OH City Tax Return - City of Geneva 2018 free printable template

Show details

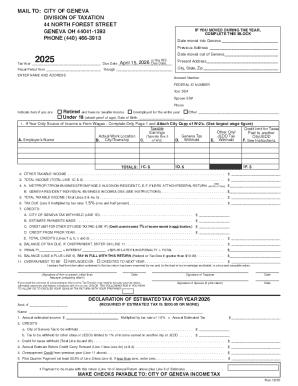

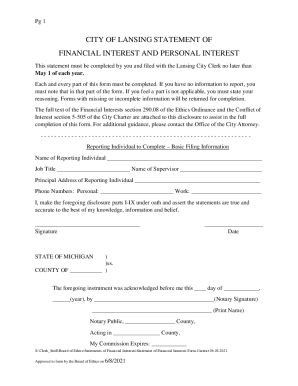

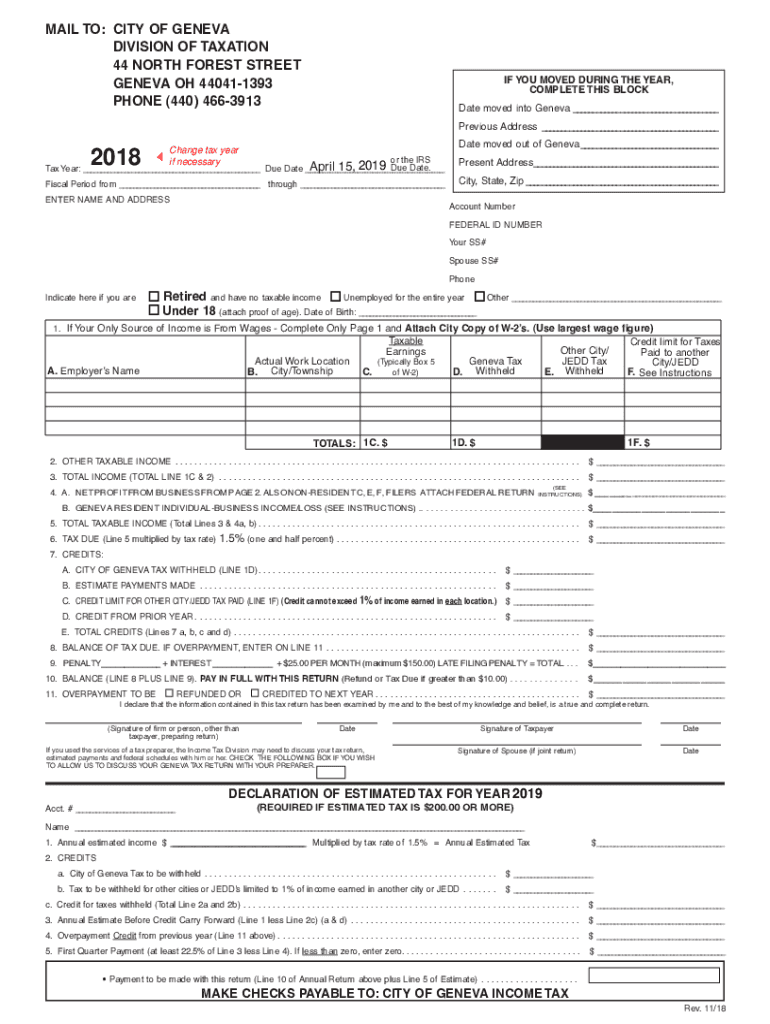

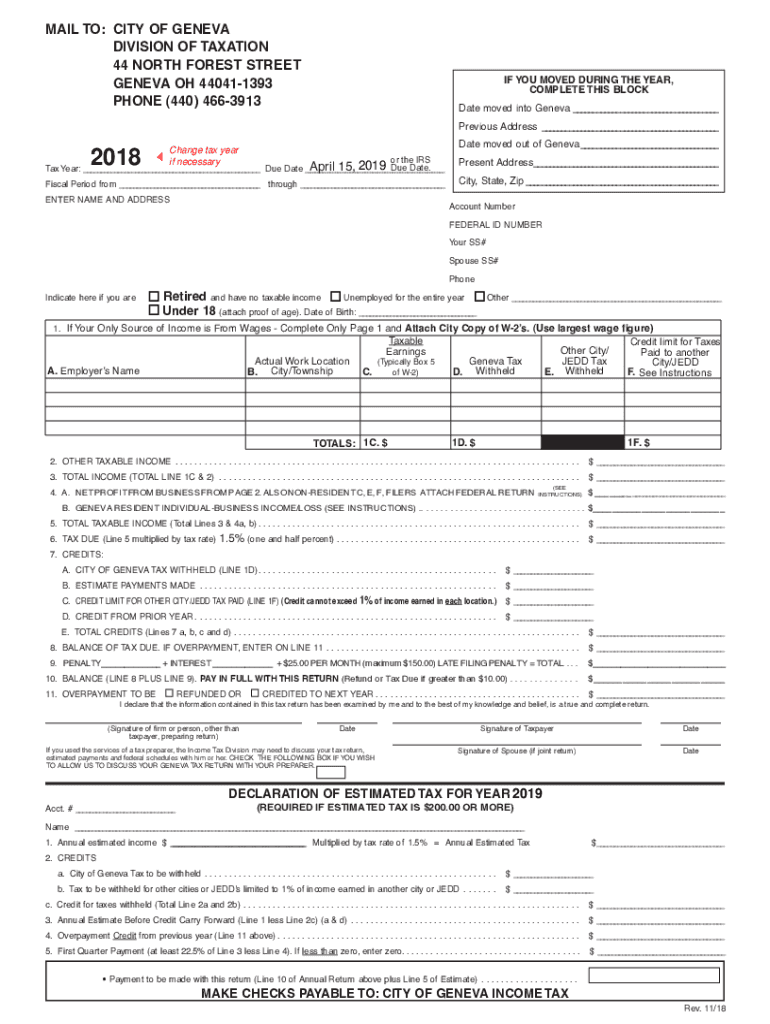

Reset Formal TO: CITY OF GENEVA DIVISION OF TAXATION 44 NORTH FOREST STREET GENEVA OH 440411393 PHONE (440) 4663913Print Formic YOU MOVED DURING THE YEAR, COMPLETE THIS BLOCK Date moved into Geneva

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH City Tax Return - City

Edit your OH City Tax Return - City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH City Tax Return - City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH City Tax Return - City online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OH City Tax Return - City. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH City Tax Return - City of Geneva Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH City Tax Return - City

How to fill out OH City Tax Return - City of Geneva

01

Obtain the OH City Tax Return form from the City of Geneva's website or local tax office.

02

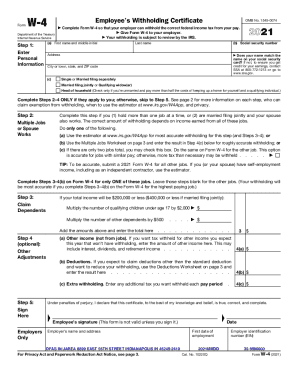

Fill in your personal information including name, address, and Social Security number.

03

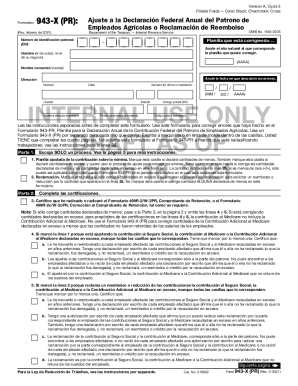

Report your total earnings for the tax year, including wages, self-employment income, and other taxable income.

04

Determine your total tax liability based on the city's tax rate and your reported income.

05

Subtract any applicable credits or withholdings to find your net tax owed or refund due.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed tax return to the appropriate city tax office by the designated deadline.

Who needs OH City Tax Return - City of Geneva?

01

Residents of the City of Geneva who earn income.

02

Non-residents who work in Geneva and have income subject to city tax.

03

Self-employed individuals conducting business within the city limits.

04

Individuals who have other taxable income that falls under the city tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a city tax return for Ohio?

a) All Ohio City residents 18 years of age and over, (except high school students) are required to regis ter and report income with the Ohio City Tax Office.

Does Geneva Ohio have a city tax?

The current tax rate is 1.5%. The maximum credit allowed for taxes paid to other municipalities will not exceed 1% of income earned in other municipalities. A tax return can be dropped off at the City of Geneva or can be mailed to 44 North Forest Street, Geneva, Ohio 44041.

What is the tax rate for the City of Geneva Ohio?

What is the sales tax rate in Geneva, Ohio? The minimum combined 2023 sales tax rate for Geneva, Ohio is 6.75%.

