Get the free FASB Accounting Standards Codification Notice to Constituents - asc fasb

Show details

Accounting Standards Codification Notice to Constituents (v 4.3) About the Codification FAST Accounting Standards Codification Notice to Constituents (v 4.3) About the Codification Notice to Constituent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fasb accounting standards codification

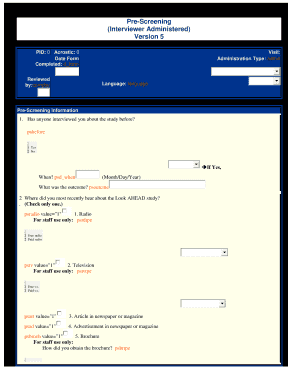

Edit your fasb accounting standards codification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fasb accounting standards codification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fasb accounting standards codification online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fasb accounting standards codification. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fasb accounting standards codification

How to fill out FASB accounting standards codification:

01

Familiarize yourself with the structure: The FASB accounting standards codification is organized into multiple topic areas, sections, and subtopics. Before filling it out, it is essential to understand the structure and how to navigate through it.

02

Determine the relevant section: Identify the specific section of the FASB codification that applies to the accounting standard or topic you are looking for. Each section covers different areas such as revenue recognition, leases, financial instruments, etc.

03

Locate the subtopic: Within the relevant section, identify the specific subtopic that pertains to your question or accounting issue. Subtopics further break down the accounting guidance into more specific areas.

04

Review the guidance: Once you have located the appropriate subtopic, carefully read and comprehend the accounting guidance provided. Take note of any key definitions, principles, or requirements mentioned.

05

Understand the application: Consider the applicability of the accounting standard or guidance to your specific situation. Identify any relevant factors or conditions that may impact the application of the accounting principle.

06

Gather necessary information: Ensure you have all the relevant information required to apply the accounting standard correctly. This may include financial data, supporting documents, and other relevant information.

07

Apply the accounting standard: Based on the guidance provided in the FASB codification, apply the accounting standard to your specific scenario. Follow the prescribed processes and methodologies outlined in the standard.

08

Document your analysis and conclusions: Document your analysis of the accounting issue, including any judgments made and the rationale behind them. Keep detailed records to support your conclusions and decisions.

Who needs FASB accounting standards codification:

01

Accounting professionals: Certified public accountants (CPAs), auditors, and financial professionals often refer to the FASB accounting standards codification to ensure compliance with generally accepted accounting principles (GAAP) when preparing financial statements or providing accounting advice.

02

Corporate finance departments: Financial reporting and analysis teams within businesses use the FASB codification as a primary resource to understand the accounting treatment of various transactions, such as revenue recognition, leases, or financial instrument measurement.

03

Students and educators: Accounting students, professors, and educators rely on the FASB accounting standards codification as a comprehensive and authoritative source to study and teach GAAP. It provides a standardized framework for understanding and applying accounting principles.

04

Regulators and government agencies: Regulatory bodies, such as the Securities and Exchange Commission (SEC) and other government agencies, refer to the FASB codification when evaluating financial statements and enforcing compliance with accounting standards.

05

Investors and analysts: Investors and financial analysts may consult the FASB codification to understand the accounting treatment of specific transactions or events disclosed in financial statements. This allows them to make informed investment decisions and perform financial analysis accurately.

In summary, anyone involved in accounting, financial reporting, or financial analysis may benefit from utilizing the FASB accounting standards codification as a comprehensive resource for understanding and applying GAAP.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fasb accounting standards codification?

FASB Accounting Standards Codification (ASC) is the single source of authoritative nongovernmental U.S. generally accepted accounting principles (GAAP).

Who is required to file fasb accounting standards codification?

Publicly traded companies in the U.S. are required to file under FASB Accounting Standards Codification.

How to fill out fasb accounting standards codification?

Filling out FASB Accounting Standards Codification involves referencing the specific sections and guidelines provided in the codification for proper accounting treatment.

What is the purpose of fasb accounting standards codification?

The purpose of FASB Accounting Standards Codification is to provide a single source of authoritative accounting principles to simplify the research process for users.

What information must be reported on fasb accounting standards codification?

Information reported on FASB Accounting Standards Codification includes financial statements, disclosures, and supporting documentation in accordance with GAAP.

How do I make changes in fasb accounting standards codification?

The editing procedure is simple with pdfFiller. Open your fasb accounting standards codification in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out fasb accounting standards codification on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your fasb accounting standards codification from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit fasb accounting standards codification on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute fasb accounting standards codification from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your fasb accounting standards codification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fasb Accounting Standards Codification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.