PA PA-40 E 2024-2025 free printable template

Show details

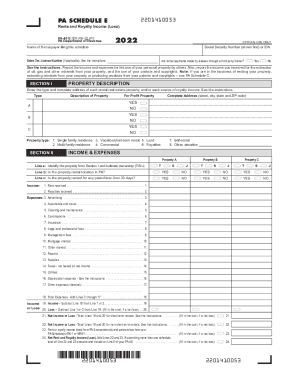

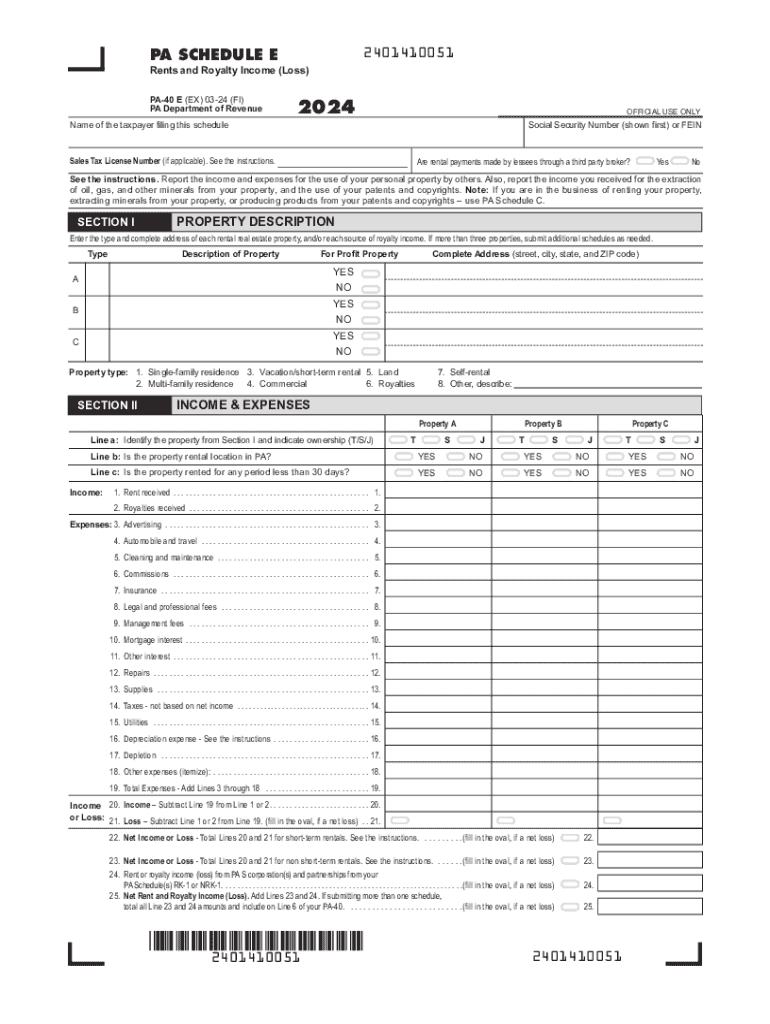

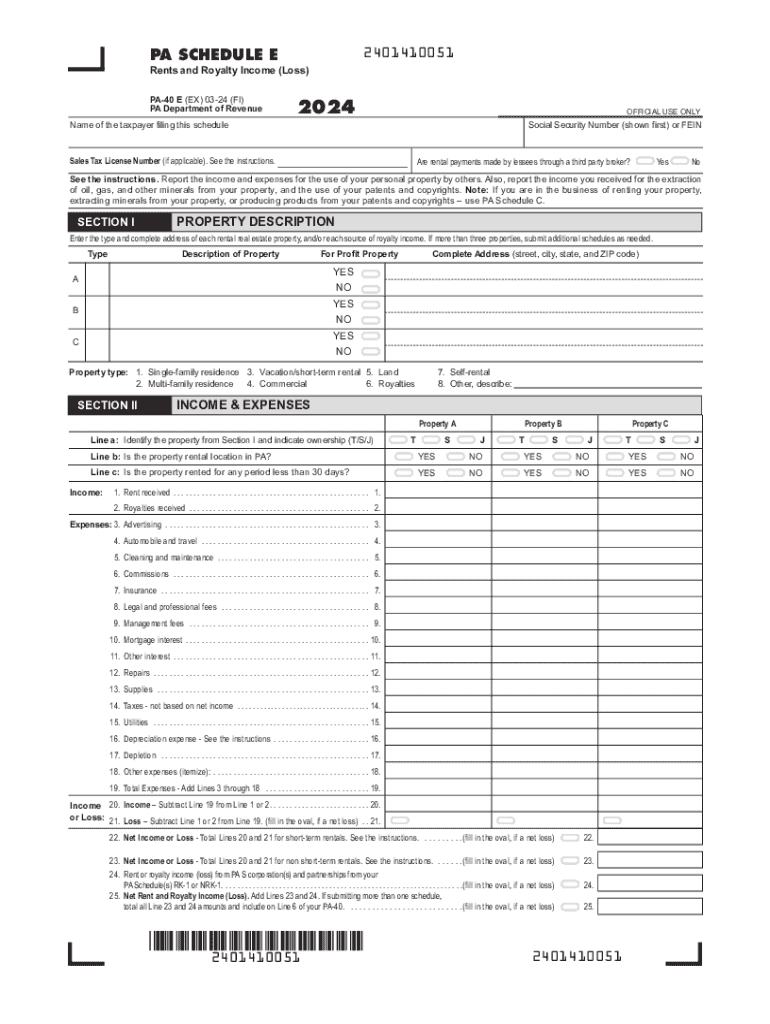

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING 2401410051 PA SCHEDULE E Rents and Royalty Income (Loss) PA-40 E (EX) 03-24 (FI) PA Department of Revenue START 2024

