PA PA-40 E 2022 free printable template

Show details

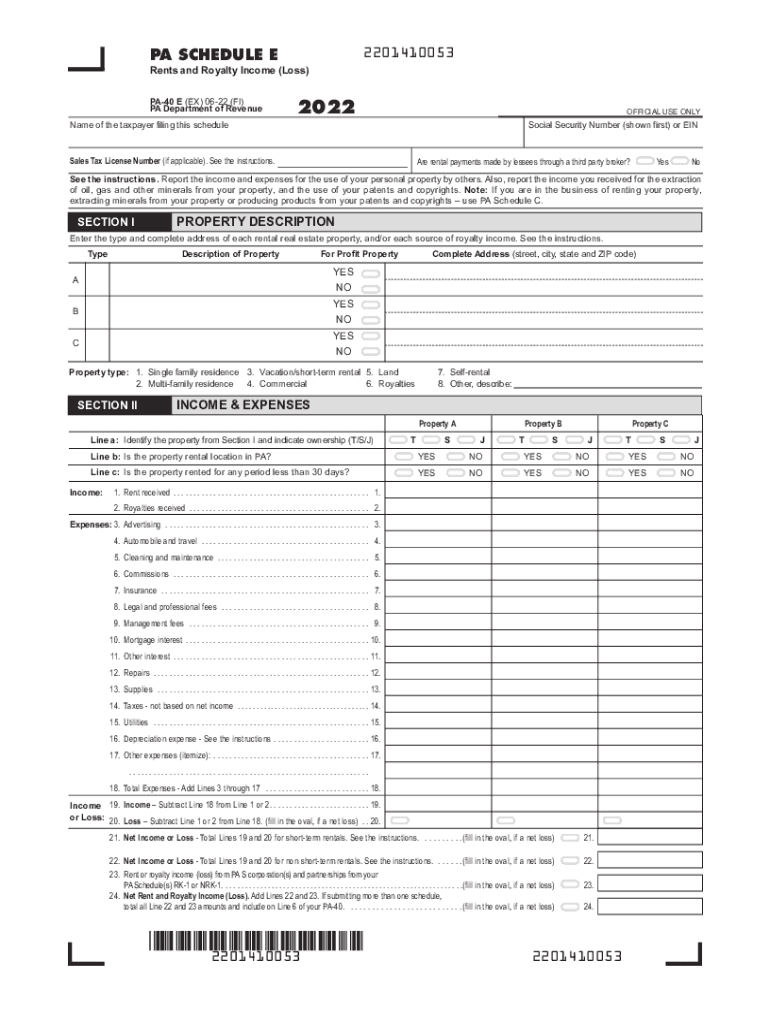

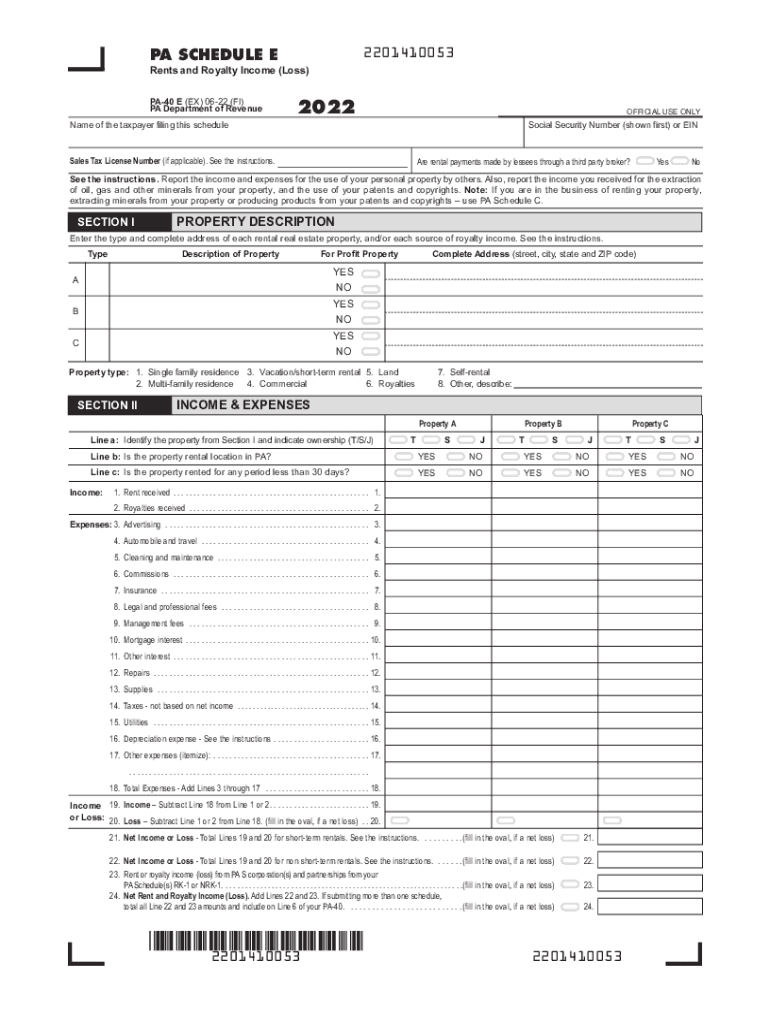

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING 2201410053PA SCHEDULE E Rents and Royalty Income (Loss) PA40 E (EX) 0622 (FI) PA Department of RevenueSTART2022OFFICIAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pennsylvania 40e form

