IRS 13661 2005 free printable template

Show details

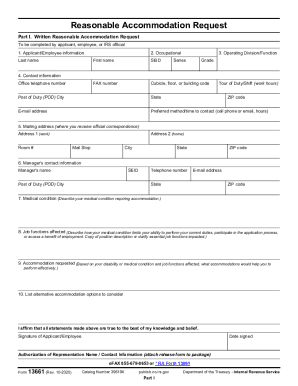

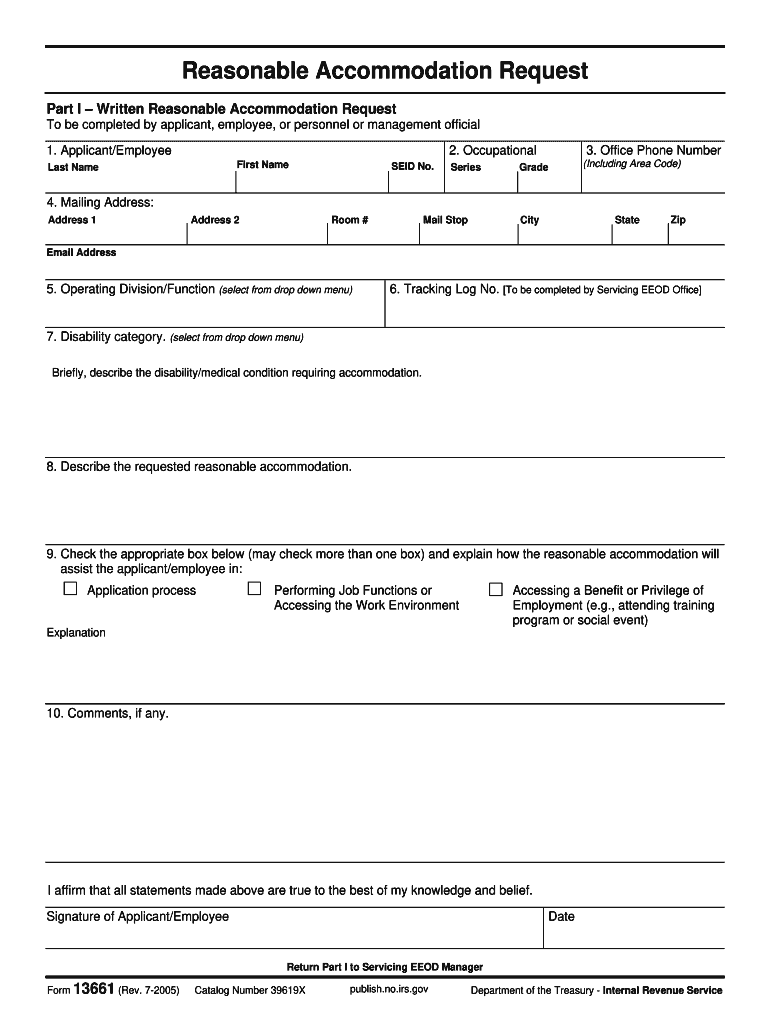

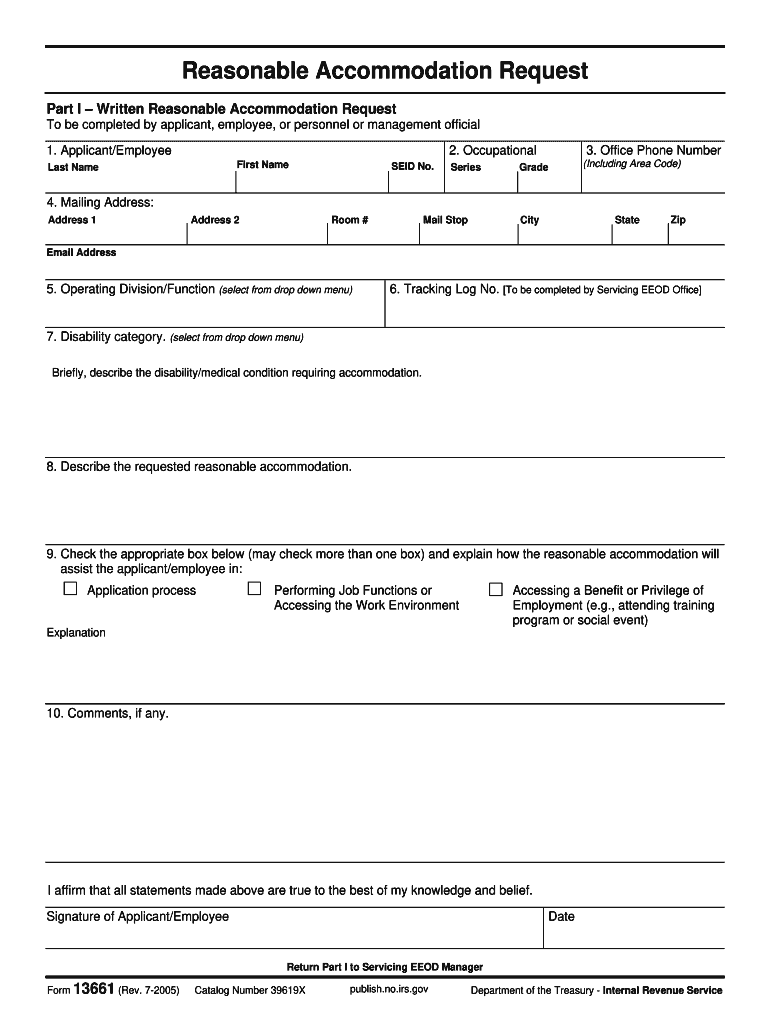

Part IV Denial of Reasonable Accommodation Request accommodation. Form 13661 Rev. 7-2005 Catalog Number 39619X publish. Reasonable Accommodation Request Part I Written Reasonable Accommodation Request To be completed by applicant for employment employee or personnel management specialist to document reasonable accommodation request. Part II Deciding Official Documentation purposes. Part II Items 5 6 and 7 may be provided to Health Care Practitioner Social Worker or Rehabilitation Counselor...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 13661

Edit your IRS 13661 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 13661 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 13661 online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 13661. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 13661 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 13661

How to fill out IRS 13661

01

Begin by downloading the IRS Form 13661 from the IRS website.

02

At the top of the form, enter the tax year for which you are filing.

03

Provide your personal information, including your name, Social Security number, and address.

04

Indicate your filing status (e.g., single, married filing jointly) by checking the appropriate box.

05

Fill out any additional necessary information regarding your dependents, if applicable.

06

Sign and date the form at the designated section.

07

Review the completed form for accuracy.

08

Submit the form according to IRS instructions, either electronically or by mailing it to the appropriate address.

Who needs IRS 13661?

01

IRS Form 13661 is typically needed by individuals who are claiming the premium tax credit under the Affordable Care Act.

02

It is also required for those seeking to claim an exemption from the shared responsibility payment.

Fill

form

: Try Risk Free

People Also Ask about

What does reasonable accommodation mean?

Under Title I of the Americans with Disabilities Act (ADA), a reasonable accommodation is a modification or adjustment to a job, the work environment, or the way things are usually done during the hiring process.

What is 1 example of a reasonable accommodation?

Examples of Reasonable Accommodations Acquiring or modifying equipment or devices such as adjusting a desk height to accommodate an employee who uses a wheelchair or providing an employee with quadriplegia a mouth stick device to type on their computer.

What is the meaning of reasonable accommodations?