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa schedule e 2024 form

Edit your PA PA-40 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA PA-40 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA PA-40 E online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA PA-40 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA-40 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA PA-40 E

How to fill out PA PA-40 E

01

Gather all necessary personal information, including your Social Security number, address, and filing status.

02

Collect all relevant income documents such as W-2s, 1099s, and other income statements.

03

Fill out the header section with your personal information on the PA PA-40 E form.

04

Report your income on the appropriate lines, ensuring to follow the instructions for each type of income.

05

Calculate your total income by adding together all reported income amounts.

06

Claim any applicable deductions and credits, making sure to fill out the corresponding sections accurately.

07

Complete the PA tax computation section based on your total income and any deductions/credits claimed.

08

Review the form for accuracy and completeness.

09

Sign and date the form before submission.

10

Submit the completed PA PA-40 E to the Pennsylvania Department of Revenue by the required deadline.

Who needs PA PA-40 E?

01

Individuals who are residents of Pennsylvania and need to report their income for tax purposes.

02

Residents who have income that exceeds the filing threshold set by the Pennsylvania Department of Revenue.

03

Taxpayers who are required to file a tax return due to income from various sources, including wages, business income, or dividends.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a PA 41?

The fiduciary of an estate or trust is required under Pennsylvania law to file a PA-41 Fiduciary Income Tax Return, and pay the tax on the taxable income of such estate or trust. If two or more fiduciaries are acting jointly, the return may be filed by any one of them.

Who Must File PA-40?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

How do I get a PA-40 form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is PA-40?

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

What is a PA-40 form?

2021 Pennsylvania Income Tax Return (PA-40)

What is a PA-40?

PERSONAL INCOME TAX (PA-40 ES) Use the 2021 Form PA-40 ES-I to make your quarterly estimated payment of tax owed.

What is PA deduction?

There are four deductions allowed for Pennsylvania personal income tax. These are for contributions to a: Medical Savings Account. Health Savings Account. IRC Section 529 Qualified Tuition Program.

What is a PA-40 NRC?

A PA-40, Personal In- come Tax Return, must be filed by the individual to report the income or loss from the pass-through entity. NOTE: If an entity files a PA-40 NRC on behalf of its qualifying electing nonresident individual owners, those owners do not file the PA-40, Individual Income Tax Return.

Who must file PA-40?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

What is a Schedule C?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

Do I need to attach w2 to PA-40?

You may need to submit other information such as copies of military orders (if on active duty outside Pennsylvania), Form(s) W-2 (if your employer withheld additional PA income tax), and tax returns you filed in other states (when requesting a PA Resident Credit).

What is Schedule C PA-40?

PA Schedule C - Profit or Loss from Business or Profession (Sole Proprietorship) (PA-40 C)

Who must file a Pennsylvania partnership tax return?

A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations. The partnership passes through any profits (losses) to the resident and nonresident partners.

What is PA-40 tax form?

Use the 2021 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SSN - enter the primary taxpayer's nine-digit SSN without the hyphens.

What is schedule PA 40X?

If you need to change or amend an accepted Pennsylvania State Income Tax Return for the current or previous Tax Year you need to complete Form PA-40 and Schedule PA-40X (explanation for amended return) for the appropriate Tax Year. Form PA-40 is used for the Tax Return and Tax Amendment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA PA-40 E for eSignature?

Once you are ready to share your PA PA-40 E, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the PA PA-40 E form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PA PA-40 E and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete PA PA-40 E on an Android device?

Complete PA PA-40 E and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is PA PA-40 E?

PA PA-40 E is a Pennsylvania state tax form used to report income and calculate personal income tax for individual residents and non-residents who have taxable income in Pennsylvania.

Who is required to file PA PA-40 E?

Individuals who earned income in Pennsylvania, including residents, non-residents, and part-year residents with taxable income above the state's filing threshold, are required to file the PA PA-40 E.

How to fill out PA PA-40 E?

To fill out PA PA-40 E, gather all necessary financial information, including income statements and deduction data, complete the form headers, report all sources of income, apply any relevant deductions or exemptions, and calculate the total tax owed before submitting.

What is the purpose of PA PA-40 E?

The purpose of PA PA-40 E is to provide the Pennsylvania Department of Revenue with accurate information about an individual's income, allowing the state to assess and collect the appropriate amount of personal income tax.

What information must be reported on PA PA-40 E?

The PA PA-40 E requires reporting of personal identification information, income from various sources (wages, interest, dividends, business income, etc.), deductions, credits, and the calculation of total tax liability for the taxable year.

Fill out your PA PA-40 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA-40 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.