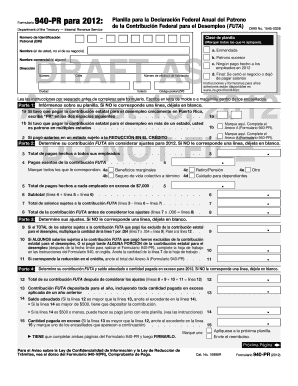

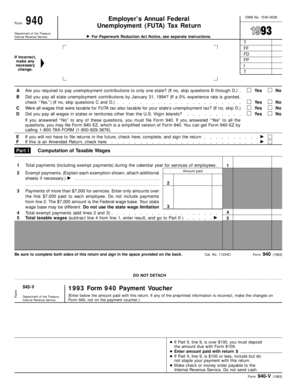

2012 Form 940

What is 2012 form 940?

The 2012 form 940 is a tax form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This form is specifically designed to report wages paid to employees and calculate the amount of federal unemployment tax owed.

What are the types of 2012 form 940?

There are no specific types of 2012 form 940. However, the form has different sections to be completed depending on the employer's circumstances. These sections include general information, taxable wages and calculations, and payment details.

How to complete 2012 form 940

Completing the 2012 form 940 is relatively straightforward. Here is a step-by-step guide:

Empower yourself with pdfFiller - the leading online document management platform. With unlimited fillable templates and powerful editing tools, pdfFiller is your one-stop solution for creating, editing, and sharing documents online. Say goodbye to manual paperwork and experience the convenience of pdfFiller now!