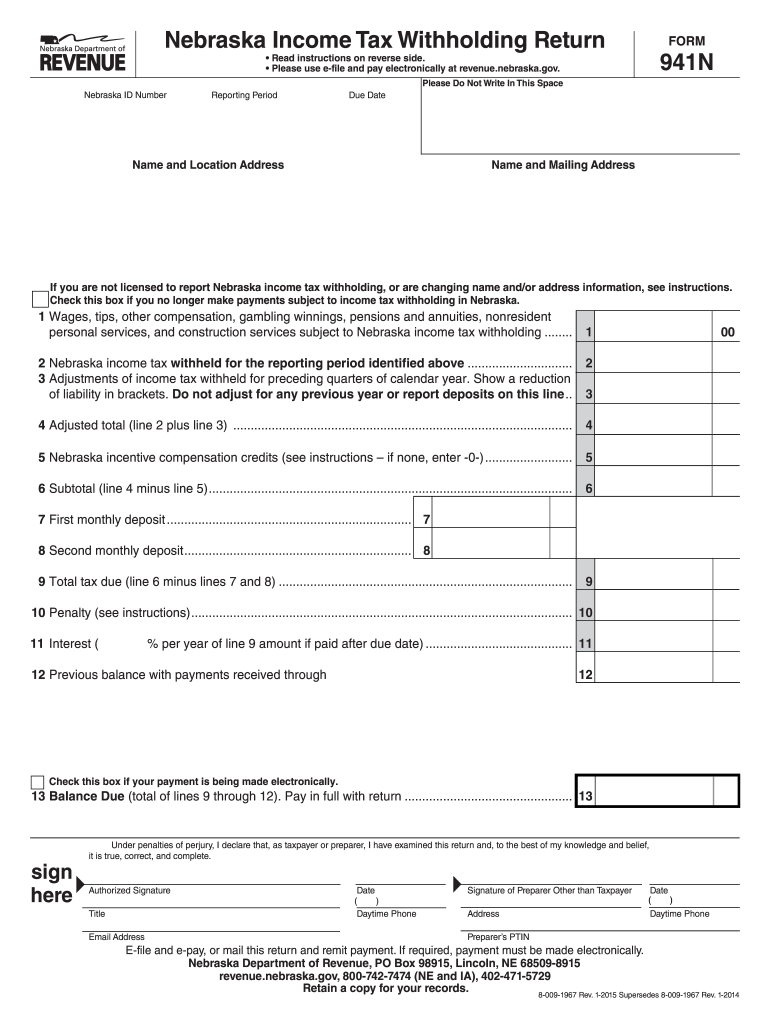

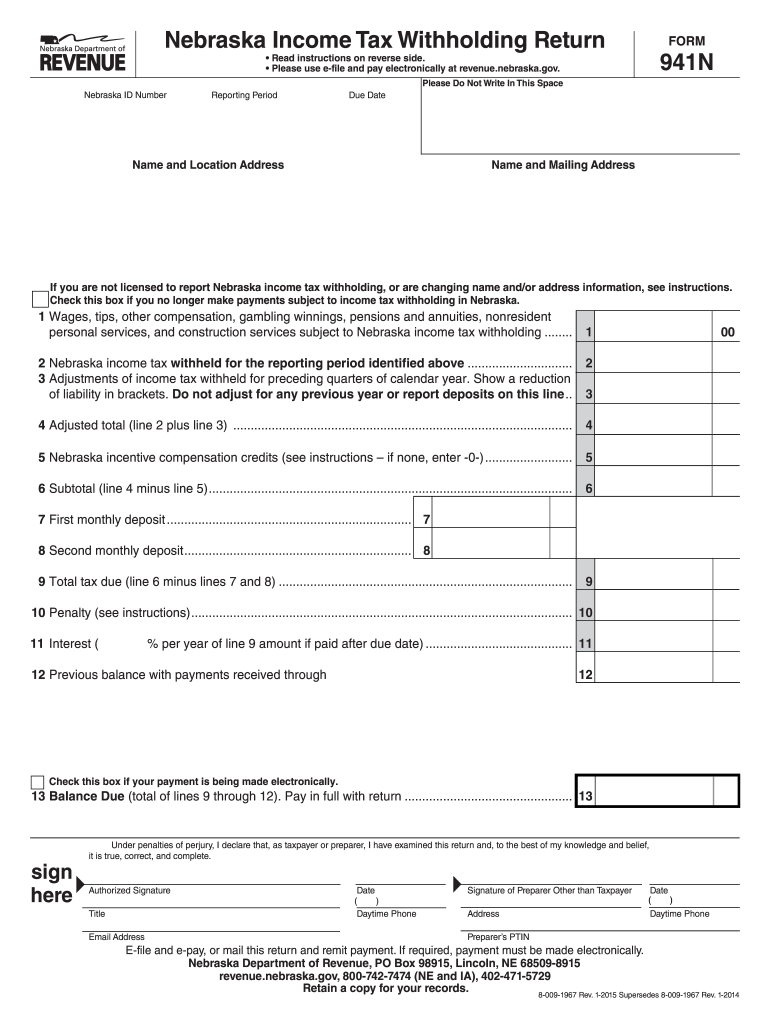

NE DoR 941N 2013 free printable template

Get, Create, Make and Sign NE DoR 941N

Editing NE DoR 941N online

Uncompromising security for your PDF editing and eSignature needs

NE DoR 941N Form Versions

How to fill out NE DoR 941N

How to fill out NE DoR 941N

Who needs NE DoR 941N?

Instructions and Help about NE DoR 941N

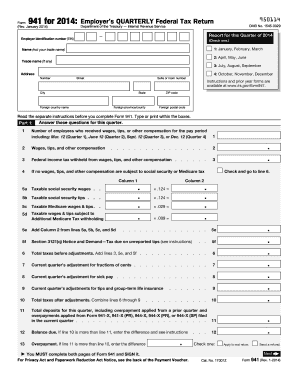

In this example we'll be preparing form 941 and Schedule B from Mayfield's candy shop for the third quarter using the information provided here the number of employees total pay withholding and tax liability dates and amounts are obtained from the payroll registers for the quarter the basic business information and the reporting period is filled in at the top of the form in part one the number of employees the total compensation paid to those employees and the amount of income tax withheld from that compensation is entered starting on line 5a enter the taxable Social Security wages in column one if any employees have exceeded the wage base for Social Security withholding this number will be smaller than the amount on line two for Mayfield's the wages are all taxable for Social Security multiply this number by twelve point four percent six point two percent for employee and six point two percent for employer and enter it in column two enter any tips subject to Social Security on the next line in column one multiply this amount by twelve point four percent and record it in column two employees at Mayfield's are not tipped employees enter the Medicare taxable wages and tips on the next line in column one multiply this amount by two point nine percent and record it in column two line 5d is for additional Medicare withholding applicable when an employee earns more than two hundred thousand dollars in a calendar year Mayfield's has no employees in this category the additional Medicare tax is 0.9 percent withheld only from the employees wages and tips the employer does not match this