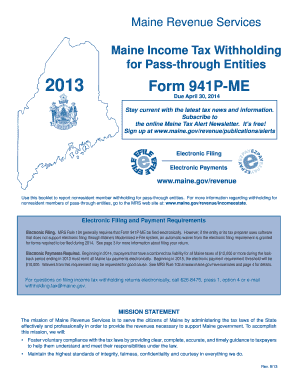

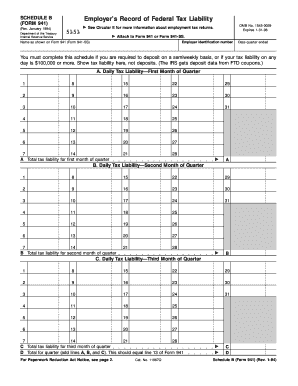

2013 Form 941

What is 2013 form 941?

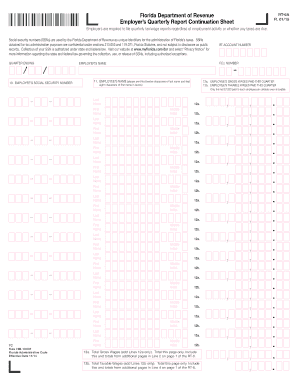

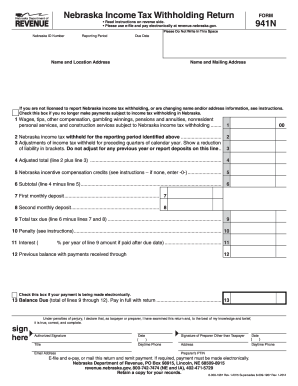

2013 form 941 is a tax form used by employers to report employment taxes. It is used to report wages paid, tips received, and taxes withheld for employees. This form is filed with the Internal Revenue Service (IRS) on a quarterly basis.

What are the types of 2013 form 941?

There is only one type of 2013 form 941, which is used to report employment taxes. However, there are different versions of the form for each quarter of the year: Q1, Q2, Q3, and Q4.

Q1 - January, February, March

Q2 - April, May, June

Q3 - July, August, September

Q4 - October, November, December

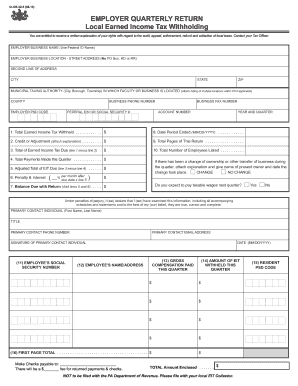

How to complete 2013 form 941

To complete the 2013 form 941, follow these steps:

01

Fill in your employer identification number (EIN) and business name.

02

Enter the total number of employees and wages paid during the quarter.

03

Report the total amount of federal income tax withheld from employees' wages.

04

Calculate and report the employer's share of Social Security and Medicare taxes.

05

Fill in any adjustments or corrections to previously reported wages and taxes.

06

Sign and date the form.

07

Submit the form to the IRS by the due date.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2013 form 941

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I submit form 941?

The fastest way to file Form 941 is through the federal e-File system. Business taxpayers can access e-File through most tax preparation software for small businesses. Your accountant or tax professional should also have access to e-File.

Can you file form 941 late?

Late Filing Deposits made between six and 15 days late have a five percent penalty and a ten percent penalty for deposits more than 16 days late, plus interest. If you file Form 941 late, the IRS imposes a penalty of five percent per month or partial month you are late, up to a maximum of 25 percent.

Do I have to file 941 electronically?

This federal tax return must be filed every quarter, enabling the IRS to understand and assess the employer's track of federal tax payments and filings. Form 941 can be filed electronically and by paper.

How much does it cost to efile 941?

940 / 941 / 943 / 944 / 945 Forms Forms 940, 941, 943, 944, 945No. of Forms Price per form or (SCH R)linePricingFirst Form$4.95Next 3 Forms$4.455-25 Forms$3.953 more rows

Who can prepare Form 941?

To submit the form Business taxpayers can access e-File through most tax preparation software for small businesses. Your accountant or tax professional should also have access to e-File. You can also mail Form 941.

What happens if you forget to file 941?

If you fail to File your Form 941 or Form 944 by the deadline: Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.