Under Title I of the Americans with Disabilities Act (ADA), a reasonable accommodation is a modification or adjustment to a job, the work environment, or the way things are usually done during the hiring process.

What are examples of reasonable accommodations?

What types of accommodations are generally considered reasonable? Change job tasks. Provide reserved parking. Improve accessibility in a work area. Change the presentation of tests and training materials. Provide or adjust a product, equipment, or software. Allow a flexible work schedule.

What would be an example of reasonable accommodation by an employer?

Examples of reasonable accommodations include making existing facilities accessible; job restructuring; part-time or modified work schedules; acquiring or modifying equipment; changing tests, training materials, or policies; providing qualified readers or interpreters; and reassignment to a vacant position.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 13661 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your IRS 13661 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an eSignature for the IRS 13661 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your IRS 13661 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out IRS 13661 using my mobile device?

Use the pdfFiller mobile app to complete and sign IRS 13661 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is IRS 13661?

IRS Form 13661 is a form used by taxpayers to apply for a Taxpayer Identification Number (TIN) for individuals who do not qualify for a Social Security Number (SSN).

Who is required to file IRS 13661?

Individuals who need to obtain a TIN but are not eligible for an SSN, typically non-resident aliens or foreign investors, are required to file IRS Form 13661.

How to fill out IRS 13661?

To fill out IRS Form 13661, provide your personal information, including name, address, and date of birth. Ensure you indicate the reason for needing a TIN and attach any required supporting documentation.

What is the purpose of IRS 13661?

The purpose of IRS Form 13661 is to facilitate individuals in obtaining a TIN so they can comply with U.S. tax requirements even when they are not eligible for an SSN.

What information must be reported on IRS 13661?

The information that must be reported on IRS Form 13661 includes personal identification details, the reason for applying for a TIN, and any relevant documentation to support the application.

Fill out your IRS 13661 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 13661 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.