amount on line 5e some the amounts in column two for rows 5a through 5d if the business has received an IRS notice and demand for tax due on unreported tips that amount is recorded online 5f total lines three five e and five F and record that amount on line six this is the total calculated tax including federal income tax withheld during the quarter at this point it is necessary to complete part two of form 941 if your business is a monthly depositor or Schedule B if your business is a semi-weekly depositor since Mayfield's is a semi-weekly depositor we will complete Schedule B the purpose of Schedule B is to provide information on the days and the amounts of the tax liability if you are wondering how the IRS would know if you made the right deposits on time this is where you would report the pay dates, and they will use this information to ensure your deposits were on time and the correct amount the days should correspond to pay dates not the dates you made the deposits enter the basic business information at the top of the form including the quarter and the calendar year using the tax liability from the payroll register and noting that this includes federal income tax withheld the employees share of Social Security and Medicare and the employers share of Social Security and Medicare record the amounts for each pay period starting with July 5th then July 19th and the pay...

People Also Ask about

What is a 941N form?

How do I contact Nebraska withholding tax?

How much is taken out of my paycheck for taxes in Nebraska?

Do I need to attach my federal return to my Nebraska return?

How do I close my Nebraska withholding account?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NE DoR 941N directly from Gmail?

How do I make changes in NE DoR 941N?

How do I complete NE DoR 941N on an iOS device?

What is NE DoR 941N?

Who is required to file NE DoR 941N?

How to fill out NE DoR 941N?

What is the purpose of NE DoR 941N?

What information must be reported on NE DoR 941N?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.