941 Form For 2014

What is 941 form for 2014?

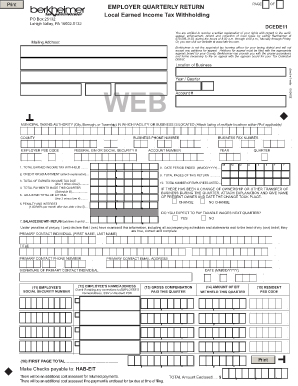

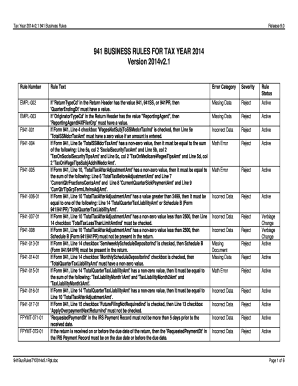

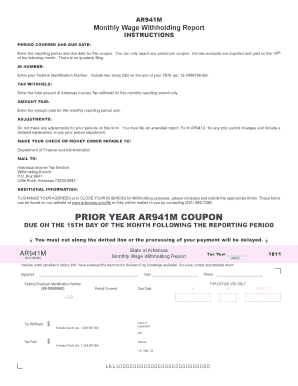

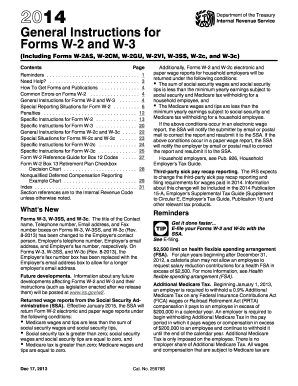

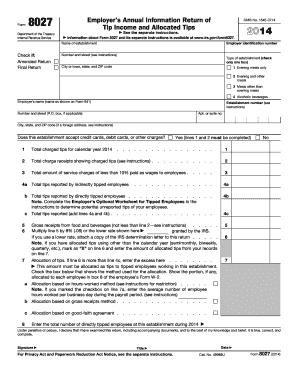

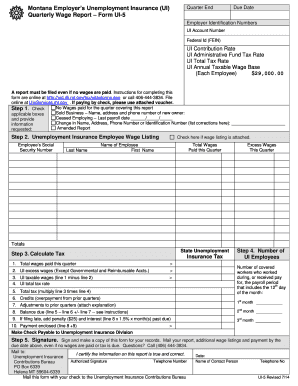

The 941 form for 2014 is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is also used to calculate the employer's portion of Social Security and Medicare taxes.

What are the types of 941 form for 2014?

The types of 941 form for 2014 include:

941 - Employer's Quarterly Federal Tax Return

941-SS - Employer's Quarterly Federal Tax Return for American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

941-PR - Employer's Quarterly Federal Tax Return for Puerto Rico

How to complete 941 form for 2014

To complete the 941 form for 2014, follow these steps:

01

Gather all necessary information, including employee wages, withholding amounts, and employer tax liabilities.

02

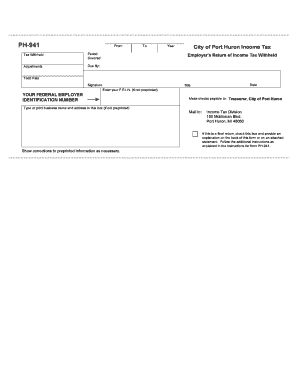

Fill out Part 1 of the form, providing general information about your business, such as name, address, and employer identification number.

03

Complete Part 2 to report payroll tax liability. This includes wages, tips, and other compensation, as well as federal income tax withheld and Social Security and Medicare tax.

04

Fill out Part 3 if you made adjustments to certain taxes or if you have any special circumstances.

05

Sign and date the form before submitting it.

06

File the completed form with the IRS by the due date.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 941 form for 2014

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you file form 941 late?

Late Filing Deposits made between six and 15 days late have a five percent penalty and a ten percent penalty for deposits more than 16 days late, plus interest. If you file Form 941 late, the IRS imposes a penalty of five percent per month or partial month you are late, up to a maximum of 25 percent.

Who can prepare Form 941?

To submit the form Business taxpayers can access e-File through most tax preparation software for small businesses. Your accountant or tax professional should also have access to e-File. You can also mail Form 941.

Can I do my own 941 form?

You can e-file any of the following employment tax forms: 940, 941, 943, 944 and 945.

How do I get a 941 form?

Go to www.irs.gov/Form941 for instructions and the latest information. Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter.

How far back can you amend 941?

Generally, you may correct overreported taxes on a previously filed Form 941 if you file Form 941-X within 3 years of the date Form 941 was filed or 2 years from the date you paid the tax reported on Form 941, whichever is later.

Do I have to file 941 electronically?

This federal tax return must be filed every quarter, enabling the IRS to understand and assess the employer's track of federal tax payments and filings. Form 941 can be filed electronically and by paper.

Related templates