941 Schedule B

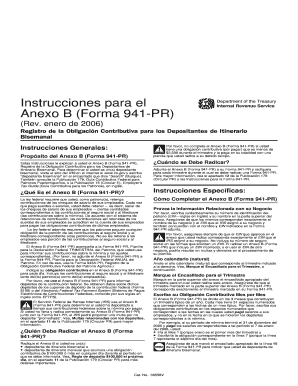

What is 941 schedule b?

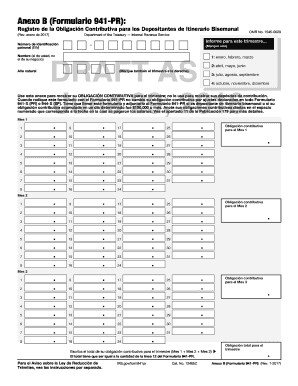

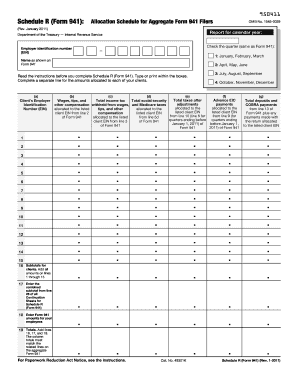

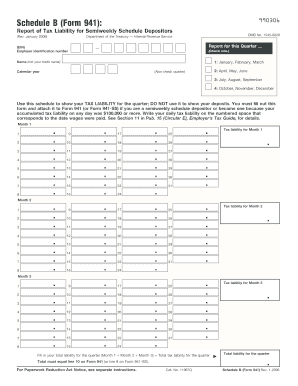

941 Schedule B is a form provided by the Internal Revenue Service (IRS) in the United States. It is used by employers to report and summarize the total tax liability for each quarter of the year. This schedule is an essential part of the annual tax return for employers who withhold federal income tax, social security tax, and Medicare tax from their employees' wages.

What are the types of 941 schedule b?

There are two types of 941 Schedule B forms: Schedule B (Form 941) and Schedule B (Form 941-SS). Schedule B (Form 941) is used by most employers, while Schedule B (Form 941-SS) is used by employers who are engaged in the business of selling or exchanging goods, services, or property.

How to complete 941 schedule b

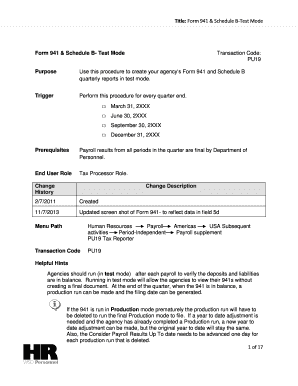

Completing the 941 Schedule B form may seem daunting, but it can be broken down into a few simple steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.