Do I have to file an Ohio CCA city tax form?

You must file a CCA Individual City Tax Form or Exemption Certificate (including retired persons, public assistance, etc.) if one or more of the following applies to you: 1. Live in a CCA member municipality that has mandatory filing.

What form is used to file Ohio local taxes?

Ohio IT 1040 and SD100 Forms.

How do I set up local tax in Ohio?

Electronic registration is available online through the Ohio Business Gateway. The paper registration form, CAT 1, can be downloaded at Tax Forms or requested by calling 1-800-282-1782. A use tax is similar to sales tax in its application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit OH City Tax Return - City online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your OH City Tax Return - City and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in OH City Tax Return - City without leaving Chrome?

OH City Tax Return - City can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out OH City Tax Return - City on an Android device?

Complete OH City Tax Return - City and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is OH City Tax Return - City of Geneva?

The OH City Tax Return for the City of Geneva is a tax form that residents and businesses are required to file to report their income and calculate any municipal taxes owed to the city.

Who is required to file OH City Tax Return - City of Geneva?

Any individual or business that earns income and resides or operates in the City of Geneva is required to file the OH City Tax Return, including residents, non-residents working in Geneva, and businesses operating within the city limits.

How to fill out OH City Tax Return - City of Geneva?

To fill out the OH City Tax Return, taxpayers should gather their income documentation, complete the required forms with financial information, calculate the tax due based on their income, and submit the return along with any payment by the due date.

What is the purpose of OH City Tax Return - City of Geneva?

The purpose of the OH City Tax Return is to collect revenue for local government services and operations, ensuring that those who earn income within the city contribute to the funding of public services such as education, infrastructure, and public safety.

What information must be reported on OH City Tax Return - City of Geneva?

The information that must be reported includes total income earned, any deductions or exemptions claimed, local tax rates, and the calculated tax amount owed to the City of Geneva.

Fill out your OH City Tax Return - City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH City Tax Return - City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.