Edit your pa 40e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa40e form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pa 40 tax form 2024 printable online

Follow the steps below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA PA-40 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA-40 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA PA-40 E

How to fill out PA PA-40 E

01

Gather necessary personal information including your Social Security number, residency information, and income data.

02

Obtain any relevant documentation such as W-2 forms, 1099 forms, and other income statements.

03

Start filling out your PA-40 E form by entering your personal details in the appropriate sections.

04

Report your income by listing all sources of income and following the instructions for each specific section.

05

Calculate your deductions and credits as applicable to your situation.

06

Double-check all entries for accuracy to avoid errors.

07

Sign and date the form.

08

Submit the completed PA-40 E form electronically or by mailing it to the appropriate Pennsylvania Department of Revenue address.

Who needs PA PA-40 E?

01

Individuals or residents who earn income in Pennsylvania and need to report their state taxes.

02

Taxpayers looking to claim deductions and credits available for Pennsylvania state taxes.

03

Those who are self-employed or have multiple income sources within the state.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a PA 41?

The fiduciary of an estate or trust is required under Pennsylvania law to file a PA-41 Fiduciary Income Tax Return, and pay the tax on the taxable income of such estate or trust. If two or more fiduciaries are acting jointly, the return may be filed by any one of them.

Who Must File PA-40?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

How do I get a PA-40 form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is PA-40?

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

What is a PA-40 form?

2021 Pennsylvania Income Tax Return (PA-40)

What is a PA-40?

PERSONAL INCOME TAX (PA-40 ES) Use the 2021 Form PA-40 ES-I to make your quarterly estimated payment of tax owed.

What is PA deduction?

There are four deductions allowed for Pennsylvania personal income tax. These are for contributions to a: Medical Savings Account. Health Savings Account. IRC Section 529 Qualified Tuition Program.

What is a PA-40 NRC?

A PA-40, Personal In- come Tax Return, must be filed by the individual to report the income or loss from the pass-through entity. NOTE: If an entity files a PA-40 NRC on behalf of its qualifying electing nonresident individual owners, those owners do not file the PA-40, Individual Income Tax Return.

Who must file PA-40?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

What is a Schedule C?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

Do I need to attach w2 to PA-40?

You may need to submit other information such as copies of military orders (if on active duty outside Pennsylvania), Form(s) W-2 (if your employer withheld additional PA income tax), and tax returns you filed in other states (when requesting a PA Resident Credit).

What is Schedule C PA-40?

PA Schedule C - Profit or Loss from Business or Profession (Sole Proprietorship) (PA-40 C)

Who must file a Pennsylvania partnership tax return?

A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations. The partnership passes through any profits (losses) to the resident and nonresident partners.

What is PA-40 tax form?

Use the 2021 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SSN - enter the primary taxpayer's nine-digit SSN without the hyphens.

What is schedule PA 40X?

If you need to change or amend an accepted Pennsylvania State Income Tax Return for the current or previous Tax Year you need to complete Form PA-40 and Schedule PA-40X (explanation for amended return) for the appropriate Tax Year. Form PA-40 is used for the Tax Return and Tax Amendment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit PA PA-40 E online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your PA PA-40 E to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in PA PA-40 E without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit PA PA-40 E and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete PA PA-40 E on an Android device?

Use the pdfFiller Android app to finish your PA PA-40 E and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is PA PA-40 E?

PA PA-40 E is a specific form used for filing personal income tax returns in the state of Pennsylvania.

Who is required to file PA PA-40 E?

Individuals who are residents of Pennsylvania and have income that exceeds the state's filing thresholds are required to file PA PA-40 E.

How to fill out PA PA-40 E?

To fill out PA PA-40 E, you need to gather your personal information, income details, and any applicable deductions or credits, and enter this information into the appropriate sections of the form.

What is the purpose of PA PA-40 E?

The purpose of PA PA-40 E is to report an individual's income to the Pennsylvania Department of Revenue and to calculate the state income tax owed.

What information must be reported on PA PA-40 E?

Information that must be reported on PA PA-40 E includes personal identification details, income details, tax deductions, credits, and any other relevant financial information.

Fill out your PA PA-40 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA-40 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.